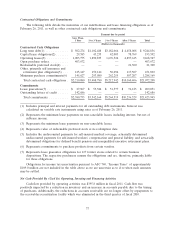

Rite Aid 2011 Annual Report Download - page 35

Download and view the complete annual report

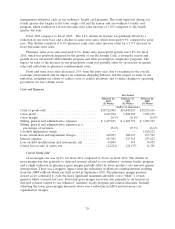

Please find page 35 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2009, we issued $410.0 million of 9.75% senior secured notes due June 12, 2016. These

notes are unsecured, unsubordinated obligations of Rite Aid Corporation and rank equally in right of

payment with all other unsubordinated indebtedness. Our obligations under these notes are guaranteed,

subject to certain limitations, by the same subsidiaries that guarantee the obligations under the senior

secured credit facility and our 8.00% senior secured notes due 2020. These guarantees are shared, on a

senior basis, with debt outstanding under the senior secured credit facility and our 8.00% senior

secured notes due 2020. The indenture that governs the 9.75% notes contains covenant provisions that,

among other things, allow the holders of the notes to participate along with the term loan holders and

holders of our 8.00% senior secured notes due 2020 in mandatory prepayments resulting from the

proceeds of certain asset dispositions (at the option of the noteholder) and include limitations on our

ability to pay dividends, make investments or other restricted payments, incur debt, grant liens, sell

assets and enter into sale-leaseback transactions. The 9.75% senior secured notes due June 2016 were

issued at 98.2% of par.

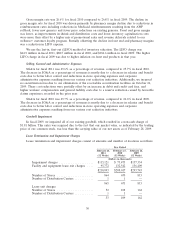

Sale Leaseback Transactions

During fiscal 2010 we sold a total of three owned stores to independent third parties. Net proceeds

from these sales were $8.0 million. Concurrent with these sales, we entered into agreements to lease

the stores back from the purchasers over minimum lease terms of 10 to 20 years. We accounted for all

of these leases as operating leases. A gain on the sale of these stores of $5.3 million was deferred and

is being recorded over the minimum term of these leases.

2009 Transactions

On June 4, 2008, we conducted a tender offer and consent solicitation under which we offered to

repurchase all outstanding amounts of our 8.125% senior secured notes due May 2010, our 7.5% senior

secured notes due January 2015 and our 9.25% senior notes due June 2013. On July 9, 2008 we repaid

$348.9 million of the outstanding balance of our 8.125% notes due May 2010, $199.6 million of our

7.5% notes due January 2015 and $144.0 million of the outstanding balance of our 9.25% notes due

June 2013 pursuant to the tender offer. Subsequent to the tender offer we redeemed the remaining

outstanding 7.5% notes due 2015. As a result of this tender and consent solicitation, the indentures

governing these notes were amended to eliminate substantially all of the restrictive covenants therein

including limitations on our ability to incur additional debt and grant liens against assets. In addition,

the guarantees on each series were eliminated. We did the transaction because these notes had

restrictions on secured debt that prohibited us from fully drawing on our revolving credit facility under

certain circumstances. We incurred a loss on debt modification related to this transaction of

$36.6 million.

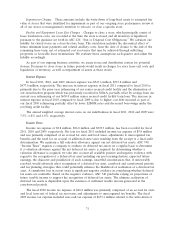

These transactions were financed via the issuance of a senior secured term loan (the Tranche 3

Term Loan) and the issuance of a $470.0 million aggregate principal amount of 10.375% senior secured

notes due July 2016. These notes are unsecured unsubordinated obligations of Rite Aid Corporation

and rank equally in right of payment with all other unsubordinated indebtedness. Our obligations under

the notes are guaranteed, subject to certain limitations, by subsidiaries that guarantee the obligations

under our senior secured credit facility. The guarantees are secured by shared second priority liens with

holders of our 7.5% senior secured notes due 2017 and our 10.25% senior secured notes due 2019. The

indenture that governs the 10.375% senior secured notes due 2016 contains covenant provisions that,

among other things, include limitations on our ability to pay dividends, make investments or other

restricted payments, incur debt, grant liens, sell assets and enter into sale-leaseback transactions. The

10.375% senior secured notes due July 2016 were issued at 90.588% of par.

In May 2008 we issued $158.0 million of 8.5% convertible notes due May 2015. These notes are

unsecured and are effectively junior to our secured debt. The notes are convertible, at the option of the

holder, into shares of our common stock at a conversion price of $2.59 per share, subject to

35