Rite Aid 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

16. Commitments, Contingencies and Guarantees (Continued)

of February 26, 2011. The obligations are for varying terms dependent upon the respective lease, the

longest of which lasts through February 17, 2024.

In the opinion of management, the ultimate disposition of these guarantees will not have a

material effect on the Company’s results of operations, financial position or cash flows.

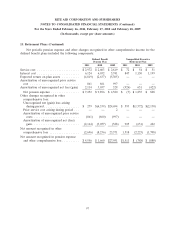

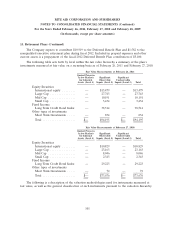

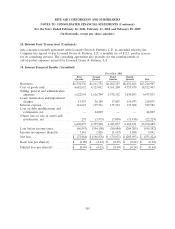

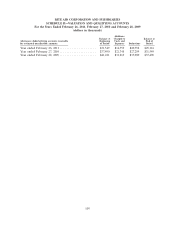

17. Supplementary Cash Flow Data

Year Ended

February 26, February 27, February 28,

2011 2010 2009

Cash paid for interest (net of capitalized

amounts of $509, $859 and $1,434) ....... $ 464,456 $ 484,873 $ 462,847

Cash payments for income taxes, net ....... $ 4,907 $ 2,987 $ 5,793

Equipment financed under capital leases .... $ 4,622 $ 185 $ 8,117

Equipment received for noncash consideration $ 3,476 $ 15,603 $ 23,878

Preferred stock dividends paid in additional

shares ............................ $ 9,346 $ 8,807 $ 18,302

Non-cash reduction in lease financing

obligation ......................... $ — $ 25,889 $ 40,221

Accrued capital expenditures ............. $ 37,557 $ 16,846 $ 16,529

Gross borrowings from revolver ........... $1,511,000 $2,746,574 $5,522,000

Gross repayments to revolver ............. $1,563,000 $3,504,574 $5,533,000

18. Related Party Transactions

There were receivables from related parties of $81 and $84 at February 26, 2011 and February 27,

2010, respectively.

In connection with the acquisition of Jean Coutu, USA, the Company entered into a transition

services agreement with the Jean Coutu Group. Under the terms of this agreement, Jean Coutu Group

provided certain information technology, network and support services to the Company. The agreement

expired in September 2008. The Company recorded an expense of $894 for services provided under this

agreement for the year ended February 28, 2009. As of February 26, 2011, the Jean Coutu Group

owned approximately 251,975 shares (27.4% of the voting power of the Company) of common stock.

During fiscal 2011, 2010 and 2009, the Company paid Leonard Green & Partners, L.P., fees of

$314, $222 and $227, for financial advisory services, respectively. These amounts include expense

reimbursements of $151, $72 and $90 for the fiscal years 2011, 2010 and 2009, respectively. Jonathan D.

Sokoloff, director, is an equity owner of Leonard Green & Partners, L.P. The Company has entered

104