Rite Aid 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

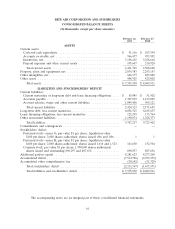

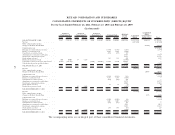

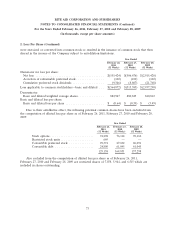

RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ (DEFICIT)/EQUITY

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands)

Accumulated

Preferred Preferred Preferred Additional Other

Stock-Series G Stock-Series H Stock-Series I Common Stock Paid-In Accumulated Comprehensive

Shares Amount Shares Amount Shares Amount Shares Amount Capital Deficit Income (Loss) Total

BALANCE MARCH 1, 2008 ............. 1,393 $ 139,253 1,352 $135,202 4,820 $ 116,415 830,209 $830,209 $4,047,499 $(3,537,276) $(20,117) $ 1,711,185

Net loss ........................ (2,915,420) (2,915,420)

Other comprehensive income:

Changes in Defined Benefit Plans .......... (21,662) (21,662)

Comprehensive loss .................. (2,937,082)

Exchange of restricted shares for taxes ....... (1,741) (1,741) (1,113) (2,854)

Issuance of restricted stock .............. 2,646 2,646 (2,646) —

Cancellation of restricted stock ............ (967) (967) 967 —

Amortization of restricted stock balance ....... 17,913 17,913

Stock-based compensation expense .......... 13,535 13,535

Stock options exercised ................ 516 516 601 1,117

Dividends on preferred stock ............. 100 10,006 83 8,296 (18,302) —

Conversion of Series G and I preferred stock . . . . (1,493) (149,258) (4,820) (116,415) 55,450 55,450 210,223 —

Cash dividends paid on preferred shares ...... (3,466) (3,466)

BALANCE February 28, 2009 ............ — $ 1 1,435 $143,498 — $ — 886,113 $886,113 $4,265,211 $(6,452,696) $(41,779) $(1,199,652)

Net loss ........................ (506,676) (506,676)

Other comprehensive income:

Changes in Defined Benefit Plans .......... 10,459 10,459

Comprehensive loss .................. (496,217)

Exchange of restricted shares for taxes ....... (1,198) (1,198) (343) (1,541)

Issuance of restricted stock .............. 3,289 3,289 (3,289) —

Cancellation of restricted stock ............ (642) (642) 642 —

Amortization of restricted stock balance ....... 11,772 11,772

Stock-based compensation expense .......... 12,022 12,022

Stock options exercised ................ 74 74 (8) 66

Dividends on preferred stock ............. 88 8,806 (8,807) (1)

BALANCE FEBRUARY 27, 2010 .......... — $ 1 1,523 $152,304 — $ — 887,636 $887,636 $4,277,200 $(6,959,372) $(31,320) $(1,673,551)

Net loss ........................ (555,424) (555,424)

Other comprehensive income:

Changes in Defined Benefit Plans .......... 1,178 1,178

Comprehensive loss .................. (554,246)

Exchange of restricted shares for taxes ....... (1,103) (1,103) (29) (1,132)

Issuance of restricted stock .............. 3,905 3,905 (3,905) —

Cancellation of restricted stock ............ (385) (385) 385 —

Amortization of restricted stock balance ....... 6,053 6,053

Stock-based compensation expense .......... 11,283 11,283

Stock options exercised ................ 244 244 (18) 226

Dividends on preferred stock ............. 93 9,346 (9,346) —

BALANCE FEBRUARY 26, 2011 .......... — $ 1 1,616 $161,650 — $ — 890,297 $890,297 $4,281,623 $(7,514,796) $(30,142) $(2,211,367)

The accompanying notes are an integral part of these consolidated financial statements.