Rite Aid 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

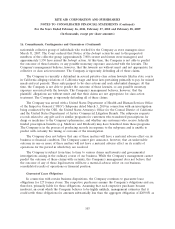

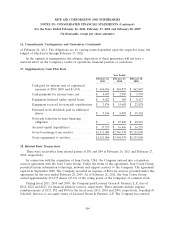

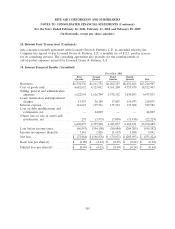

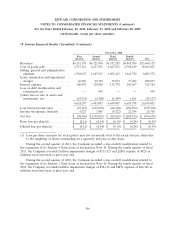

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 26, 2011, February 27, 2010 and February 28, 2009

(In thousands, except per share amounts)

21. Subsequent Events (Continued)

during the first quarter of fiscal 2012 due to the write off of debt issue costs of $2.7 million and

unamortized original issue discount of $19.7 million.

On March 21, 2011, the Company launched a Stock Option Exchange Program (‘‘Program’’) for

eligible associates only. Under the Program, eligible associates had the opportunity to surrender certain

stock options for a lesser number of new stock options with a strike price that was determined based

on the closing market price on April 21, 2011, the day the Program concluded. The number of new

options was determined by applying exchange ratios that resulted in providing new stock options with

an aggregate fair value that approximates the aggregate fair value of the options they replaced. The

new options vest over two years and have a five year life with an exercise price of $1.03. A total of

14.0 million options with an exercise price in excess of $1.77 were cancelled and 5.3 million new

options were granted with an exercise price of $1.03. The Company expects to recognize a minimal

incremental compensation expense as a result of the Program.

108