Red Lobster 2005 Annual Report Download - page 48

Download and view the complete annual report

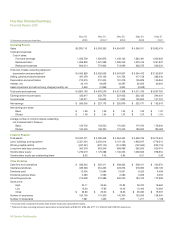

Please find page 48 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

Financial Review 2005

56 Darden Restaurants

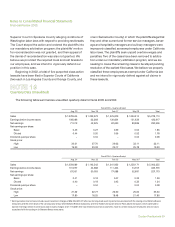

At the end of fiscal 2005, the ESOP borrowed $1,606

from us at a variable interest rate and acquired an additional

50,000 shares of our common stock, which were held in

suspense within the ESOP at May 29, 2005. The loan, which

had a variable interest rate of 3.42 percent at May 29, 2005,

is due to be repaid no later than December 2018. The shares

acquired under this loan are accounted for in accordance

with Statement of Position (SOP) 93-6, “Employers Account-

ing for Employee Stock Ownership Plans.” Fluctuations in

our stock price are recognized as adjustments to common

stock and surplus when the shares are committed to be

released. These ESOP shares are not considered outstand-

ing until they are committed to be released and, therefore,

have been excluded for purposes of calculating basic and

diluted net earnings per share at May 29, 2005. The fair

value of these shares at May 29, 2005 was $1,624.

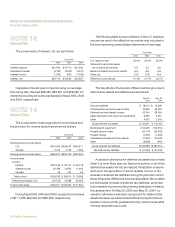

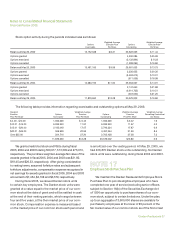

NOTE 16

Stock Plans

We maintain two active stock option and stock grant

plans under which new awards may still be issued: the 2002

Stock Incentive Plan (2002 Plan) and the Stock Plan for

Directors (Director Stock Plan). We also have two other stock

option and stock grant plans under which we no longer can

make new awards, although awards outstanding under the

plans may still vest and be exercised in accordance with

their terms: the Stock Option and Long-Term Incentive Plan

of 1995 (1995 Plan) and the Restaurant Management and

Employee Stock Plan of 2000 (2000 Plan). All of the plans

are administered by the Compensation Committee of the

Board of Directors. The 2002 Plan provides for the issuance

of up to 8,550,000 common shares in connection with the

granting of non-qualified stock options, incentive stock

options, stock appreciation rights, stock awards, restricted

stock, RSUs, stock awards and other stock-based awards to

key employees and non-employee directors. Up to 1,700,000

shares may be granted under the plan as restricted stock

and RSUs. The Director Stock Plan provides for the issu-

ance of up to 375,000 common shares out of our treasury

in connection with the granting of non-qualified stock options,

restricted stock and RSUs to non-employee directors. The

1995 Plan provided for the issuance of up to 33,300,000

common shares in connection with the granting of non-

qualified stock options, restricted stock or RSUs to key

employees. No new awards could be made under the 1995

Plan after September 30, 2004. The 2000 Plan provided for

the issuance of up to 5,400,000 shares of common stock out

of our treasury as non-qualified stock options, restricted

stock, or RSUs. As noted above, no new awards may be

made under the 1995 Plan and the 2000 Plan, although

awards outstanding under those plans may still vest and be

exercised in accordance with their terms. Under all of the

plans, stock options are granted at a price equal to the fair

value of the shares at the date of grant, for terms not exceed-

ing ten years and have various vesting periods at the discre-

tion of the Compensation Committee. Outstanding options

generally vest over one to four years. Restricted stock and

RSUs granted under the 1995, 2000 and 2002 Plans generally

vest over periods ranging from three to five years and no

sooner than one year from the date of grant. The restricted

period for certain grants may be accelerated based on per-

formance goals established by the Compensation Committee.

We also maintain the Compensation Plan for Non-

Employee Directors. This plan provides that non-employee

directors may elect to receive their annual retainer and meet-

ing fees in any combination of cash, deferred cash, or our

common shares and authorizes the issuance of up to 105,981

common shares out of our treasury for this purpose. The

common shares are issued under the plan at a value equal

to the market price in consideration of foregone retainer

and meeting fees.

The per share weighted-average fair value of stock

options granted during fiscal 2005, 2004 and 2003 was

$7.75, $6.83 and $9.01, respectively.