Red Lobster 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Financial Review 2005

Darden Restaurants 31

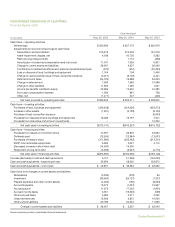

Net cash flows provided by operating activities were

$583 million, $525 million and $509 million in fiscal 2005,

2004 and 2003, respectively. Net cash flows provided by

operating activities include net earnings of $291 million,

$227 million and $226 million in fiscal 2005, 2004 and

2003, respectively. Fiscal 2004 net earnings included a

$36.5 million pre-tax ($22.4 million after-tax) charge for

long-lived asset impairments associated with the closing

of six Bahama Breeze restaurants and the write-down of

the carrying value of four other Bahama Breeze restau-

rants, one Olive Garden restaurant and one Red Lobster

restaurant, which continued to operate. Net cash flows

provided by operating activities also reflect income tax

payments of $111 million, $92 million and $65 million in

fiscal 2005, 2004 and 2003, respectively. The increase in

tax payments in fiscal 2005 and 2004 resulted primarily

from accelerated deductions allowable for depreciation

of certain capital expenditures in fiscal 2004 and 2003,

which lowered our income tax payments in those fiscal

years. These accelerated deductions were allowable

for only a portion of fiscal 2005 capital expenditures.

In fiscal 2005, however, the impact of the reduction in

accelerated depreciation deductions was partially offset

by an increase in income tax benefits associated with the

exercise of employee stock options.

Net cash flows used in financing activities were $264

million, $194 million and $193 million in fiscal 2005, 2004

and 2003, respectively. Net cash flows used in financing

activities included our repurchase of 11.3 million shares

of our common stock for $312 million in fiscal 2005,

compared to 10.7 million shares for $235 million in fiscal

2004 and 10.7 million shares for $213 million in fiscal

2003. Our Board of Directors has authorized us to repur-

chase up to 137.4 million shares of our common stock.

At May 29, 2005 a total of 120.6 million shares have been

repurchased under the authorization. The repurchased

common stock is reflected as a reduction of stockhold-

ers’ equity. We received proceeds from the issuance of

common stock upon the exercise of stock options of $75

million, $40 million and $34 million in fiscal 2005, 2004

and 2003, respectively. Net cash flows used in financing

activities also included dividends paid to stockholders

of $13 million, $13 million and $14 million in fiscal 2005,

2004 and 2003, respectively.

Net cash flows used in investing activities were $313

million, $343 million and $420 million in fiscal 2005, 2004

and 2003, respectively. Net cash flows used in investing

activities included capital expenditures incurred princi-

pally for building new restaurants, replacing equipment

and remodeling existing restaurants. Capital expenditures

were $329 million in fiscal 2005, compared to $354 mil-

lion in fiscal 2004 and $423 million in fiscal 2003. The

decreased expenditures in fiscal 2005 and 2004 resulted

primarily from decreased spending associated with

building fewer new restaurants and fewer remodels. We

estimate that our fiscal 2006 capital expenditures will

approximate $350 million to $375 million.

Net cash flows provided by operating activities for fiscal

2003 included a $20 million contribution to our defined

benefit pension plans, which enabled the plans to main-

tain a fully funded status as of the plans’ February 28,

2003 annual valuation date. Approximately $0.1 million

was required to fund our defined benefit pension plans in

fiscal 2005 and fiscal 2004. Our defined benefit and other

postretirement benefit costs and liabilities are calculated

using various actuarial assumptions and methodologies

prescribed under the Financial Accounting Standards

Board’s (FASB) Statement of Financial Accounting

Standards (SFAS) No. 87, “Employers’ Accounting for

Pensions” and No. 106, “Employers’ Accounting for

Postretirement Benefits Other Than Pensions.” We use

certain assumptions including, but not limited to, the

selection of a discount rate, expected long-term rate of

return on plan assets and expected health care cost trend

rates. We set the discount rate assumption annually for

each plan at its valuation date to reflect the yield of high

quality fixed-income debt instruments, with lives that

approximate the maturity of the plan benefits. At May 29,

2005, our discount rate was 5.75 percent. The expected

long-term rate of return on plan assets and health care

cost trend rates are based upon several factors, includ-

ing our historical assumptions compared with actual

results, an analysis of current market conditions, asset

allocations and the views of leading financial advisers and

economists. Based on our analysis during fiscal 2003, we

lowered our defined benefit plans’ expected long-term

rate of return on plan assets for fiscal 2004 from 10.4

percent to 9.0 percent. The change in our defined benefit