Red Lobster 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Financial Review 2005

32 Darden Restaurants

plans’ expected long-term rate of return on plan assets

decreased earnings before income taxes by approximately

$2 million in fiscal 2004. At May 29, 2005, our expected

health care cost trend rates ranged from 11.0 percent to

12.0 percent for fiscal 2006, depending on the medical

service category. The rates gradually decrease to 5.0 per-

cent through fiscal 2011 and remain at that level thereafter.

The expected long-term rate of return on plan assets

component of our net periodic benefit cost is calculated

based on the market-related value of plan assets. Our

target asset allocation is 35 percent U.S. equities, 30 per-

cent high-quality, long-duration fixed-income securities,

15 percent international equities, 10 percent private equi-

ties and 10 percent real assets. We monitor our actual

asset allocation to ensure that it approximates our target

allocation and believe that our long-term asset allocation

will continue to approximate our target allocation. Our

historical ten-year rate of return on plan assets, calcu-

lated using the geometric method average of returns, is

approximately 10.9 percent as of May 29, 2005.

We have an unrecognized net actuarial loss for the

defined benefit plans and postretirement benefit plan as

of May 29, 2005 of $59 million and $4 million, respec-

tively. The unrecognized net actuarial loss represents

changes in the amount of the projected benefit obligation

and plan assets resulting from differences in the assump-

tions used and actual experience. The amortization of the

unrecognized net actuarial loss component of our fiscal

2006 net periodic benefit cost for the defined benefit

plans and postretirement benefit plan is expected to be

approximately $5 million and $0.2 million, respectively.

We believe our defined benefit and postretirement

benefit plan assumptions are appropriate based upon the

factors discussed above. However, other assumptions

could also be reasonably applied that could differ from the

assumptions used. A quarter percentage point change in

the defined benefit plans’ discount rate and the expected

long-term rate of return on plan assets would increase or

decrease earnings before income taxes by $0.7 million and

$0.4 million, respectively. A quarter percentage point

change in our postretirement benefit plan discount rate

would increase or decrease earnings before income taxes

by $0.1 million. A one percentage point increase in the health

care cost trend rates would increase the accumulated

postretirement benefit obligation (APBO) by $4 million at

May 29, 2005 and the aggregate of the service cost and

interest cost components of net periodic postretirement

benefit cost by $0.6 million for fiscal 2005. A one percent-

age point decrease in the health care cost trend rates would

decrease the APBO by $3 million at May 29, 2005 and the

aggregate of the service cost and interest cost components

of net periodic postretirement benefit cost by $0.5 million

for fiscal 2005. These changes in assumptions would not

significantly impact our funding requirements.

We are not aware of any trends or events that would

materially affect our capital requirements or liquidity. We

believe that our internal cash-generating capabilities,

borrowings available under our shelf registration for

unsecured debt securities and short-term commercial

paper program should be sufficient to finance our capital

expenditures, debt maturities, stock repurchase program

and other operating activities through fiscal 2006.

Off-Balance Sheet Arrangements

We are not a party to any off-balance sheet arrange-

ments that have, or are reasonably likely to have, a current

or future material effect on our financial condition, changes

in financial condition, sales or expenses, results of opera-

tions, liquidity, capital expenditures or capital resources.

Financial Condition

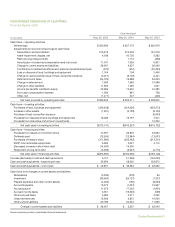

Our total current assets were $407 million at May 29,

2005, compared to $346 million at May 30, 2004. The

increase resulted primarily from increases in inventories

of $37 million that resulted from opportunistic product

purchases made during fiscal 2005.

Our total current liabilities were $1.04 billion at May 29,

2005, compared to $0.68 billion at May 30, 2004. The

increase in current liabilities is primarily due to the reclas-

sification of the $150 million of unsecured 8.375 percent

senior notes due in September 2005 and the $150 million

of unsecured 6.375 percent notes due in February 2006

from long-term debt to current liabilities. Accounts payable

of $191 million at May 29, 2005 increased from $175 mil-

lion, primarily due to the timing of our inventory and capital

expenditures at the end of fiscal 2005. Other current