Red Lobster 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

Financial Review 2005

44 Darden Restaurants

and hedged items, as well as our risk-management objective

and strategy for undertaking the various hedge transactions.

This process includes linking all derivatives designated as

cash flow hedges to specific assets and liabilities on the con-

solidated balance sheet or to specific forecasted transactions.

We also formally assess, both at the hedge’s inception and

on an ongoing basis, whether the derivatives used in hedg-

ing transactions are highly effective in offsetting changes in

cash flows of hedged items.

Changes in the fair value of derivatives that are highly

effective and that are designated and qualify as cash flow

hedges are recorded in other comprehensive income until

earnings are affected by the variability in cash flows of the

designated hedged item. Where applicable, we discontinue

hedge accounting prospectively when it is determined that

the derivative is no longer effective in offsetting changes in

the cash flows of the hedged item or the derivative is termi-

nated. Any changes in the fair value of a derivative where

hedge accounting has been discontinued or is ineffective

are recognized immediately in earnings. Cash flows related

to derivatives are included in operating activities.

Operating Leases

We recognize rent expense on a straight-line basis over

the expected lease term, including cancelable option periods

when it is deemed to be reasonably assured that we would

incur an economic penalty for not exercising the options.

Within the provisions of certain of our leases, there are rent

holidays and/or escalations in payments over the base lease

term, as well as renewal periods. The effects of the holidays

and escalations have been reflected in rent expense on a

straight-line basis over the expected lease term, which

includes cancelable option periods when it is deemed to be

reasonably assured that we would incur an economic penalty

for not exercising the option. The lease term commences on

the date when we have the right to control the use of the

leased property, which is typically before rent payments are

due under the terms of the lease. Many of our leases have

renewal periods totaling five to 20 years, exercisable at our

option and require payment of property taxes, insurance and

maintenance costs in addition to the rent payments. Per-

centage rent expense is generally based on sales levels and

is accrued at the point in time we determine that it is proba-

ble that such sales levels will be achieved.

Pre-Opening Expenses

Non-capital expenditures associated with opening new

restaurants are expensed as incurred.

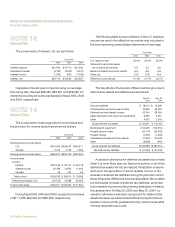

Advertising

Production costs of commercials are charged to oper-

ations in the fiscal period the advertising is first aired. The

costs of programming and other advertising, promotion

and marketing programs are charged to operations in the

fiscal period incurred. Advertising expense amounted to

$214,608, $210,989 and $200,020, in fiscal 2005, 2004

and 2003, respectively.

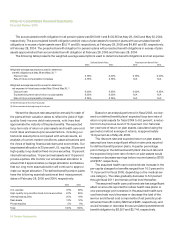

Stock-Based Compensation

Statement of Financial Accounting Standards (SFAS)

No. 123, “Accounting for Stock-Based Compensation,”

encourages the use of a fair-value method of accounting

for stock-based awards under which the fair value of stock

options is determined on the date of grant and expensed over

the vesting period. As allowed by SFAS No. 123, we have

elected to account for our stock-based compensation plans

under an intrinsic value method that requires compensation

expense to be recorded only if, on the date of grant, the cur-

rent market price of our common stock exceeds the exercise

price the employee must pay for the stock. Our policy is to

grant stock options at the fair market value of our underlying

stock on the date of grant. Accordingly, no compensation

expense has been recognized for stock options granted

under any of our stock plans because the exercise price of

all options granted was equal to the current market value

of our stock on the grant date.