Red Lobster 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Financial Review 2005

Darden Restaurants 47

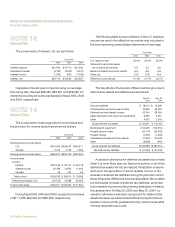

NOTE 2

Accounts Receivable

Our accounts receivable is primarily comprised of receiv-

ables from national storage and distribution companies with

which we contract to provide services that are billed to us on

a per-case basis. In connection with these services, certain of

our inventory items are conveyed to these storage and distri-

bution companies to transfer ownership and risk of loss prior

to delivery of the inventory to our restaurants. We reacquire

these items when the inventory is subsequently delivered to

our restaurants. These transactions do not impact the con-

solidated statements of earnings. Receivables from national

storage and distribution companies amounted to $20,296

and $20,276 at May 29, 2005 and May 30, 2004, respectively.

The allowance for doubtful accounts associated with all of

our receivables amounted to $400 and $350 at May 29, 2005

and May 30, 2004, respectively.

NOTE 3

Restructuring and Asset Impairment Activities

Asset impairment charges related to the decision to

relocate or rebuild certain restaurants amounted to $900,

$5,667 and $4,876 in fiscal 2005, 2004 and 2003, respec-

tively. Asset impairment credits related to assets sold that

were previously impaired amounted to $2,786, $1,437 and

$594 in fiscal 2005, 2004 and 2003, respectively. During fiscal

2005, we also recorded charges of $6,407 for the write-down

of carrying value of two Olive Garden restaurants, one Red

Lobster restaurant and one Smokey Bones restaurant. The

Smokey Bones restaurant was closed subsequent to fiscal

2005 while the two Olive Garden restaurants and one Red

Lobster restaurant continued to operate. All impairment

amounts are included in asset impairment and restructur-

ing charges in the consolidated statements of earnings.

During fiscal 2004, we recorded pre-tax asset impair-

ment charges of $36,526 for long-lived asset impairments

associated with the closing of six Bahama Breeze restau-

rants and the write-down of the carrying value of four other

Bahama Breeze restaurants, one Olive Garden restaurant and

one Red Lobster restaurant, which continued to operate.

We also recorded a restructuring charge of $1,112 primarily

related to severance payments made to certain restaurant

employees and exit costs associated with the closing of the

six Bahama Breeze restaurants in accordance with SFAS

No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities.” Below is a summary of the restructur-

ing costs for fiscal 2005:

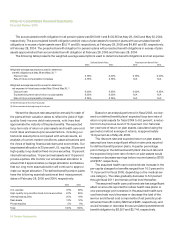

Balance at Cash Balance at

May 29, 2004 Additions Payments May 30, 2005

One-time termination

benefits $ 49 $ – $ (49) $ –

Lease termination costs – – – –

Other exit costs 311 – (311) –

$360 $ – $(360) $ –

The results of operations for all restaurants closed in

fiscal 2005, 2004 and 2003 are not material to our consoli-

dated results of operations and, therefore, have not been

presented as discontinued operations.

NOTE 4

Land, Buildings and Equipment, Net

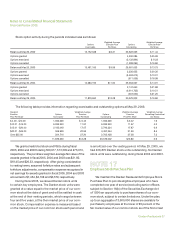

The components of land, buildings and equipment, net,

are as follows:

May 29, May 30,

2005 2004

Land $ 565,965 $ 545,191

Buildings 2,306,342 2,138,376

Equipment 1,036,143 1,008,133

Construction in progress 107,750 87,655

Total land, buildings and equipment 4,016,200 3,779,355

Less accumulated depreciation (1,664,746) (1,528,739)

Net land, buildings and equipment, net $ 2,351,454 $ 2,250,616