Red Lobster 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

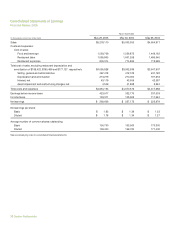

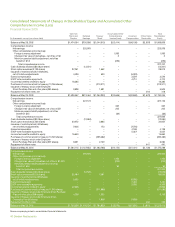

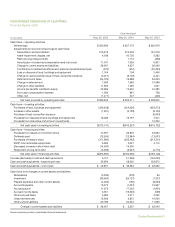

Notes to Consolidated Financial Statements

Financial Review 2005

48 Darden Restaurants

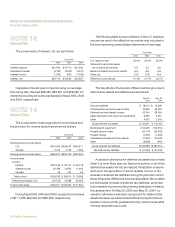

NOTE 5

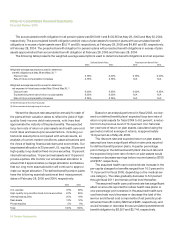

Other Assets

The components of other assets are as follows:

May 29, May 30,

2005 2004

Prepaid pension costs $ 63,475 $ 67,077

Trust-owned life insurance 43,873 40,422

Capitalized software costs, net 31,165 32,328

Liquor licenses 24,570 22,201

Prepaid interest and loan costs 8,008 12,396

Miscellaneous 7,960 9,001

Total other assets $179,051 $183,425

NOTE 6

Short-Term Debt

Short-term debt at May 29, 2005 and May 30, 2004,

consisted of $0 and $14,500, respectively, of unsecured

commercial paper borrowings with original maturities of

one month or less. The debt bore an interest rate of 1.09

percent at May 30, 2004.

NOTE 7

Other Current Liabilities

The components of other current liabilities are as follows:

May 29, May 30,

2005 2004

Employee benefits $134,272 $115,083

Sales and other taxes 39,011 40,122

Insurance 35,938 38,254

Miscellaneous 34,458 24,388

Accrued interest 10,499 10,477

Total other current liabilities $254,178 $228,324

NOTE 8

Long-Term Debt

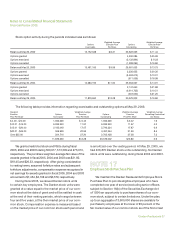

The components of long-term debt are as follows:

May 29, May 30,

2005 2004

8.375% senior notes due September 2005 $ 150,000 $ 150,000

6.375% notes due February 2006 150,000 150,000

5.75% medium-term notes due March 2007 150,000 150,000

7.45% medium-term notes due April 2011 75,000 75,000

7.125% debentures due February 2016 100,000 100,000

ESOP loan with variable rate of interest

(3.42% at May 29, 2005) due December 2018 26,010 29,403

Total long-term debt 651,010 654,403

Less issuance discount (763) (1,054)

Total long-term debt less issuance discount 650,247 653,349

Less current portion (299,929) –

Long-term debt, excluding current portion $ 350,318 $ 653,349

In July 2000, we registered $500,000 of debt securities

with the Securities and Exchange Commission (SEC) using

a shelf registration process. Under this process, we may

offer, from time to time, up to an aggregate of $500,000 of

debt securities. In September 2000, we issued $150,000

of unsecured 8.375 percent senior notes due in Septem-

ber 2005. The senior notes rank equally with all of our other

unsecured and unsubordinated debt and will be senior in

right of payment to any future subordinated debt we may

issue. In April 2001, we issued $75,000 of unsecured 7.45

percent medium-term notes due in April 2011. In March

2002, we issued $150,000 of unsecured 5.75 percent

medium-term notes due in March 2007. At May 29, 2005,

our shelf registration provides for the issuance of an addi-

tional $125,000 of unsecured debt securities.

In January 1996, we issued $150,000 of unsecured

6.375 percent notes due in February 2006 and $100,000 of

unsecured 7.125 percent debentures due in February 2016.

Concurrent with the issuance of the notes and debentures,

we terminated, and settled for cash, interest-rate swap

agreements with notional amounts totaling $200,000, which

hedged the movement of interest rates prior to the issuance

of the notes and debentures. The cash paid in terminating

the interest-rate swap agreements is being amortized to

interest expense over the life of the notes and debentures.