Red Lobster 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Financial Review 2005

52 Darden Restaurants

NOTE 13

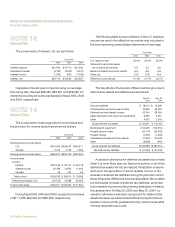

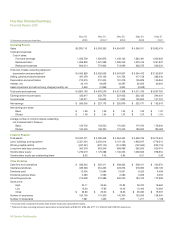

Interest, Net

The components of interest, net, are as follows:

Fiscal Year

2005 2004 2003

Interest expense $47,656 $47,710 $47,566

Capitalized interest (3,182) (3,500) (3,470)

Interest income (1,355) (551) (1,499)

Interest, net $43,119 $43,659 $42,597

Capitalized interest was computed using our average

borrowing rate. We paid $39,083, $39,661 and $38,682, for

interest (excluding amounts capitalized) in fiscal 2005, 2004

and 2003, respectively.

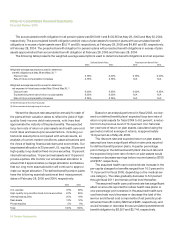

NOTE 14

Income Taxes

The components of earnings before income taxes and

the provision for income taxes thereon are as follows:

Fiscal Year

2005 2004 2003

Earnings before income taxes:

U.S. $416,905 $328,577 $335,611

Canada 7,012 4,199 1,992

Earnings before income taxes $423,917 $332,776 $337,603

Income taxes:

Current:

Federal $137,549 $ 75,121 $ 68,178

State and local 20,438 13,663 11,396

Canada 46 131 24

Total current $158,033 $ 88,915 $ 79,598

Deferred (principally U.S.) (24,722) 16,688 32,026

Total income taxes $133,311 $105,603 $111,624

During fiscal 2005, 2004 and 2003, we paid income taxes

of $111,386, $92,265 and $65,398, respectively.

The following table is a reconciliation of the U.S. statutory

income tax rate to the effective income tax rate included in

the accompanying consolidated statements of earnings:

Fiscal Year

2005 2004 2003

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 2.9 3.2 3.0

Benefit of federal income tax credits (5.0) (5.2) (4.5)

Other, net (1.5) (1.3) (0.4)

Effective income tax rate 31.4% 31.7% 33.1%

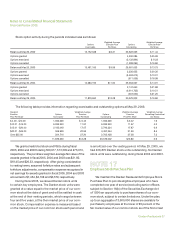

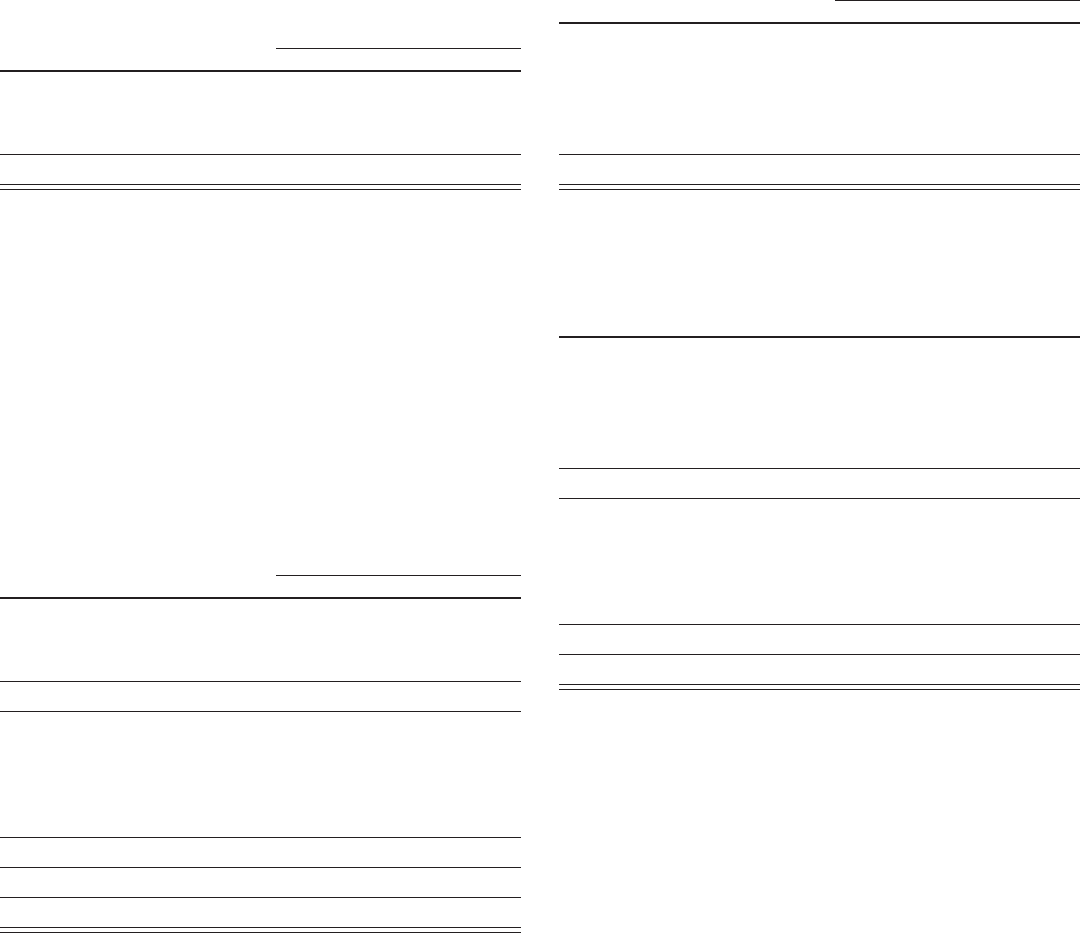

The tax effects of temporary differences that give rise to

deferred tax assets and liabilities are as follows:

May 29, May 30,

2005 2004

Accrued liabilities $ 18,016 $ 13,286

Compensation and employee benefits 76,680 63,234

Deferred rent and interest income 33,149 28,094

Asset disposition and restructuring liabilities 2,239 2,651

Other 4,537 2,918

Gross deferred tax assets $ 134,621 $ 110,183

Buildings and equipment (145,421) (143,910)

Prepaid pension costs (24,115) (25,452)

Prepaid interest (1,205) (1,333)

Capitalized software and other assets (11,334) (15,976)

Other (3,808) (944)

Gross deferred tax liabilities $(185,883) $(187,615)

Net deferred tax liabilities $ (51,262) $ (77,432)

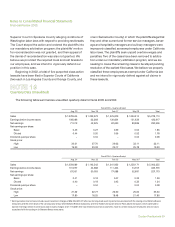

A valuation allowance for deferred tax assets is provided

when it is more likely than not that some portion or all of the

deferred tax assets will not be realized. Realization is depen-

dent upon the generation of future taxable income or the

reversal of deferred tax liabilities during the periods in which

those temporary differences become deductible. We consider

the scheduled reversal of deferred tax liabilities, projected

future taxable income and tax planning strategies in making

this assessment. At May 29, 2005 and May 30, 2004, no

valuation allowance has been recognized for deferred tax

assets because we believe that sufficient projected future

taxable income will be generated to fully utilize the benefits

of these deductible amounts.