Red Lobster 2005 Annual Report Download - page 38

Download and view the complete annual report

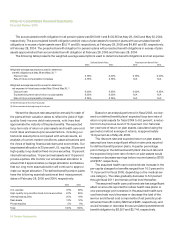

Please find page 38 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

Financial Review 2005

46 Darden Restaurants

adjustments, the effective unrealized portion of changes in

the fair value of cash flow hedges and amounts associated

with minimum pension liability adjustments.

Foreign Currency

The Canadian dollar is the functional currency for our

Canadian restaurant operations. Assets and liabilities

denominated in Canadian dollars are translated into U.S.

dollars using the exchange rates in effect at the balance

sheet date. Results of operations are translated using the

average exchange rates prevailing throughout the period.

Translation gains and losses are reported as a separate

component of accumulated other comprehensive income

(loss) in stockholders’ equity. Aggregate cumulative transla-

tion losses were $8,724 and $10,174 at May 29, 2005 and

May 30, 2004, respectively. Losses from foreign currency

transactions, which amounted to $18, $53 and $105, are

included in the consolidated statements of earnings for fis-

cal 2005, 2004 and 2003, respectively.

Use of Estimates

The preparation of financial statements in conformity

with accounting principles generally accepted in the United

States of America requires us to make estimates and

assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported

amounts of sales and expenses during the reporting period.

Actual results could differ from those estimates.

Segment Reporting

As of May 29, 2005, we operated 1,381 Red Lobster,

Olive Garden, Bahama Breeze, Smokey Bones Barbeque &

Grill and Seasons 52 restaurants in North America as operat-

ing segments. The restaurants operate principally in the U.S.

within the casual dining industry, providing similar products

to similar customers. The restaurants also possess similar

pricing structures, resulting in similar long-term expected

financial performance characteristics. Revenues from exter-

nal customers are derived principally from food and beverage

sales. We do not rely on any major customers as a source

of revenue. We believe we meet the criteria for aggregating

our operating segments into a single reporting segment.

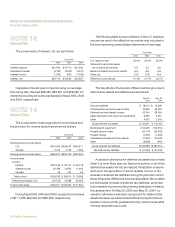

Future Application of Accounting Standards

In November 2004, the Financial Accounting Standards

Board (FASB) issued SFAS No. 151, “Inventory Costs.”

SFAS No. 151 clarifies the accounting for abnormal amounts

of idle facilities expense, freight, handling costs and wasted

material. SFAS No. 151 is effective for inventory costs

incurred during fiscal years beginning after June 15, 2005.

We do not believe the adoption of SFAS No. 151 will have

a material impact on our financial statements.

In December 2004, the FASB issued SFAS No. 153,

“Exchanges of Non-Monetary Assets.” SFAS No. 153

eliminates the exception for non-monetary exchanges of

similar productive assets and replaces it with a general

exception for exchanges of non-monetary assets that do

not have commercial substance. SFAS No. 153 is effective

for non-monetary asset exchanges occurring in fiscal peri-

ods beginning after June 15, 2005. We do not believe the

adoption of SFAS No. 153 will have a material impact on

our financial statements.

In December 2004, the FASB issued SFAS No. 123

(Revised), “Share-Based Payment.” SFAS No. 123R revises

SFAS No. 123, “Accounting for Stock-Based Compensation,”

and generally requires the cost associated with employee

services received in exchange for an award of equity instru-

ments be measured based on the grant-date fair value of

the award and recognized in the financial statements over

the period during which employees are required to provide

service in exchange for the award. SFAS No. 123R also

provides guidance on how to determine the grant-date fair

value for awards of equity instruments as well as alternative

methods of adopting its requirements. SFAS No. 123R is

effective for annual reporting periods beginning after June 15,

2005. As disclosed in Note 1, based on the current assump-

tions and calculations used, had we recognized compen-

sation expense based on the fair value of awards of equity

instruments, net earnings would have been reduced by

approximately $17,585, $14,822 and $17,159 for fiscal 2005,

2004 and 2003, respectively. We have not yet determined the

method of adoption or the effect of adopting SFAS No. 123R

and have not determined whether the adoption will result in

future amounts similar to the current pro forma disclosures

under SFAS No. 123.