Red Lobster 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Financial Review 2005

Darden Restaurants 55

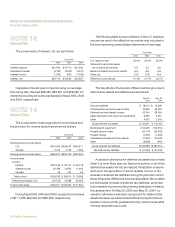

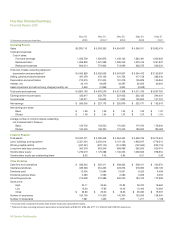

Components of net periodic benefit cost (income) are as follows:

Defined Benefit Plans Postretirement Benefit Plan

2005 2004 2003 2005 2004 2003

Service cost $ 4,840 $ 4,516 $ 3,732 $ 699 $ 626 $ 388

Interest cost 7,315 7,076 7,088 1,005 919 648

Expected return on plan assets (12,841) (12,821) (12,739) – – –

Amortization of unrecognized prior service cost (348) (348) (348) – 29 18

Recognized net actuarial loss 4,992 3,710 1,924 346 334 46

Net periodic benefit cost (income) $ 3,958 $ 2,133 $ (343) $ 2,050 $ 1,908 $ 1,100

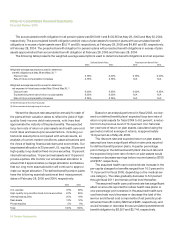

The following benefit payments are expected to be paid:

Defined Postretirement

Benefit Plans Benefit Plan

2006 $ 5,666 $ 292

2007 6,283 340

2008 6,756 386

2009 7,151 453

2010 7,628 503

2011-2015 46,695 3,696

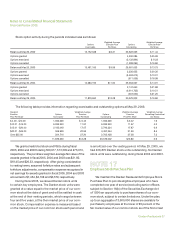

Defined Contribution Plan

We have a defined contribution plan covering most

employees age 21 and older. We match contributions for

participants with at least one year of service at up to six per-

cent of compensation, based on our performance. The match

ranges from a minimum of $0.25 to $1.20 for each dollar

contributed by the participant. The plan had net assets of

$498,125 at May 29, 2005 and $390,461 at May 30, 2004.

Expense recognized in fiscal 2005, 2004 and 2003, was

$2,713, $2,666 and $1,732, respectively. Employees clas-

sified as “highly compensated” under the Internal Revenue

Code are not eligible to participate in this plan. Instead, highly

compensated employees are eligible to participate in a

separate non-qualified deferred compensation plan. This

plan allows eligible employees to defer the payment of all or

part of their annual salary and bonus and provides for awards

that approximate the matching contributions and other

amounts that participants would have received had they

been eligible to participate in our defined contribution and

defined benefit plans. Amounts payable to highly compen-

sated employees under the non-qualified deferred com-

pensation plan totaled $108,407 and $88,569 at May 29,

2005 and May 30, 2004, respectively. These amounts are

included in other current liabilities.

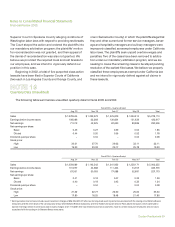

The defined contribution plan includes an Employee

Stock Ownership Plan (ESOP). This ESOP originally bor-

rowed $50,000 from third parties, with guarantees by us,

and borrowed $25,000 from us at a variable interest rate.

The $50,000 third party loan was refinanced in 1997 by a

commercial bank’s loan to us and a corresponding loan

from us to the ESOP. Compensation expense is recognized

as contributions are accrued. In addition to matching plan

participant contributions, our contributions to the plan are

also made to pay certain employee incentive bonuses.

Fluctuations in our stock price impact the amount of expense

to be recognized. Contributions to the plan, plus the divi-

dends accumulated on allocated and unallocated shares

held by the ESOP, are used to pay principal, interest and

expenses of the plan. As loan payments are made, com-

mon stock is allocated to ESOP participants. In fiscal 2005,

2004 and 2003, the ESOP incurred interest expense of $677,

$473 and $697, respectively, and used dividends received

of $1,235, $454 and $1,002, respectively, and contributions

received from us of $3,389, $4,093 and $4,266, respectively,

to pay principal and interest on our debt.

These ESOP shares are included in average common

shares outstanding for purposes of calculating net earn-

ings per share. At May 29, 2005, the ESOP’s debt to us had

a balance of $26,010 with a variable rate of interest of 3.42

percent; $9,110 of the principal balance is due to be repaid

no later than December 2007, with the remaining $16,900

due to be repaid no later than December 2014. The number

of our common shares held in the ESOP at May 29, 2005

approximated 9,810,000 shares, representing 4,211,000

allocated shares, 9,000 committed-to-be-released shares

and 5,590,000 suspense shares.