Red Lobster 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

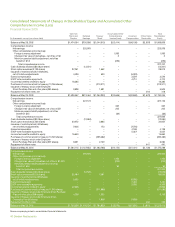

Consolidated Statements of Changes in Stockholders’ Equity and Accumulated Other

Comprehensive Income (Loss)

Financial Review 2005

40 Darden Restaurants

Common Accumulated Other Total

Stock and Retained Treasury Comprehensive Unearned Officer Notes Stockholders’

(In thousands, except per share data)

Surplus Earnings Stock Income (Loss) Compensation Receivable Equity

Balance at May 26, 2002 $1,474,054 $700,986 $(1,044,915) $(12,414) $(46,108) $(1,997) $1,069,606

Comprehensive income:

Net earnings – 225,979 – – – – 225,979

Other comprehensive income (loss):

Foreign currency adjustment – – – 1,995 – – 1,995

Change in fair value of derivatives, net of tax of $0 – – – 2 – – 2

Minimum pension liability adjustment, net of tax

benefit of $141 – – – (229) – – (229)

Total comprehensive income 227,747

Cash dividends declared ($0.08 per share) – (13,501) – – – – (13,501)

Stock option exercises (3,133 shares) 27,261 – 1,652 – – – 28,913

Issuance of restricted stock (148 shares),

net of forfeiture adjustments 4,429 – 600 – (5,029) – –

Earned compensation – – – – 3,579 – 3,579

ESOP note receivable repayments – – – – 4,710 – 4,710

Income tax benefits credited to equity 16,385 – – – – – 16,385

Purchases of common stock for treasury (10,746 shares) – – (213,311) – – – (213,311)

Issuance of treasury stock under Employee

Stock Purchase Plan and other plans (280 shares) 3,828 – 1,681 – – – 5,509

Repayment of officer notes, net – – – – – 418 418

Balance at May 25, 2003 $1,525,957 $913,464 $(1,254,293) $(10,646) $(42,848) $(1,579) $1,130,055

Comprehensive income:

Net earnings – 227,173 – – – – 227,173

Other comprehensive income (loss):

Foreign currency adjustment – – – 337 – – 337

Change in fair value of derivatives, net of tax of $51 – – – 205 – – 205

Minimum pension liability adjustment, net of tax

benefit of $45 – – – (69) – – (69)

Total comprehensive income 227,646

Cash dividends declared ($0.08 per share) – (12,984) – – – – (12,984)

Stock option exercises (3,464 shares) 30,972 – 3,685 – – – 34,657

Issuance of restricted stock (409 shares),

net of forfeiture adjustments 7,605 – 173 – (7,778) – –

Earned compensation – – – – 4,198 – 4,198

ESOP note receivable repayments – – – – 5,027 – 5,027

Income tax benefits credited to equity 15,650 – – – – – 15,650

Purchases of common stock for treasury (10,749 shares) – – (235,462) – – – (235,462)

Issuance of treasury stock under Employee

Stock Purchase Plan and other plans (357 shares) 3,931 – 2,129 – – – 6,060

Repayment of officer notes – – – – – 441 441

Balance at May 30, 2004 $1,584,115 $1,127,653 $(1,483,768) $(10,173) $(41,401) $(1,138) $1,175,288

Comprehensive income:

Net earnings – 290,606 – – – – 290,606

Other comprehensive income (loss):

Foreign currency adjustment – – – 1,450 – – 1,450

Change in fair value of derivatives, net of tax of $1,503 – – – (243) – – (243)

Minimum pension liability adjustment, net of tax

benefit of $56 – – – 90 – – 90

Total comprehensive income 291,903

Cash dividends declared ($0.08 per share) – (12,505) – – – – (12,505)

Stock option exercises (6,615 shares) 62,464 – 7,081 – – – 69,545

Issuance of restricted stock (378 shares),

net of forfeiture adjustments 9,535 – – – (9,535) – –

Earned compensation – – – – 7,464 – 7,464

ESOP note receivable repayments – – – – 3,393 – 3,393

Income tax benefits credited to equity 42,996 – – – – – 42,996

Purchases of common stock for treasury (11,343 shares) – – (311,686) – – – (311,686)

Issuance of treasury stock under Employee Stock Purchase

Plan and other plans (296 shares) 4,226 – 1,932 – – – 6,158

Issuance of treasury stock under Employee Stock

Ownership Plan (50 shares) – – 1,606 – (1,606) – –

Repayment of officer notes – – – – – 463 463

Balance at May 29, 2005 $1,703,336 $1,405,754 $(1,784,835) $ (8,876) $(41,685) $ (675) $1,273,019

See accompanying notes to consolidated financial statements.