Red Lobster 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Financial Review 2005

Darden Restaurants 45

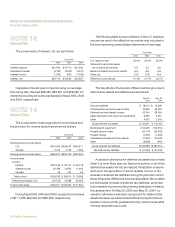

Had we determined compensation expense for our stock

options based on the fair value at the grant date as prescribed

under SFAS No. 123, our net earnings and net earnings per

share would have been reduced to the pro forma amounts

indicated below:

Fiscal Year

2005 2004 2003

Net earnings, as reported $290,606 $227,173 $225,979

Add: Stock-based compensation

expense included in reported net

earnings, net of related tax effects 5,134 3,158 2,642

Deduct: Total stock-based

compensation expense determined

under fair value based method for all

awards, net of related tax effects (22,719) (17,980) (19,801)

Pro forma $273,021 $212,351 $208,820

Basic net earnings per share

As reported $ 1.85 $ 1.39 $ 1.33

Pro forma $ 1.74 $ 1.30 $ 1.23

Diluted net earnings per share

As reported $ 1.78 $ 1.34 $ 1.27

Pro forma $ 1.67 $ 1.25 $ 1.18

To determine pro forma net earnings, reported net

earnings have been adjusted for compensation expense

associated with stock options granted that are expected to

eventually vest. The preceding pro forma results were deter-

mined using the Black Scholes option-pricing model, which

values options based on the stock price at the grant date,

the expected life of the option, the estimated volatility of the

stock, expected dividend payments and the risk-free interest

rate over the expected life of the option. The dividend yield

was calculated by dividing the current annualized dividend

by the option exercise price for each grant. The expected

volatility was determined considering stock prices for the fis-

cal year the grant occurred and prior fiscal years, as well as

considering industry volatility data. The risk-free interest rate

was the rate available on zero coupon U.S. government obli-

gations with a term equal to the expected life of each grant.

The expected life of the option was estimated based on the

exercise history from previous grants.

The weighted-average assumptions used in the Black

Scholes model were as follows:

Stock Options

Granted in Fiscal Year

2005 2004 2003

Risk-free interest rate 3.75% 2.62% 4.37%

Expected volatility of stock 30.0% 30.0% 30.0%

Dividend yield 0.3% 0.2% 0.2%

Expected option life 6.0 years 6.0 years 6.0 years

Restricted stock and restricted stock unit (RSU) awards

are recognized as unearned compensation, a component

of stockholders’ equity, based on the fair market value of

our common stock on the award date. These amounts are

amortized to compensation expense, using the straight-line

method, over the vesting period using assumed forfeiture

rates for different types of awards. Compensation expense

is adjusted in future periods if actual forfeiture rates differ

from initial estimates.

Net Earnings Per Share

Basic net earnings per share are computed by dividing

net earnings by the weighted-average number of common

shares outstanding for the reporting period. Diluted net

earnings per share reflect the potential dilution that could

occur if securities or other contracts to issue common

stock were exercised or converted into common stock.

Outstanding stock options and restricted stock granted

by us represent the only dilutive effect reflected in diluted

weighted-average shares outstanding. Options and

restricted stock do not impact the numerator of the diluted

net earnings per share computation.

Options to purchase 2,680,412 shares, 4,643,389 shares

and 3,952,618 shares of common stock were excluded from

the calculation of diluted net earnings per share for fiscal

2005, 2004 and 2003, respectively, because their exercise

prices exceeded the average market price of common shares

for the period.

Comprehensive Income (Loss)

Comprehensive income (loss) includes net earnings and

other comprehensive income (loss) items that are excluded

from net earnings under accounting principles generally

accepted in the United States of America. Other comprehen-

sive income (loss) items include foreign currency translation