Red Lobster 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations

Financial Review 2005

28 Darden Restaurants

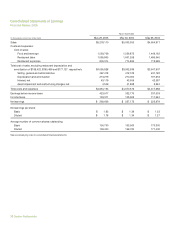

that we would incur an economic penalty for not exercising

the option. The lease term commences on the date when

we have the right to control the use of the leased property,

which is typically before rent payments are due under the

terms of the lease. Many of our leases have renewal periods

totaling five to 20 years, exercisable at our option and require

payment of property taxes, insurance and maintenance

costs in addition to the rent payments. The consolidated

financial statements reflect the same lease term for amortiz-

ing leasehold improvements as we use to determine capital

versus operating lease classifications and in calculating

straight-line rent expense for each restaurant. Percentage

rent expense is generally based upon sales levels and is

accrued at the point in time we determine that it is probable

that such sales levels will be achieved.

Our judgments related to the probable term for each

restaurant affect the classification and accounting for

leases as capital versus operating, the rent holidays and

escalation in payments that are included in the calculation

of straight-line rent and the term over which leasehold

improvements for each restaurant facility are amortized.

These judgments may produce materially different amounts

of depreciation, amortization and rent expense than would

be reported if different assumed lease terms were used.

Impairment of Long-Lived Assets

Land, buildings and equipment and certain other assets,

including capitalized software costs and liquor licenses,

are reviewed for impairment whenever events or changes

in circumstances indicate that the carrying amount of an

asset may not be recoverable. Recoverability of assets to be

held and used is measured by a comparison of the carrying

amount of the assets to the future undiscounted net cash

flows expected to be generated by the assets. Identifiable

cash flows are measured at the lowest level for which they

are largely independent of the cash flows of other groups

of assets and liabilities, generally at the restaurant level. If

these assets are determined to be impaired, the amount of

impairment recognized is the amount by which the carrying

amount of the assets exceeds their fair value. Fair value is

generally determined by appraisals or sales prices of compa-

rable assets. Restaurant sites and certain other assets to be

disposed of are reported at the lower of their carrying amount

or fair value, less estimated costs to sell. Restaurant sites and

certain other assets to be disposed of are included in assets

held for sale when certain criteria are met. These criteria

include the requirement that the likelihood of disposing of

these assets within one year is probable. Assets whose dis-

posal is not probable within one year remain in land, buildings

and equipment until their disposal is probable within one year.

The judgments we make related to the expected useful

lives of long-lived assets and our ability to realize undis-

counted cash flows in excess of the carrying amounts of

these assets are affected by factors such as the ongoing

maintenance and improvements of the assets, changes in

economic conditions and changes in usage or operating

performance. As we assess the ongoing expected cash

flows and carrying amounts of our long-lived assets, sig-

nificant adverse changes in these factors could cause us to

realize a material impairment charge. In the fourth quarter

of fiscal 2004, we recognized asset impairment charges

of $37 million ($23 million after-tax) for the closing of six

Bahama Breeze restaurants and the write-down of four

other Bahama Breeze restaurants, one Olive Garden restau-

rant and one Red Lobster restaurant based on an evaluation

of expected cash flows. During fiscal 2005, we recognized

asset impairment charges of $6 million ($4 million after-tax)

for the write-down of two Olive Garden restaurants, one Red

Lobster restaurant and one Smokey Bones restaurant based

on an evaluation of expected cash flows. The Smokey Bones

restaurant was closed subsequent to fiscal 2005 while the

two Olive Garden restaurants and one Red Lobster restau-

rant continued to operate.

Insurance Accruals

Through the use of insurance program deductibles and

self-insurance, we retain a significant portion of expected

losses under our workers’ compensation, employee medical

and general liability programs. However, we carry insurance

for individual claims that generally exceed $0.25 million for

workers’ compensation and general liability claims. Accrued

liabilities have been recorded based on our estimates of the

anticipated ultimate costs to settle all claims, both reported

and not yet reported.

Our accounting policies regarding these insurance

programs include our judgments and independent actu-

arial assumptions regarding economic conditions, the

frequency or severity of claims and claim development