Red Lobster 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

Financial Review 2005

Darden Restaurants 49

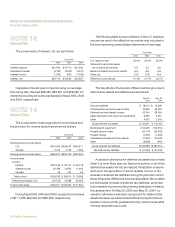

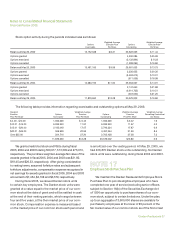

The effective annual interest rate is 7.57 percent for the

notes and 7.82 percent for the debentures, after consider-

ation of loan costs, issuance discounts and interest-rate

swap termination costs.

We also maintain a credit facility that expires in October

2008, with a consortium of banks under which we can bor-

row up to $400,000. The credit facility allows us to borrow at

interest rates that vary based on a spread over (i) LIBOR or

(ii) a base rate that is the higher of the prime rate, or one-half

of one percent above the federal funds rate, at our option. The

interest rate spread over LIBOR is determined by our debt

rating. The credit facility supports our commercial paper

borrowing program. We are required to pay a facility fee of

12.5 basis points per annum on the average daily amount of

loan commitments by the consortium. The amount of inter-

est and the annual facility fee are subject to change based on

our maintenance of certain debt ratings and financial ratios,

such as maximum debt to capital ratios. Advances under the

credit facility are unsecured. At May 29, 2005 and May 30,

2004, no borrowings were outstanding and we were in com-

pliance with the covenants under this credit facility.

The aggregate maturities of long-term debt for each of

the five fiscal years subsequent to May 29, 2005, and there-

after are $300,000 in 2006, $150,000 in 2007, $0 in 2008,

2009 and 2010 and $201,010 thereafter.

NOTE 9

Derivative Instruments and Hedging Activities

We use interest rate related derivative instruments to

manage our exposure on debt instruments, as well as com-

modities derivatives to manage our exposure to commodity

price fluctuations. We also use equity related derivative instru-

ments to manage our exposure on cash compensation

arrangements indexed to the market price of our common

stock. By using these instruments, we expose ourselves, from

time to time, to credit risk and market risk. Credit risk is the

failure of the counterparty to perform under the terms of the

derivative contract. When the fair value of a derivative con-

tract is positive, the counterparty owes us, which creates

credit risk for us. We minimize this credit risk by entering into

transactions with high quality counterparties. Market risk is

the adverse effect on the value of a financial instrument that

results from a change in interest rates, commodity prices, or

market price of our common stock. We minimize this market

risk by establishing and monitoring parameters that limit the

types and degree of market risk that may be undertaken.

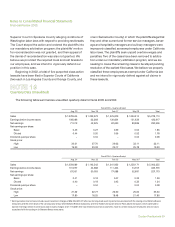

Futures Contracts and Commodity Swaps

During fiscal 2005 and 2004, we entered into futures con-

tracts and commodity swaps to reduce the risk of natural

gas price fluctuations. To the extent these derivatives are

effective in offsetting the variability of the hedged cash flows,

changes in the derivatives’ fair value are not included in

current earnings but are reported as accumulated other

comprehensive income (loss). These changes in fair value

are subsequently reclassified into earnings when the natu-

ral gas is purchased and used by us in our operations. Net

losses of $311 and $439 related to these derivatives were

recognized in earnings during fiscal 2005 and 2004, respec-

tively. The fair value of these contracts was a net gain of $60

at May 29, 2005 and is expected to be reclassified from

accumulated other comprehensive income (loss) into restau-

rant expenses during the next nine months. To the extent

these derivatives are not effective, changes in their fair value

are immediately recognized in current earnings. Outstand-

ing derivatives are included in other current assets or other

current liabilities.

At May 29, 2005, the maximum length of time over which

we are hedging our exposure to the variability in future natural

gas cash flows is 12 months. No gains or losses were reclas-

sified into earnings during fiscal 2005 or fiscal 2004 as a result

of the discontinuance of natural gas cash flow hedges.

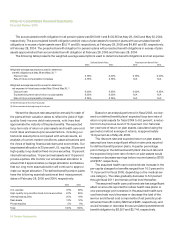

Interest Rate Lock Agreement

During fiscal 2002, we entered into a treasury interest

rate lock agreement (treasury lock) to hedge the risk that the

cost of a future issuance of fixed-rate debt may be adversely

affected by interest rate fluctuations. The treasury lock, which

had a $75,000 notional principal amount of indebtedness,

was used to hedge a portion of the interest payments asso-

ciated with $150,000 of debt subsequently issued in March

2002. The treasury lock was settled at the time of the related

debt issuance with a net gain of $267 being recognized in

other comprehensive income (loss). The net gain on the trea-

sury lock is being amortized into earnings as an adjustment

to interest expense over the same period in which the related

interest costs on the new debt issuance are being recognized

in earnings. Annual amortization of $53 was recognized in