Proctor and Gamble 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements The Procter & Gamble Company 71

Amounts in millions of dollars except per share amounts or as otherwise specified.

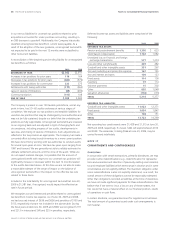

NOTE 12

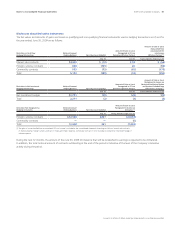

DISCONTINUED OPERATIONS

In November2008, the Company completed the divestiture of our

Coffee business through the merger of its Folgers coffee subsidiary into

The J.M. Smucker Company (Smucker) in an all-stock reverse Morris

Trust transaction. In connection with the merger, 38.7million shares

of common stock of the Company were tendered by shareholders and

exchanged for all shares of Folgers common stock, resulting in an

increase of treasury stock of $2,466. Pursuant to the merger, a Smucker

subsidiary merged with and into Folgers and Folgers became a wholly

owned subsidiary of Smucker. The Company recorded an after-tax

gain on the transaction of $2,011, which is included in Net Earnings

from Discontinued Operations in the Consolidated Statement of

Earnings for the year ended June30,2009.

The Coffee business had historically been part of the Company’s Snacks,

Coffee and Pet Care reportable segment, as well as the coffee portion

of our away-from-home business which is included in the Fabric Care

and Home Care reportable segment. In accordance with the applicable

accounting guidance for the impairment or disposal of long-lived

assets, the results of Folgers are presented as discontinued operations

and, as such, have been excluded from both continuing operations and

segment results for all years presented. Following is selected financial

information included in Net Earnings from Discontinued Operations

for the Coffee business:

Years Ended June 30 2009 2008 2007

Net Sales $668 $1,754 $1,644

Earnings from discontinued

operation 212 446 447

Income tax expense (80) (169)(170)

Gain on sale of discontinued

operation 1,896

— —

Deferred tax benefit on sale 115

— —

Net earnings from discontinued

operations 2,143 277 277

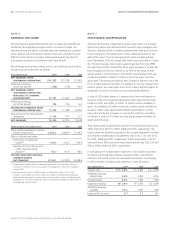

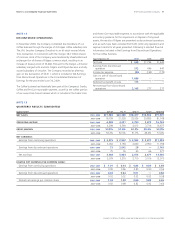

NOTE 13

QUARTERLY RESULTS (UNAUDITED)

Quarters Ended Sept 30 Dec 31 Mar 31 Jun 30 Total Year

NET SALES 2008 –2009 $21,582 $20,368 $18,417 $18,662 $79,029

2007–2008 19,799 21,038 20,026 20,885 81,748

OPERATING INCOME 2008 –2009 4,569 4,251 3,730 3,573 16,123

2007–2008 4,298 4,590 4,013 3,736 16,637

GROSS MARGIN 2008 –2009 50.8% 51.6% 50.3% 50.3% 50.8%

2007–2008 53.2% 52.3% 51.7% 49.4% 51.6%

NET EARNINGS:

Earnings from continuing operations 2008 –2009 $3,275 $2,962 $2,585 $2,471 $11,293

2007–2008 3,004 3,194 2,650 2,950 11,798

Earnings from discontinued operations 2008 –2009 73 2,042 28 —2,143

2007–2008 75 76 60 66 277

Net earnings 2008 –2009 3,348 5,004 2,613 2,471 13,436

2007–2008 3,079 3,270 2,710 3,016 12,075

DILUTED NET EARNINGS PER COMMON SHARE:

Earnings from continuing operations 2008 –2009 $1.01 $0.94 $0.83 $0.80 $3.58

2007–2008 0.90 0.96 0.80 0.90 3.56

Earnings from discontinued operations 2008 –2009 0.02 0.64 0.01 —0.68

2007–2008 0.02 0.02 0.02 0.02 0.08

Diluted net earnings per common share 2008 –2009 1.03 1.58 0.84 0.80 4.26

2007–2008 0.92 0.98 0.82 0.92 3.64