Proctor and Gamble 2009 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 The Procter & Gamble Company Management’s Discussion and Analysis

Beauty

BEAUTY

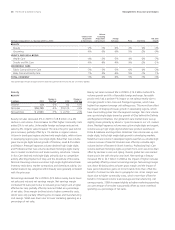

($ millions) 2009

Change vs.

Prior Year 2008

Change vs.

Prior Year

Volume n/a -2% n/a +2%

Net sales $18,789 -4% $19,515 +9%

Net earnings $2,531 -7% $2,730 +5%

Beauty net sales decreased 4% in 2009 to $18.8billion on a 2%

decline in unit volume. Price increases to offset higher commodity costs

added 2% to net sales. Unfavorable foreign exchange reduced net

sales by 4%. Organic sales increased 1% versus the prior year behind

price increases, partially offset by a 1% decline in organic volume.

Volume in developed regions declined mid-single digits, while volume

in developing regions grew low single digits. Retail Hair Care volume

grew low single digits behind growth of Pantene, Head & Shoulders

and Rejoice. Prestige Fragrances volume declined high single digits

and Professional Hair Care volume declined mid-single digits mainly

due to market contractions and trade inventory reductions. Volume

in Skin Care declined mid-single digits primarily due to competitive

activity affecting shipments of Olay and the divestiture of Noxzema.

Personal Cleansing volume was down high single digits behind trade

inventory reductions, market contractions and divestiture activity. Our

market shares in key categories within Beauty were generally consistent

with the prior year.

Net earnings decreased 7% in 2009 to $2.5billion mainly due to lower

net sales and reduced net earnings margin. Net earnings margin

contracted 50 basis points due to reduced gross margin and a higher

effective tax rate, partially offset by reduced SG&A as a percentage

of net sales. Gross margin declined due to higher commodity costs,

which were only partially offset by price increases and manufacturing

cost savings. SG&A was down due to lower marketing spending as a

percentage of net sales.

Beauty net sales increased 9% in 2008 to $19.5billion behind 2%

volume growth and 6% of favorable foreign exchange. Favorable

product mix had a positive 1% impact on net sales primarily due to

stronger growth in Skin Care and Prestige Fragrances, which have

higher than segment average unit selling prices. This more than offset

the impact of disproportionate growth in developing regions, which

have lower selling prices than the segment average. Skin Care volume

was up mid-single digits driven by growth of Olay behind the Definity

and Regenerist initiatives. Our global skin care market share was up

slightly, driven primarily by about a 1 point increase in our U.S. market

share. Prestige Fragrances volume was up low single digits and organic

volume was up high single digits behind new product launches on

Dolce & Gabbana and Hugo Boss. Retail Hair Care volume was up mid-

single digits, led by high single-digit growth in developing markets.

Retail Hair Care volume in developed regions was flat as a double-digit

volume increase of Head & Shoulders was offset by a double-digit

volume decline of Pantene in North America. Professional Hair Care

volume declined mid-single digits as growth from color was more than

offset by declines in care and styling. Overall, global hair care market

share was in line with the prior year level. Net earnings in Beauty

increased 5% to $2.7billion in 2008 as the impact of higher net sales

was partially offset by a lower net earnings margin. Net earnings margin

was down 60 basis points as lower gross margin and the impact of

base period divestiture gains on minor brands more than offset the

benefit of a lower tax rate due to geographic mix. Gross margin was

down due to higher commodity costs, which more than offset the

benefit of increased volume scale leverage and manufacturing cost

savings projects. SG&A increased slightly as higher marketing spending

as a percentage of net sales was partially offset by lower overhead

spending as a percentage of net sales.

Net Sales Change Drivers vs. Year Ago (2009 vs. 2008)

Volume with

Acquisitions

& Divestitures

Volume

Excluding

Acquisitions

& Divestitures

Foreign

Exchange Price Mix/Other

Net Sales

Growth

BEAUTY

Beauty -2% -1% -4% 2% 0% -4%

Grooming -6% -5% -6% 5% -2% -9%

HEALTH AND WELL-BEING

Health Care-4% -3% -5% 4% -2% -7%

Snacks and Pet Care-6% -6% -4% 9% -2% -3%

HOUSEHOLD CARE

Fabric Care and Home Care-3% -3% -5% 6% 0% -2%

Baby Care and Family Care1% 2% -4% 5% -1% 1%

TOTAL COMPANY -3% -2% -4% 5% -1% -3%

Sales percentage changes are approximations based on quantitative formulas that are consistently applied.