Proctor and Gamble 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

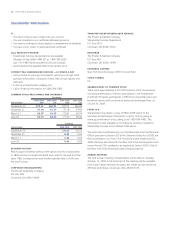

Notes to Consolidated Financial Statements The Procter & Gamble Company 67

Amounts in millions of dollars except per share amounts or as otherwise specified.

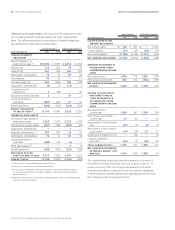

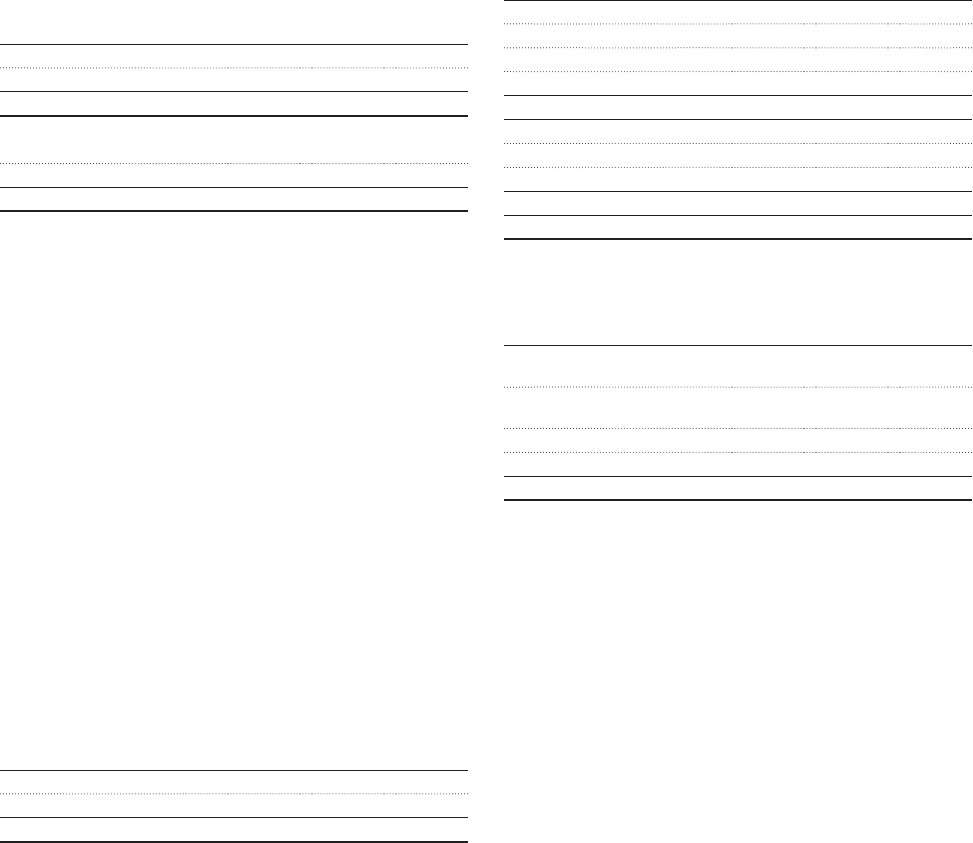

The series A and B preferred shares of the ESOP are allocated to

employees based on debt service requirements, net of advances

made by the Company to the Trust. The number of preferred shares

outstanding at June30 was as follows:

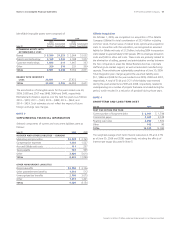

Shares in thousands 2009 2008 2007

Allocated 56,818 58,557 60,402

Unallocated 16,651 18,665 20,807

TOTAL SERIES A 73,469 77,222 81,209

Allocated 20,991 21,134 21,105

Unallocated 42,522 43,618 44,642

TOTAL SERIES B 63,513 64,752 65,747

For purposes of calculating diluted net earnings per common share,

the preferred shares held by the ESOP are considered converted from

inception.

In connection with the Gillette acquisition, we assumed the Gillette

ESOP, which was established to assist Gillette employees in financing

retiree medical costs. These ESOP accounts are held by participants and

must be used to reduce the Company’s other retiree benefit obligations.

Such accounts reduced our obligation by $171 at June30,2009.

NOTE 9

INCOME TAXES

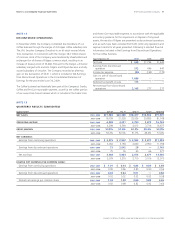

Income taxes are recognized for the amount of taxes payable for the

current year and for the impact of deferred tax liabilities and assets,

which represent future tax consequences of events that have been

recognized differently in the financial statements than for tax purposes.

Deferred tax assets and liabilities are established using the enacted

statutory tax rates and are adjusted for any changes in such rates in

the period of change.

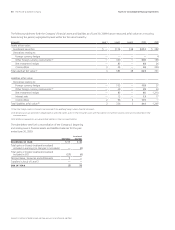

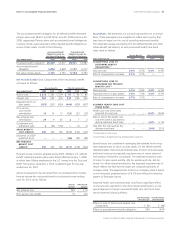

Earnings from continuing operations before income taxes consisted

of the following:

Years ended June 30 2009 2008 2007

United States $9,064 $8,696 $8,692

International 6,261 6,936 5,572

TOTAL 15,325 15,632 14,264

The provision for income taxes on continuing operations consisted of

the following:

Years ended June 30 2009 2008 2007

CURRENT TAX EXPENSE

U.S. federal $1,867 $860 $2,511

International 1,316 1,546 1,325

U.S. state and local 253 214 112

3,436 2,620 3,948

DEFERRED TAX EXPENSE

U.S. federal 577 1,267 231

International and other 19 (53)22

596 1,214 253

TOTAL TAX EXPENSE 4,032 3,834 4,201

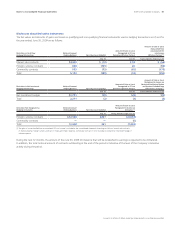

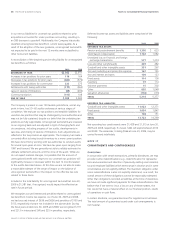

A reconciliation of the U.S. federal statutory income tax rate to our

actual income tax rate on continuing operations is provided below:

Years ended June 30 2009 2008 2007

U.S. federal statutory income

tax rate 35.0% 35.0% 35.0%

Country mix impacts of foreign

operations -6.9% -6.8% -4.5%

Income tax reserve adjustments -1.2% -3.2% -0.3%

Other -0.6% -0.5% -0.7%

EFFECTIVE INCOME TAX RATE 26.3% 24.5% 29.5%

Income tax reserve adjustments represent changes in our net liability

for unrecognized tax benefits related to prior year tax positions.

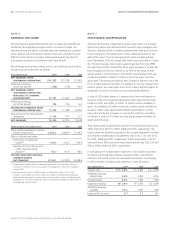

Tax benefits credited to shareholders’ equity totaled $556 and $1,823

for the years ended June30,2009 and 2008, respectively. These

primarily relate to the tax effects of net investment hedges, excess tax

benefits from the exercise of stock options and the impacts of certain

adjustments to pension and other retiree benefit obligations recorded

in shareholders’ equity.

We have undistributed earnings of foreign subsidiaries of approxi-

mately $25billion at June30,2009, for which deferred taxes have not

been provided. Such earnings are considered indefinitely invested in

the foreign subsidiaries. If such earnings were repatriated, additional

tax expense may result, although the calculation of such additional

taxes is not practicable.

On July1,2007, we adopted new accounting guidance on the

accounting for uncertainty in income taxes. The adoption of the new

guidance resulted in a decrease to retained earnings as of July1, 2007,

of $232, which was reflected as a cumulative effect of a change in

accounting principle, with a corresponding increase to the net liability

for unrecognized tax benefits. The impact primarily reflects the accrual

of additional statutory interest and penalties as required by the new

accounting guidance, partially offset by adjustments to existing

unrecognized tax benefits to comply with measurement principles.

The implementation of the new guidance also resulted in a reduction