Proctor and Gamble 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

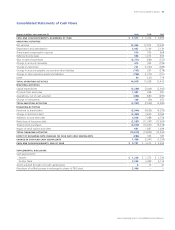

Management’s Discussion and Analysis The Procter & Gamble Company 43

below our 90% target primarily due to the gain on the Folgers coffee

transaction which lowered productivity by approximately 15% because

the gain is included in net earnings but had no impact on operating

cash flow.

In 2008, free cash flow was $12.0billion, compared to $10.5billion

in 2007. Free cash flow increased primarily as a result of higher

operating cash flow. Capital expenditures were $3.0billion and 3.7%

of net sales. Free cash flow productivity was 99% in 2008, ahead of

our 90% target.

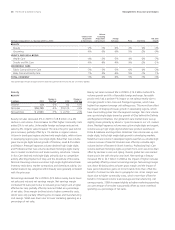

Target %

%

87%

%

07

09

08

FREE CASH FLOW PRODUCTIVITY

(% of net earnings)

Investing Activities

Net investing activities used $2.4billion of cash in 2009 and $2.5billion

in 2008 mainly due to capital spending.

Capital Spending. We view capital spending efficiency as a critical

component of our overall cash management strategy. Capital

expenditures in 2009 were $3.2billion, compared to $3.0billion in

2008. Capital spending as a percentage of net sales was 4.1% in 2009,

compared to 3.7% in 2008, as we continued to make investments to

support capacity, innovation and cost savings. Capital spending for

our discontinued Coffee business was $3million and $30million in

2009 and 2008, respectively.

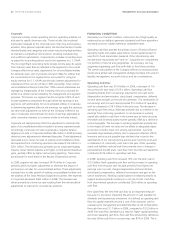

3.9%

4.%

3.7%

07

09

08

CAPITAL SPENDING

(% of net sales)

Acquisitions. Acquisitions used $368million of cash in 2009 primarily

for the acquisition of Nioxin, a leader in the scalp care professional

hair care market, which was incorporated into Beauty. In 2008,

acquisitions used $381million of cash primarily for the acquisition of

Frederic Fekkai, a premium hair care brand, in Beauty.

Proceeds from Asset Sales. Proceeds from asset sales were

$1.1billion in 2009 mainly due to the sale of our Coffee business

and the Thermacare brand. Of these proceeds, $350million related

to debt issued in connection with the Folgers coffee transaction.

The underlying debt obligation was transferred to The J.M. Smucker

Company pursuant to the transaction. No cash was received from

Smucker in the exchange transaction. During 2009, we also divested

our Thermacare brand and a number of other minor brands. In 2008,

proceeds from asset sales were $928million primarily behind the sale

of our Western Europe family care business as well as several minor

Beauty and Health Care divestitures.

Financing Activities

Dividend Payments. Our first discretionary use of cash is dividend

payments. Dividends per common share increased 13% to $1.64

per share in 2009. Total dividend payments to both common and

preferred shareholders were $5.0billion, $4.7billion and $4.2billion

in 2009, 2008 and 2007, respectively. In April 2009, the Board of

Directors declared an increase in our quarterly dividend from $0.40

to $0.44 per share on Common Stock and Series A and B ESOP

Convertible Class A Preferred Stock.

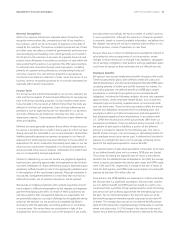

$1.28

$.64

$1.45

07

09

08

DIVIDENDS

(per common share)

Long-Term and Short-Term Debt. We maintain debt levels we consider

appropriate after evaluating a number of factors, including cash flow

expectations, cash requirements for ongoing operations, investment

and financing plans (including acquisitions and share repurchase

activities) and the overall cost of capital. Total debt was $37.0billion

in 2009, $36.7billion in 2008 and $35.4billion in 2007. Debt

increased in 2009 and 2008 primarily to fund our share repurchase

plan discussed below.

Treasury Purchases. In 2007, we began to acquire $24–30billion of

our outstanding shares under a publicly announced three-year share

repurchase plan. To date, we have acquired $16.3billion of shares

under this repurchase plan. Total share repurchases were $6.4billion

in 2009 and $10.0billion in 2008, nearly all of which were made under

our publicly announced share repurchase plan. Total share repurchases

under the publicly announced plan may be below the announced

range due to lower earnings growth in fiscal 2009 and 2010 versus

expectations at the time the plan was publicly announced.

In November 2008, we completed the divestiture of our Folgers coffee

subsidiary. In connection with this divestiture, 38.7 million shares of

P&G common stock were tendered by shareholders and exchanged for

all shares of Folgers common stock, resulting in an increase of treasury

stock of $2.5 billion.

Liquidity

Our current liabilities exceeded current assets by $9.0billion, driven

by our short-term debt position. We utilize short- and long-term debt

to fund discretionary items such as acquisitions and share repurchases.

We anticipate being able to support our short-term liquidity and

operating needs largely through cash generated from operations.

We have strong short- and long-term debt ratings which despite the

current credit crisis have enabled and should continue to enable us to

refinance our debt as it becomes due at favorable rates in commercial

paper and bond markets. In addition, we have agreements with a

diverse group of financial institutions that, if needed, should provide

sufficient credit funding to meet short-term financing requirements.