Proctor and Gamble 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis The Procter & Gamble Company 35

related to general overhead and workforce optimization. Successfully

managing these changes, including identifying, developing and

retaining key employees, is critical to our success.

Global Economic Conditions. Economic changes, terrorist activity and

political unrest may result in business interruption, inflation, deflation

or decreased demand for our products. Our success will depend, in

part, on our ability to manage continued global political and/or

economic uncertainty, especially in our significant geographic markets,

as well as any political or economic disruption due to terrorist and

other hostile activities.

Regulatory Environment. Changes in laws, regulations and the related

interpretations may alter the environment in which we do business.

This includes changes in environmental, competitive and product-

related laws, as well as changes in accounting standards and taxation

requirements. Our ability to manage regulatory, tax and legal matters

(including product liability, patent, intellectual property, competition

law matters and tax policy) and to resolve pending legal matters

within current estimates may impact our results.

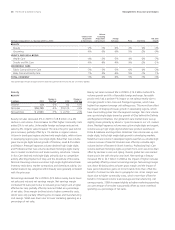

RESULTS OF OPERATIONS

Net Sales

Net sales decreased 3% in 2009 to $79.0billion behind a 3% decline

in unit volume. Unfavorable foreign exchange reduced net sales by

4% as many foreign currencies weakened versus the U.S. dollar.

Price increases, taken across all segments, primarily to offset higher

commodity costs and foreign exchange impacts, added 5% to net

sales. Negative product mix reduced net sales by 1% mainly due to

disproportionate volume declines in our more discretionary categories

(primarily Prestige Fragrances, Professional Hair Care and Braun

appliances), along with Pharmaceuticals and Personal Health Care,

all of which have higher than Company average selling prices. Every

reportable segment except Baby Care and Family Care reported volume

declines led by mid-single-digit declines in Grooming and Snacks and

Pet Care. Volume in both developed and developing regions was below

previous year levels. Organic volume, which excludes the impact of

acquisitions and divestitures, declined 2%. Organic sales increased

2% behind the net benefit of pricing and mix. The global economic

downturn, credit crisis and price increases have contributed to market

contractions, trade inventory reductions and share declines in certain

businesses, resulting in organic sales below the Company’s long-term

financial target range. These impacts were more pronounced in our

more discretionary categories and may continue to negatively impact

results of operations into fiscal 2010.

$.

$9.0

$.

07

09

08

NET SALES

($ billions)

29%

32%

31%

07

09

08

DEVELOPING MARKETS

(% of net sales)

Net sales increased 9% in 2008 to $81.7billion behind 4% unit volume

growth, a favorable 5% foreign exchange impact and a positive 1%

pricing impact. Favorable foreign exchange resulted primarily from the

strengthening of European and other currencies relative to the U.S.

dollar. Price increases were taken across a number of our businesses

primarily to offset higher commodity costs. Mix had a negative 1%

impact on net sales primarily due to disproportionate growth in

developing regions, where selling prices are below the Company

average. Each reportable segment posted year-on-year volume growth,

with mid-single-digit growth in Fabric Care and Home Care, Baby

Care and Family Care, Grooming and Health Care and low single-digit

growth in Beauty and Snacks and Pet Care. Each geographic region

posted year-on-year volume growth except Western Europe, which

was down low single digits due to the impact of divestitures. Volume

grew primarily behind initiative activity on key brands and continued

double-digit growth in developing regions. Organic sales increased

5% behind organic volume growth of 5%. Each reportable segment

posted year-on-year organic sales and organic volume growth.