Proctor and Gamble 2009 Annual Report Download - page 71

Download and view the complete annual report

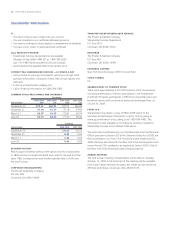

Please find page 71 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements The Procter & Gamble Company 69

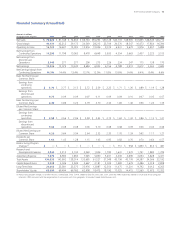

Amounts in millions of dollars except per share amounts or as otherwise specified.

Off-Balance Sheet Arrangements

We do not have off-balance sheet financing arrangements, including

variable interest entities, that have a material impact on our financial

statements.

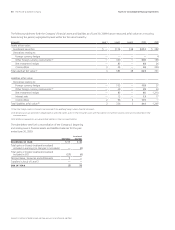

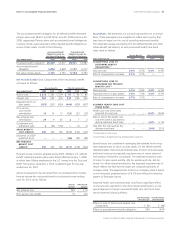

Purchase Commitments

We have purchase commitments for materials, supplies, services

and property, plant and equipment as part of the normal course of

business. Commitments made under take-or-pay obligations are as

follows: 2010

—

$1,258; 2011

—

$872; 2012

—

$787; 2013

—

$525;

2014

—

$156; and $299 thereafter. Such amounts represent future

purchases in line with expected usage to obtain favorable pricing.

Approximately 43% of our purchase commitments relate to service

contracts for information technology, human resources management

and facilities management activities that have been outsourced to

third-party suppliers. Due to the proprietary nature of many of our

materials and processes, certain supply contracts contain penalty

provisions for early termination. We do not expect to incur penalty

payments under these provisions that would materially affect our

financial position, results of operations or cash flows.

Operating Leases

We lease certain property and equipment for varying periods. Future

minimum rental commitments under noncancelable operating

leases are as follows: 2010

—

$305; 2011

—

$272; 2012

—

$223;

2013

—

$202; 2014

—

$176; and $442 thereafter. Operating lease

obligations are shown net of guaranteed sublease income.

Litigation

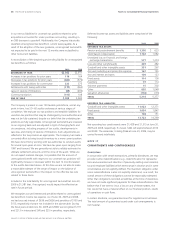

We are subject to various legal proceedings and claims arising out of

our business which cover a wide range of matters such as govern-

mental regulations, antitrust and trade regulations, product liability,

patent and trademark matters, income taxes and other actions.

As previously disclosed, the Company is subject to a variety of investi-

gations into potential competition law violations in Europe, including

investigations initiated in the fourth quarter of fiscal 2008 by the

European Commission with the assistance of national authorities

from a variety of countries. We believe these matters involve a number

of other consumer products companies and/or retail customers. The

Company’s policy is to comply with all laws and regulations, including

all antitrust and competition laws, and to cooperate with investigations

by relevant regulatory authorities, which the Company is doing.

Competition and antitrust law inquiries often continue for several years

and, if violations are found, can result in substantial fines. In other

industries, fines have amounted to hundreds of millions of dollars.

At this point, no significant formal claims have been made against the

Company or any of our subsidiaries in connection with any of the

above inquiries.

In response to the actions of the European Commission and national

authorities, the Company has launched its own internal investigations

into potential violations of competition laws, some of which are

ongoing. The Company has identified violations in certain European

countries and appropriate actions are being taken. It is still too early

for us to reasonably estimate the fines to which the Company will be

subject as a result of these competition law issues. However, the

ultimate resolution of these matters will likely result in fines or other

costs that could materially impact our income statement and cash

flows in the period in which they are accrued and paid, respectively.

As these matters evolve the Company will, if necessary, recognize the

appropriate reserves.

With respect to other litigation and claims, while considerable uncer-

tainty exists, in the opinion of management and our counsel, the

ultimate resolution of the various lawsuits and claims will not materially

affect our financial position, results of operations or cash flows.

We are also subject to contingencies pursuant to environmental laws

and regulations that in the future may require us to take action to

correct the effects on the environment of prior manufacturing and

waste disposal practices. Based on currently available information, we

do not believe the ultimate resolution of environmental remediation

will have a material adverse effect on our financial position, results of

operations or cash flows.

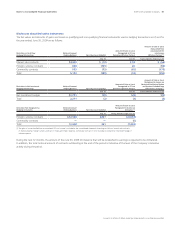

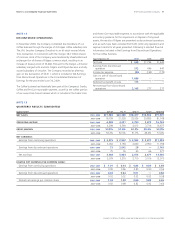

NOTE 11

SEGMENT INFORMATION

Through fiscal 2009, we were organized under three GBUs as follows:

ō The Beauty GBU includes the Beauty and the Grooming businesses.

The Beauty business is comprised of cosmetics, deodorants, prestige

fragrances, hair care, personal cleansing and skin care. The Grooming

business includes blades and razors, electric hair removal devices,

face and shave products and home appliances.

ō The Health and Well-Being GBU includes the Health Care and the

Snacks and Pet Care businesses. The Health Care business includes

feminine care, oral care, personal health care and pharmaceuticals.

The Snacks and Pet Care business includes pet food and snacks.

ō The Household Care GBU includes the Fabric Care and Home Care

as well as the Baby Care and Family Care businesses. The Fabric Care

and Home Care business includes air care, batteries, dish care,

fabric care and surface care. The Baby Care and Family Care business

includes baby wipes, bath tissue, diapers, facial tissue and paper

towels.

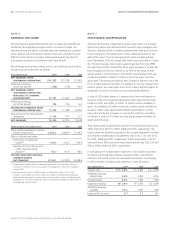

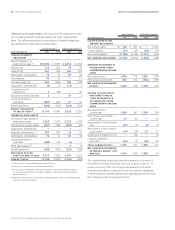

Under U.S. GAAP, we have six reportable segments: Beauty; Grooming;

Health Care; Snacks and Pet Care; Fabric Care and Home Care; and

Baby Care and Family Care. The accounting policies of the businesses

are generally the same as those described in Note 1. Differences

between these policies and U.S. GAAP primarily reflect: income taxes,

which are reflected in the businesses using applicable blended statutory

rates; the recording of fixed assets at historical exchange rates in certain

high-inflation economies; and the treatment of certain unconsolidated

investees. Certain unconsolidated investees are managed as integral

parts of our business units for management reporting purposes.