Proctor and Gamble 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis The Procter & Gamble Company 47

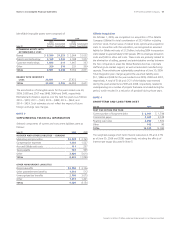

Our annual impairment testing for both goodwill and indefinite-lived

intangible assets indicated that all reporting units and intangible assets

fair values exceeded their respective recorded values. However, future

changes in the judgments, assumptions and estimates that are used

in our impairment testing for goodwill and indefinite-lived intangible

assets, including discount and tax rates or future cash flow projections,

could result in significantly different estimates of the fair values, which

could result in impairment charges that could materially affect the

financial statements in any given year. The recorded value of goodwill

and intangible assets from recently acquired businesses are derived

from more recent business operating plans and macroeconomic

environmental conditions and therefore are more susceptible to an

adverse change that could require an impairment charge. For example,

because the Gillette intangible and goodwill amounts represent current

values as of the relatively recent acquisition date, such amounts are

more susceptible to an impairment risk if business operating results

or macroeconomic conditions deteriorate. Gillette indefinite-lived

intangible assets represent approximately 89% of the $26.9billion of

indefinite-lived intangible assets at June 30, 2009. Goodwill allocated

to reporting units consisting entirely of businesses purchased as part of

the Gillette acquisition (Blades and Razors, Braun, Batteries) represents

47% of the $56.5billion of goodwill at June 30, 2009. With the

exception of our Braun business, all of our other reporting units have

fair values that significantly exceed recorded values. While the fair

value of our Braun business exceeds its carrying value, which includes

goodwill and indefinite-lived intangibles of $2.4billion, the economic

downturn in 2009 has resulted in a disproportionate decline in that

business in developing geographies given the more discretionary nature

of home and personal grooming appliances purchases. Our valuation

of the Braun business has it returning to sales and earnings growth

rates consistent with our long-term business plans. Failure to achieve

these business plans or a further deterioration of the macroeconomic

conditions could result in a valuation that would trigger an impairment

of the Braun business goodwill and intangibles.

New Accounting Pronouncements

On July 1, 2008, we adopted new accounting guidance on fair value

measurements. This new guidance defines fair value, establishes a

framework for measuring fair value in generally accepted accounting

principles and expands disclosures about fair value measurements. The

new guidance was effective for the Company beginning July1, 2008,

for certain financial assets and liabilities. Refer to Note 5 for additional

information regarding our fair value measurements for financial assets

and liabilities. The new guidance is effective for non-financial assets

and liabilities recognized or disclosed at fair value on a non-recurring

basis beginning July 1, 2009.

On January 1, 2009, we adopted new accounting guidance on disclo-

sures about derivative instruments and hedging activities. The new

guidance impacts disclosures only and requires additional qualitative

and quantitative information on the use of derivatives and their impact

on an entity’s financial position, results of operations and cash flows.

Refer to Note 5 for additional information regarding our risk manage-

ment activities, including derivative instruments and hedging activities.

In December2007, the Financial Accounting Standards Board (FASB)

issued new accounting guidance on business combinations and

noncontrolling interests in consolidated financial statements. The new

guidance revises the method of accounting for a number of aspects

of business combinations and noncontrolling interests, including

acquisition costs, contingencies (including contingent assets, contingent

liabilities and contingent purchase price), the impacts of partial and

step-acquisitions (including the valuation of net assets attributable

to non-acquired minority interests), and post acquisition exit activities

of acquired businesses. The new guidance will be effective for the

Company beginning July1, 2009.

No other new accounting pronouncement issued or effective during

the fiscal year has had or is expected to have a material impact on the

Consolidated Financial Statements.

OTHER INFORMATION

Hedging and Derivative Financial Instruments

As a multinational company with diverse product offerings, we are

exposed to market risks, such as changes in interest rates, currency

exchange rates and commodity prices. We evaluate exposures on a

centralized basis to take advantage of natural exposure netting and

correlation. To the extent we choose to manage volatility associated

with the net exposures, we enter into various financial transactions

which we account for using the applicable accounting guidance for

derivative instruments and hedging activities. These financial transac-

tions are governed by our policies covering acceptable counterparty

exposure, instrument types and other hedging practices. Note 5 to

the Consolidated Financial Statements includes a detailed discussion

of our accounting policies for financial instruments.

Derivative positions are monitored using techniques including market

valuation, sensitivity analysis and value-at-risk modeling. The tests for

interest rate, currency rate and commodity price exposures discussed

below are based on the CorporateManager™value-at-risk model

using a one-year horizon and a 95% confidence level. The model

incorporates the impact of correlation (the degree to which exposures

move together over time) and diversification (from holding multiple

currency, commodity and interest rate instruments) and assumes that

financial returns are normally distributed. Estimates of volatility and

correlations of market factors are drawn from the RiskMetrics™dataset

as of June 30, 2009. In cases where data is unavailable in RiskMetrics™,

a reasonable proxy is included.

Our market risk exposures relative to interest rates, currency rates and

commodity prices, as discussed below, have not changed materially

versus the previous reporting period. In addition, we are not aware of

any facts or circumstances that would significantly impact such

exposures in the near term.

Interest Rate Exposure on Financial Instruments. Interest rate swaps

are used to hedge exposures to interest rate movement on underlying

debt obligations. Certain interest rate swaps denominated in foreign

currencies are designated to hedge exposures to currency exchange