Proctor and Gamble 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.42 The Procter & Gamble Company Management’s Discussion and Analysis

Corporate

Corporate includes certain operating and non-operating activities not

allocated to specific business units. These include: the incidental

businesses managed at the corporate level; financing and investing

activities; other general corporate items; the historical results of certain

divested brands and categories; and certain restructuring-type activities

to maintain a competitive cost structure, including manufacturing

and workforce optimization. Corporate also includes reconciling items

to adjust the accounting policies used in the segments to U.S. GAAP.

The most significant reconciling items include income taxes (to adjust

from statutory rates that are reflected in the segments to the overall

Company effective tax rate), adjustments for unconsolidated entities

(to eliminate sales, cost of products sold and SG&A for entities that

are consolidated in the segments but accounted for using the

equity method for U.S. GAAP) and minority interest adjustments for

subsidiaries where we do not have 100% ownership. Since certain

unconsolidated entities and less than 100%-owned subsidiaries are

managed as integral parts of the Company, they are accounted for

similar to a wholly owned subsidiary for management and segment

purposes. This means our segment results recognize 100% of each

income statement component through before-tax earnings in the

segments, with eliminations for unconsolidated entities in Corporate.

In determining segment after-tax net earnings, we apply the statutory

tax rates (with adjustments to arrive at the Company’s effective tax

rate in Corporate) and eliminate the share of earnings applicable to

other ownership interests, in a manner similar to minority interest.

Corporate net sales primarily reflect the adjustment to eliminate the

sales of unconsolidated entities included in business segment results.

Accordingly, Corporate net sales is generally a negative balance.

Negative net sales in Corporate declined $86million in 2009 primarily

driven by lower adjustments to eliminate these sales. These adjustments

decreased due to lower net sales of existing unconsolidated entities.

Net expenses from continuing operations decreased $316million to

$201million. The decrease was primarily due to corporate hedging

impacts, lower interest expense and higher current period divestiture

gains, partially offset by higher restructuring spending. These items

are discussed in more detail in the Results of Operations section.

In 2008, negative net sales increased $474million in Corporate

primarily driven by higher adjustments to eliminate the impact of

joint venture net sales for unconsolidated entities. These adjustments

increased due to sales growth of existing unconsolidated entities and

the addition of the Swiss Precision Diagnostics business. Net expenses

in Corporate decreased $450million in 2008. The decrease was

driven primarily by a lower tax rate resulting from the net benefits of

adjustments to reserves for uncertain tax positions.

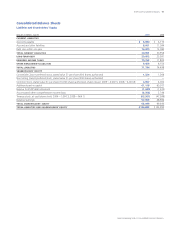

FINANCIAL CONDITION

We believe our financial condition continues to be of high quality, as

evidenced by our ability to generate substantial cash from operations

and ready access to capital markets at competitive rates.

Operating cash flow provides the primary source of funds to finance

operating needs and capital expenditures. Excess operating cash is

used first to fund shareholder dividends. Other discretionary uses

include share repurchases and “tack-on” acquisitions to complement

our portfolio of brands and geographies. As necessary, we may

supplement operating cash flow with debt to fund these activities.

The overall cash position of the Company reflects our strong business

results and a global cash management strategy that takes into account

liquidity management, economic factors and tax considerations.

Operating Activities

Operating cash flow was $14.9billion in 2009, a decrease of 1%

versus the prior year total of $15.0billion. Operating cash flow

resulted primarily from net earnings adjusted for non-cash items

(depreciation and amortization, stock-based compensation, deferred

income taxes and gain on the sale of businesses). The combination of

net earnings and non-cash items provided $15.3billion of operating

cash as compared to $16.7billion in the prior year. The decrease in

operating cash flow versus 2008 was primarily due to a decline in net

earnings from continuing operations. A net decrease in working

capital also added to cash flow in the current year as lower accounts

receivable and inventory balances were partially offset by a decline in

accounts payable. The decrease in working capital was primarily due

to the impact of lower net sales and our ability to adequately adjust

production to better meet unit volume requirements. Accounts

receivable days declined primarily due to improved collection efforts.

Inventory and accounts payable days declined due in part to the

optimization of our manufacturing process and inventory levels and

a moderation of commodity costs late in the year. Other operating

assets and liabilities reduced cash flow primarily due to changes in

postretirement benefit plans. Cash flow from discontinued operations

contributed $124million to operating cash flow.

In 2008, operating cash flow increased 12% over the prior year to

$15.0billion. Both operating cash flow and the increase in operating

cash flow over the prior year resulted primarily from higher net

earnings and non-cash charges (depreciation and amortization,

stock-based compensation, deferred income taxes and gain on the

sale of businesses). Working capital balances increased primarily to

support business growth resulting in a net use of cash. Cash flow

from discontinued operations contributed $263million to operating

cash flow.

Free Cash Flow.We view free cash flow as an important measure

because it is one factor impacting the amount of cash available for

dividends and discretionary investment. It is defined as operating cash

flow less capital expenditures and is one of the measures used to

evaluate senior management and determine their at-risk compensation.

Free cash flow was $11.7billion in 2009, compared to $12.0billion in

2008. Free cash flow decreased as a result of higher capital spending

and lower operating cash flow. Free cash flow productivity, defined as

the ratio of free cash flow to net earnings, was 87% in 2009. This is