Proctor and Gamble 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 The Procter & Gamble Company Notes to Consolidated Financial Statements

Amounts in millions of dollars except per share amounts or as otherwise specified.

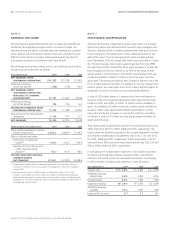

NOTE 6

EARNINGS PER SHARE

Net earnings less preferred dividends (net of related tax benefits) are

divided by the weighted average number of common shares out-

standing during the year to calculate basic net earnings per common

share. Diluted net earnings per common share are calculated to give

effect to stock options and other stock-based awards (see Note 7)

and assume conversion of preferred stock (see Note 8).

Net earnings and common shares used to calculate basic and diluted

net earnings per share were as follows:

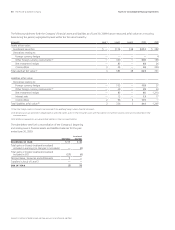

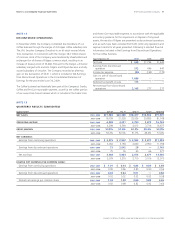

Years ended June 30 2009 2008 2007

NET EARNINGS FROM

CONTINUING OPERATIONS $11,293 $11,798 $10,063

Preferred dividends,

net of tax benefit (192)(176)(161)

NET EARNINGS FROM

CONTINUING OPERATIONS

AVAILABLE TO COMMON

SHAREHOLDERS 11,101 11,622 9,902

Preferred dividends,

net of tax benefit 192 176 161

DILUTED NET EARNINGS FROM

CONTINUING OPERATIONS 11,293 11,798 10,063

Net earnings from discontinued

operations 2,143 277 277

NET EARNINGS 13,436 12,075 10,340

Shares in millions; Years ended June 30 2009 2008 2007

Basic weighted average common

shares outstanding 2,952.2 3,080.8 3,159.0

Effect of dilutive securities

Conversion of preferred

shares (1) 139.2 144.2 149.6

Exercise of stock options and

other unvested equity

awards (2) 62.7 91.8 90.0

DILUTED WEIGHTED AVERAGE

COMMON SHARES

OUTSTANDING 3,154.1 3,316.8 3,398.6

(1) Despite being included currently in diluted net earnings per common share, the actual

conversion to common stock occurs pursuant to the repayment of the ESOPs’ obligations

through 2035.

(2) Approximately 92 million in 2009, 40 million in 2008 and 41 million in 2007 of the

Company’s outstanding stock options were not included in the diluted net earnings per

share calculation because the options were out of the money or to do so would have been

antidilutive (i.e., the total proceeds upon exercise would have exceeded the market value of

the underlying common shares).

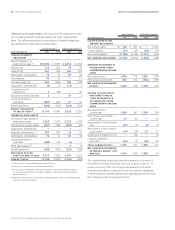

NOTE 7

STOCK-BASED COMPENSATION

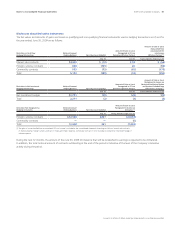

We have stock-based compensation plans under which we annually

grant stock option and restricted stock awards to key managers and

directors. Exercise prices on options granted have been and continue

to be set equal to the market price of the underlying shares on the

date of the grant. The key manager stock option awards granted

since September2002 are vested after three years and have a 10-year

life. The key manager stock option awards granted from July1998

through August2002 vested after three years and have a 15-year life.

Key managers can elect to receive up to 50% of the value of their

option award in restricted stock units (RSUs). Key manager RSUs are

vested and settled in shares of common stock five years from the

grant date. The awards provided to the Company’s directors are in the

form of restricted stock and RSUs. In addition to our key manager and

director grants, we make other minor stock option and RSU grants to

employees for which the terms are not substantially different.

A total of 229million shares of common stock were authorized for

issuance under stock-based compensation plans approved by share-

holders in 2001 and 2003, of which 12million remain available for

grant. An additional 20million shares of common stock available for

issuance under a plan approved by Gillette shareholders in 2004

were assumed by the Company in conjunction with the acquisition

of Gillette. A total of 10million of these shares remain available for

grant under this plan.

Total stock-based compensation expense for stock option grants was

$460, $522 and $612 for 2009, 2008 and 2007, respectively. The

total income tax benefit recognized in the income statement for these

stock-based compensation arrangements was $126, $141 and $163

for 2009, 2008 and 2007, respectively. Total compensation cost for

restricted stock, RSUs and other stock-based grants, was $56, $33 and

$56 in 2009, 2008 and 2007, respectively.

In calculating the compensation expense for stock options granted,

we utilize a binomial lattice-based valuation model. Assumptions

utilized in the model, which are evaluated and revised, as necessary,

to reflect market conditions and experience, were as follows:

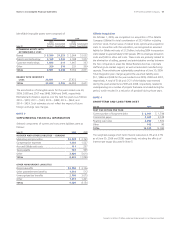

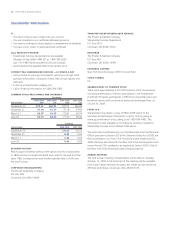

Years ended June 30 2009 2008 2007

Interest rate 0.7– 3.8% 1.3 – 3.8% 4.3 –4.8%

Weighted average

interest rate 3.6% 3.4% 4.5%

Dividend yield 2.0% 1.9% 1.9%

Expected volatility 18 –34% 19 –25% 16 –20%

Weighted average

volatility 21% 20% 19%

Expected life in years 8.78.3 8.7