Proctor and Gamble 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 The Procter & Gamble Company Management’s Discussion and Analysis

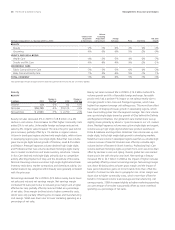

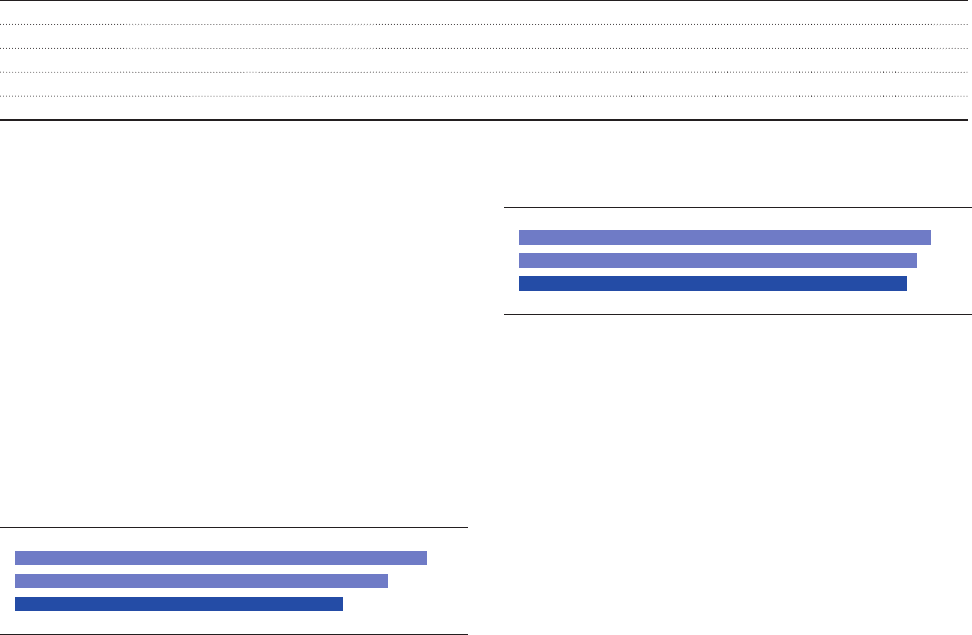

Gross margin declined 80 basis points to 50.8% of net sales in 2009.

Higher commodity and energy costs, partially offset by savings projects

on raw and packing materials, negatively impacted gross margin by

about 250 basis points. Unfavorable foreign exchange and incremental

restructuring charges also negatively impacted gross margin. These

impacts were partially offset by price increases and manufacturing and

logistics cost savings.

Gross margin was down 70 basis points in 2008 to 51.6% of net sales.

Commodity and energy cost increases had anegative impact on gross

margin of about 200 basis points. These were largely offset by the

benefits of scale leverage from volume growth and cost savings projects

resulting from manufacturing efficiency improvements and product

reformulations.

52.3%

50.8%

51.6%

07

09

08

GROSS MARGIN

(% of net sales)

Total selling, general and administrative expenses (SG&A) decreased 6%

to $24.0billion in 2009 driven primarily by foreign currency impacts

and cost reduction efforts. SG&A as a percentage of net sales was

down 80 basis points due to lower marketing expenses and the impact

of foreign currency transaction gains on working capital balances

caused by strengthening of the U.S. dollar. Marketing expenses were

down as a percentage of net sales for the total Company and for each

reportable segment mainly due to media rate reductions, foreign

exchange and reductions in the amount of media purchased primarily

in the fourth fiscal quarter. Overhead spending as a percentage of

net sales was up 10 basis points versus the prior year as productivity

improvements were mostly offset by the negative impacts of sales

deleverage and incremental restructuring charges.

SG&A increased 6% to $25.6billion in 2008 driven by higher over-

head and marketing spending to support business growth. SG&A as

a percentage of net sales was down 110 basis points. Overhead

spending was down as a percentage of net sales for the total

Company and for each reportable segment primarily due to volume

scale leverage, a focus on overhead productivity and incremental

synergy savings from the Gillette acquisition. Marketing spending as

a percentage of net sales was in line with previous year levels.

32.3%

30.%

31.2%

07

09

08

SELLING, GENERAL AND ADMINISTRATIVE EXPENSE

(% of net sales)

We fund a number of restructuring-type activities primarily related

to manufacturing and workforce optimization efforts to maintain a

competitive cost structure. We have incurred annual charges of

approximately $400million after tax in recent years. In 2009, we

implemented additional restructuring-type activities in order to

offset the dilution caused by the disposition of our Coffee business.

These incremental charges, which impacted both gross margin and

SG&A as a percentage of net sales, reduced operating margin by

about 50 basis points in 2009.

Non-Operating Items

Non-operating items primarily include interest expense, divestiture

gains and interest and investment income. Interest expense decreased

7% in 2009 to $1.4billion primarily driven by a reduction in U.S. dollar

interest rates partially offset by a higher debt level primarily to fund the

Company’s previously announced share repurchase program. In July

2007, the Company announced plans to repurchase $24–30billion

of P&G stock over a three-year period. In 2008, interest expense

increased 13% to $1.5billion driven by a higher interest rate on our

long-term borrowings and a higher debt level to fund the Company’s

previously announced share repurchase program.

Other non-operating income increased $98million in 2009 mainly due

to higher divestiture gains from the current year sales of Thermacare,

Noxzema, Infusium and other minor brands. In 2008, other non-

operating income decreased $103million versus the prior year primarily

due to lower interest income resulting from lower interest rates and

cash balances. Divestiture gains in 2008 were in line with previous

year levels and included the sale of the Western European tissue and

Japanese adult incontinence businesses as well as other minor brands.

The effective tax rate from continuing operations in 2009 was up

180 basis points to 26.3% primarily due to a lower level of net favorable

adjustments to reserves for previously existing uncertain tax positions

and the utilization of tax credits, partially offset by unfavorable geo-

graphic mix of earnings across all reporting segments resulting from

a weakening of key foreign currencies versus the U.S. dollar. During

Operating Costs

Comparisons as a percentage of net sales; Years ended June 30 2009

Basis Point

Change 2008

Basis Point

Change 2007

Gross margin 50.8% (80)51.6% (70)52.3%

Selling, general and administrative 30.4% (80)31.2% (110)32.3%

Operating margin 20.4% 020.4% 40 20.0%

Earnings from continuing operations before income taxes 19.4% 30 19.1% 019.1%

Net earnings from continuing operations 14.3% (10)14.4% 100 13.4%