Pfizer 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

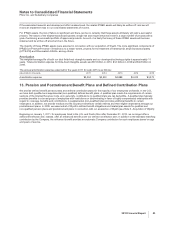

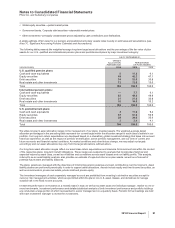

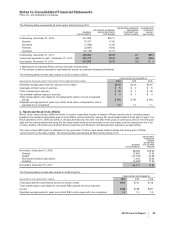

C. Employee Stock Ownership Plans

We have two employee stock ownership plans (collectively, the ESOPs), the Preferred ESOP and another that holds common stock

of the company (Common ESOP). As of January 1, 2008, the legacy Pharmacia U.S. savings plan was merged with the Pfizer

Savings Plan. Prior to the merger, a portion of the matching contributions for legacy Pharmacia U.S. savings plan participants was

funded through the ESOPs.

Allocated shares held by the Common ESOP are considered outstanding for the earnings per share (EPS) calculations and the

eventual conversion of allocated preferred shares held by the Preferred ESOP is assumed in the diluted EPS calculation. As of

December 31, 2010, the Preferred ESOP held preferred shares with a stated value of approximately $52 million, convertible into

approximately 3 million shares of our common stock. As of December 31, 2010, the Common ESOP held approximately 4 million

shares of our common stock. As of December 31, 2010, all preferred and common shares held by the ESOPs have been allocated

to the Pharmacia U.S. and certain Puerto Rico savings plan participants.

D. Employee Benefit Trust

The Pfizer Inc. Employee Benefit Trust (EBT) was established in 1999 to fund our employee benefit plans through the use of its

holdings of Pfizer Inc. stock. Our consolidated balance sheets reflect the fair value of the shares owned by the EBT as a reduction of

Shareholders’ equity. Beginning in May 2009, the Company began using the shares held in the EBT to help fund the Company’s

matching contribution in the Pfizer Savings Plan.

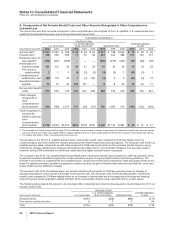

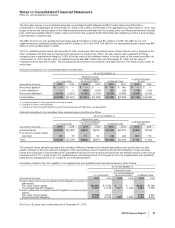

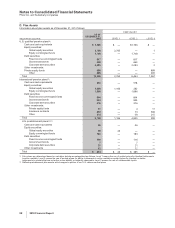

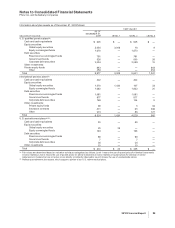

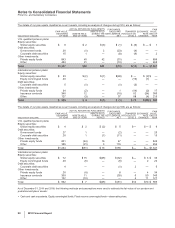

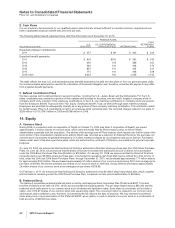

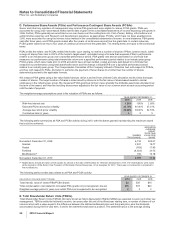

15. Share-Based Payments

Our compensation programs can include share-based payments. In 2010, 2009 and 2008, the primary share-based awards and

their general terms and conditions are as follows:

•Stock options, which, when vested, entitle the holder to purchase a specified number of shares of Pfizer common stock at a price per

share equal to the market price of Pfizer common stock on the date of grant.

•Restricted stock units (RSUs), which, when vested, entitle the holder to receive a specified number of shares of Pfizer common stock,

including shares resulting from dividend equivalents paid on such RSUs.

•Performance share awards (PSAs) which entitle the holder, and performance-contingent share awards (PCSAs) which entitled the

holder, upon vesting, to receive a number of shares of Pfizer common stock, within a range of shares from zero to 200% of the holder’s

target award, calculated using a formula that measures Pfizer’s performance relative to an industry peer group over a specified

performance period. The Compensation Committee of the Company’s Board of Directors had, with respect to PCSAs, and has, with

respect to PSAs, discretion to authorize the payment of fewer shares to a holder than the number of shares determined pursuant to the

formula. Dividend equivalents accumulate on PSAs and are paid, and dividend equivalents accumulated on PCSAs and were paid, at

the end of the vesting term in respect of any shares paid. PCSA grants were made prior to 2006 and have all been settled.

•Short-term Incentive Shift Awards, which entitle the holder to receive a percentage of the holder’s target award (between 0% and

200%) approximately one year following the grant, based on a combination of individual performance and Company performance (as

measured by revenue, adjusted diluted earnings per share and cash flow from operations) during the year in which the grant is made.

At the election of the holder, the award is paid: (i) in the case of the Executive Leadership Team (ELT) members (determined at the

time of the grant ), all in RSUs, or half in RSUs and half in cash; and (ii) in the case of all other holders, all in RSUs, all in cash, or half in

RSUs and half in cash.

•Stock appreciation rights (SARs), also referred to as Total Shareholder Return Units (TSRUs), which vest on the third anniversary of

the grant and entitle the holder to receive, two years after the end of the three-year vesting term, a number of shares of Pfizer common

stock with a value equal to the difference between the defined settlement price and the closing market price of Pfizer common stock on

the date of grant, plus accumulated dividend equivalents through the payment date, if and to the extent the total value is positive.

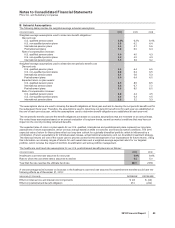

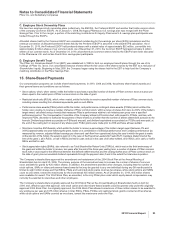

The Company’s shareholders approved the amendment and restatement of the 2004 Stock Plan at the Annual Meeting of

Shareholders held on April 23, 2009. The primary purpose of the amendment was to increase the number of shares of common

stock available for grants by 425 million shares. In addition, the amendment provided other changes, including that the number of

stock options, SARs or other performance-based awards that may be granted to any one individual during any 36-month period is

limited to eight million shares and that RSUs, PSAs and restricted stock grants count as two shares, while stock options and SARs

count as one share, toward the maximums for the incremental 425 million shares. As of December 31, 2010, 405 million shares

were available for award. The 2004 Stock Plan, as amended, is the only Pfizer plan under which equity-based compensation may

currently be awarded to executives and other employees.

The Company’s shareholders originally approved the 2004 Stock Plan at the Annual Meeting of Shareholders held on April 22,

2004, and, effective upon that approval, new stock option and other share-based awards could be granted only under the originally

approved 2004 Stock Plan. As originally approved, the 2004 Stock Plan allowed a maximum of three million shares to be awarded to

any employee per year and 475 million shares in total. RSUs, PSAs, PCSAs and restricted stock grants counted as three shares,

while stock options and SARs counted as one share, toward the maximums under the Plan.

2010 Financial Report 93