Pfizer 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

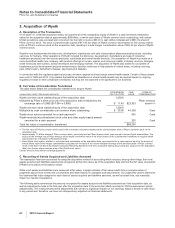

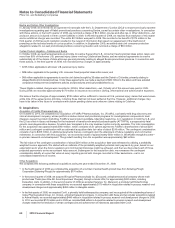

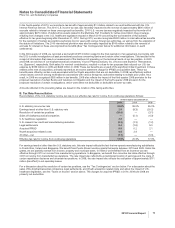

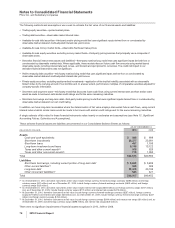

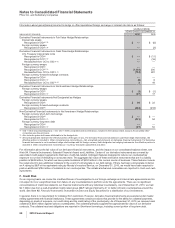

C. Deferred Taxes

Deferred taxes arise as a result of basis differentials between financial statement accounting and tax amounts. The tax effect of the

major items recorded as deferred tax assets and liabilities, shown before jurisdictional netting, as of December 31 is as follows:

2010 DEFERRED TAX 2009 DEFERRED TAX

(MILLIONS OF DOLLARS) ASSETS (LIABILITIES) ASSETS (LIABILITIES)

Prepaid/deferred items $ 1,321 $ (112) $ 1,330 $ (60)

Inventories 132 (59) 437 (859)

Intangibles 1,165 (17,104) 949 (19,802)

Property, plant and equipment 420 (2,146) 715 (2,014)

Employee benefits 4,479 (56) 4,786 (66)

Restructurings and other charges 1,359 (70) 884 (8)

Legal and product liability reserves 1,411 — 1,010 —

Net operating loss/credit carryforwards 4,575 — 4,658 —

Unremitted earnings — (9,524) — (7,057)

State and local tax adjustments 452 — 747 —

All other 607 (575) 744 (187)

Subtotal 15,921 (29,646) 16,260 (30,053)

Valuation allowance (894) — (353) —

Total deferred taxes $15,027 $(29,646) $15,907 $(30,053)

Net deferred tax liability $(14,619) $(14,146)

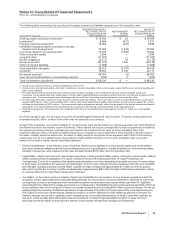

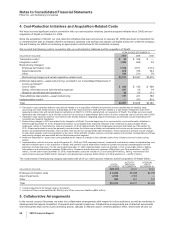

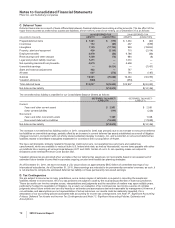

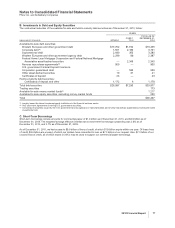

The net deferred tax liability is classified in our Consolidated Balance Sheets as follows:

DEFERRED TAX ASSET/

(LIABILITY)

DEFERRED TAX ASSET/

(LIABILITY)

Current:

Taxes and other current assets $ 2,951 $ 2,591

Other current liabilities (111) (226)

Noncurrent:

Taxes and other noncurrent assets 1,189 1,328

Noncurrent deferred tax liabilities (18,648) (17,839)

Net deferred tax liability $(14,619) $(14,146)

The increase in net deferred tax liability position in 2010, compared to 2009, was primarily due to an increase in noncurrent deferred

tax liabilities on unremitted earnings, partially offset by an increase in current deferred tax assets established as a result of litigation

charges incurred in connection with our wholly owned subsidiary Quigley Company, Inc. and a reduction in noncurrent deferred tax

liabilities related to identifiable intangibles established in connection with our acquisition of Wyeth.

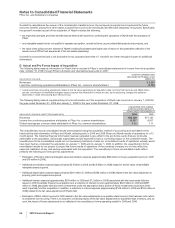

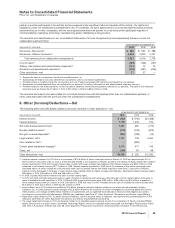

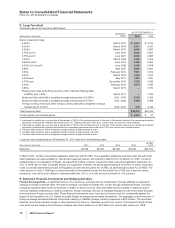

We have carryforwards, primarily related to foreign tax credit carryovers, net operating loss carryovers and capital loss

carryforwards, which are available to reduce future U.S. federal and state, as well as international, income taxes payable with either

an indefinite life or expiring at various times between 2011 and 2029. Certain of our U.S. net operating losses are subject to

limitations under Internal Revenue Code Section 382.

Valuation allowances are provided when we believe that our deferred tax assets are not recoverable based on an assessment of

estimated future taxable income that incorporates ongoing, prudent and feasible tax planning strategies.

As of December 31, 2010, we have not made a U.S. tax provision on approximately $48.2 billion of unremitted earnings of our

international subsidiaries. As of December 31, 2010, these earnings are intended to be permanently reinvested overseas; as such, it

is not practical to compute the estimated deferred tax liability on these permanently reinvested earnings.

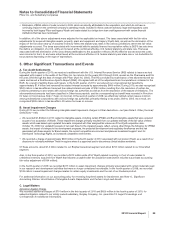

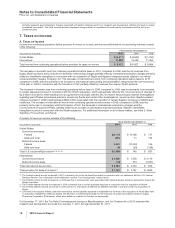

D. Tax Contingencies

We are subject to income tax in many jurisdictions, and a certain degree of estimation is required in recording the assets and

liabilities related to income taxes. All of our tax positions are subject to audit by the local taxing authorities in each tax jurisdiction.

These tax audits can involve complex issues, interpretations and judgments and the resolution of matters may span multiple years,

particularly if subject to negotiation or litigation. As a result, our evaluation of tax contingencies can involve a series of complex

judgments about future events and can rely heavily on estimates and assumptions deemed reasonable by management. However, if

our estimates and assumptions are not representative of actual outcomes, our results could be materially impacted. For a

description of our accounting policies associated with accounting for income tax contingencies, see Note 1P. Significant Accounting

Policies: Deferred Tax Assets and Income Tax Contingencies and Note 1C. Significant Accounting Policies: Estimates and

Assumptions.

72 2010 Financial Report