Pfizer 2010 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

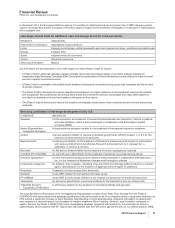

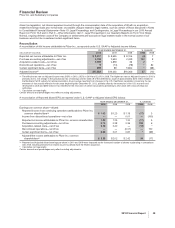

(j) Included in Cost of sales (see also the “Costs and Expenses––Cost of Sales” section of this Financial Review and Notes to Consolidated Financial

Statements—Note 10. Inventories).

(k) Included in Revenues and reflects an adjustment to the prior years’ liabilities for product returns (see Notes to Consolidated Financial Statements—

Note 3F. Other Significant Transactions and Events: Adjustment of Prior Years’ Liabilities for Product Returns).

(l) Included in Other deductions––net and represents a gain related to ViiV, a new equity method investment (see Notes to Consolidated Financial

Statements—Note 3E. Other Significant Transactions and Events: Equity Method Investments).

(m) In 2008, these charges primarily relate to the exit of a manufacturing plant in Italy and are included in Other deductions—net

(n) Included in Provision for taxes on income. Includes a $2.0 billion tax benefit recorded in the fourth quarter of 2010 as a result of a settlement of

certain audits covering the years 2002 – 2005 (see Notes to Consolidated Financial Statements—Note 3A. Other Significant Transactions and

Events: Tax Audit Settlements). Amounts in 2009 include tax benefits of approximately $556 million related to the sale of one of our

biopharmaceutical companies, Vicuron, which were recorded in the fourth quarter of 2009, and tax benefits of approximately $174 million related to

the final resolution of the investigations concerning Bextra and various other products referred to above in footnote (g) to this table, which were

recorded in the third quarter of 2009. This resolution resulted in the receipt of information that raised our assessment of the likelihood of prevailing

on the technical merits of our tax position. 2008 includes tax benefits of approximately $426 million related to the sale of one of our

biopharmaceutical companies (Esperion Therapeutics, Inc.).

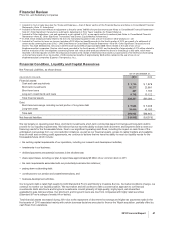

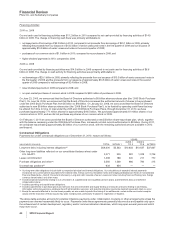

Financial Condition, Liquidity and Capital Resources

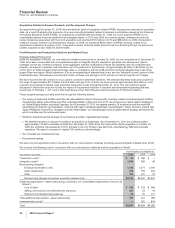

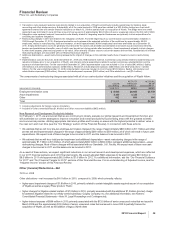

Net Financial Liabilities, as shown below:

AS OF DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009

Financial assets:

Cash and cash equivalents $ 1,735 $ 1,978

Short-term investments 26,277 23,991

Short-term loans 467 1,195

Long-term investments and loans 9,748 13,122

Total financial assets $38,227 $40,286

Debt:

Short-term borrowings, including current portion of long-term debt $ 5,623 $ 5,469

Long-term debt 38,410 43,193

Total debt $44,033 $48,662

Net financial liabilities $ (5,806) $ (8,376)

We rely largely on operating cash flows, short-term investments, short-term commercial paper borrowings and long-term debt to

provide for our liquidity requirements. We believe that we have the ability to obtain both short-term and long-term debt to meet our

financing needs for the foreseeable future. Due to our significant operating cash flows, including the impact on cash flows of the

anticipated cost savings from our cost-reduction initiatives, as well as our financial assets, access to capital markets and available

lines of credit and revolving credit agreements, we continue to believe that we have the ability to meet our liquidity needs for the

foreseeable future which include:

•the working capital requirements of our operations, including our research and development activities;

•investments in our business;

•dividend payments and potential increases in the dividend rate;

•share repurchases, including our plan to repurchase approximately $5 billion of our common stock in 2011;

•the cash requirements associated with our productivity/cost-reduction initiatives;

•paying down outstanding debt;

•contributions to our pension and postretirement plans; and

•business-development activities.

Our long-term debt is rated high quality by both Standard & Poor’s and Moody’s Investors Service. As market conditions change, we

continue to monitor our liquidity position. We have taken and will continue to take a conservative approach to our financial

investments. Both short-term and long-term investments consist primarily of high-quality, highly liquid, well-diversified,

available-for-sale debt securities. Our short-term and long-term loans are due from companies with highly rated securities

(Standard & Poor’s ratings of mostly AA or better).

Total financial assets decreased during 2010 due to the repayment of short-term borrowings and higher tax payments made in the

first-quarter of 2010 associated mainly with certain business decisions executed to finance the Wyeth acquisition, partially offset by

cash flows from operations.

2010 Financial Report 41