Pfizer 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

primarily represent asset impairment charges associated with certain materials used in our research and development activities that were no longer

considered recoverable. The 2008 amounts primarily represent charges related to impairment of certain equity investments and the exit of our

Exubera product.

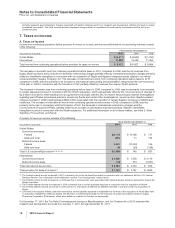

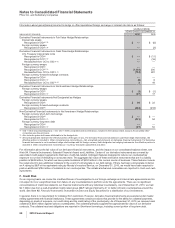

7. Taxes on Income

A. Taxes on Income

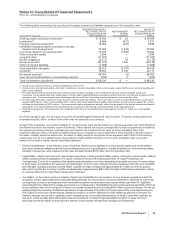

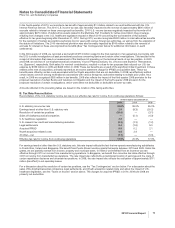

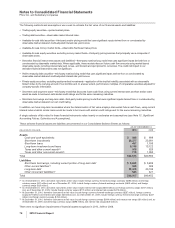

Income from continuing operations before provision for taxes on income, and income attributable to noncontrolling interests consist

of the following:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

United States $ (2,477) $ (3,632) $ (1,760)

International 11,899 14,459 11,454

Total income from continuing operations before provision for taxes on income $ 9,422 $10,827 $ 9,694

The decrease in domestic loss from continuing operations before taxes in 2010, compared to 2009, was due to revenues from

legacy Wyeth products and a reduction in domestic restructuring charges partially offset by increased amortization charges primarily

related to identifiable intangibles in connection with our acquisition of Wyeth and litigation charges primarily related to our wholly

owned subsidiary Quigley Company, Inc. The decrease in international income from continuing operations before taxes in 2010,

compared to 2009, was due primarily to an increase in international restructuring and amortization charges plus the non-recurrence

of the gain in 2009 in connection with the formation of ViiV, partially offset by revenues from legacy Wyeth products.

The increase in domestic loss from continuing operations before taxes in 2009, compared to 2008, was due primarily to an increase

in certain expenses incurred in connection with the Wyeth acquisition, which was partially offset by the non-recurrence of charges of

$2.3 billion recorded in 2008 resulting from an agreement-in-principle with the DOJ to resolve the previously reported investigations

regarding past off-label promotional practices concerning Bextra and certain other investigations, as well as other litigation-related

charges recorded in 2008 of approximately $900 million associated with the resolution of certain litigation involving our NSAID pain

medicines. The increase in international income from continuing operations before taxes in 2009, compared to 2008, was due

primarily to the gain in connection with the formation of ViiV, the decrease in international restructuring charges and the

non-recurrence of acquired IPR&D, partially offset by an increase in amortization expenses primarily related to identifiable

intangibles incurred in connection with the Wyeth acquisition. For additional information on all of these matters, see Note 3. Other

Significant Transactions and Events.

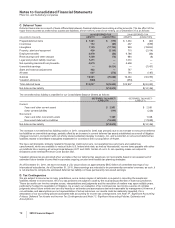

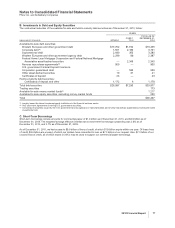

Provision for taxes on income consists of the following:

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

United States:

Current income taxes:

Federal $(2,774) $ 10,169 $ 707

State and local (313) 71 154

Deferred income taxes:

Federal 2,033 (10,002) 106

State and local (6) (93) (136)

Total U.S. tax (benefit)/provision(a), (b), (c), (d) $(1,060) $ 145 $ 831

International:

Current income taxes $ 2,258 $ 1,539 $ 2,115

Deferred income taxes (74) 513 (1,301)

Total international tax provision $ 2,184 $ 2,052 $ 814

Total provision for taxes on income(e) $ 1,124 $ 2,197 $ 1,645

(a) The Federal current income tax benefit in 2010 is primarily due to the tax benefit recorded in connection with our settlement with the U.S. Internal

Revenue Service. For a discussion of the settlement, see the “Tax Contingencies” section below.

(b) The Federal current income tax expense in 2009 was due to increased tax costs associated with certain business decisions executed to finance the

Wyeth acquisition.

(c) The Federal deferred income tax expense in 2010 is primarily due to certain business decisions in connection with our acquisition of Wyeth.

(d) The Federal deferred income tax benefit in 2009 was due to a reduction of deferred tax liabilities recorded in connection with our acquisition of

Wyeth.

(e) 2009 and 2010 excludes federal, state and international net tax liabilities assumed or established on the date of the acquisition of Wyeth (See Note

2. Acquisition of Wyeth for additional details) and $4 million in 2008 primarily related to the resolution of certain tax positions related to legacy

Pharmacia Corporation (Pharmacia), which were debited or credited to Goodwill, as appropriate.

On December 17, 2010, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 extended the

research and development tax credit from January 1, 2010, through December 31, 2011.

70 2010 Financial Report