Pfizer 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

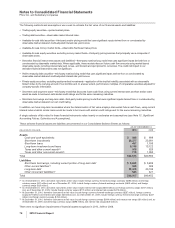

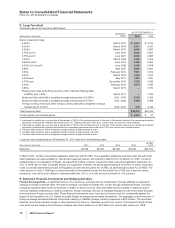

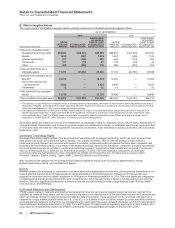

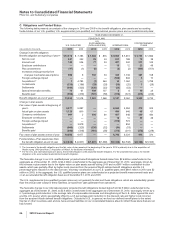

All derivative contracts used to manage foreign currency risk are measured at fair value and are reported as assets or liabilities on

the consolidated balance sheet. Changes in fair value are reported in earnings or deferred, depending on the nature and purpose of

the financial instrument (offset or hedge relationship) and the effectiveness of the hedge relationships, as follows:

•We defer on the balance sheet the effective portion of the gains or losses on foreign currency forward-exchange contracts and foreign

currency swaps that are designated as cash flow hedges and reclassify those amounts, as appropriate, into earnings in the same

period or periods during which the hedged transaction affects earnings.

•We recognize the gains and losses on forward-exchange contracts and foreign currency swaps that are used to offset the same foreign

currency assets or liabilities immediately into earnings along with the earnings impact of the items they generally offset. These contracts

essentially take the opposite currency position of that reflected in the month-end balance sheet to counterbalance the effect of any

currency movement.

•We recognize the gain and loss impact on foreign currency swaps designated as hedges of our net investments in earnings in three

ways: over time––for the periodic net swap payments; immediately––to the extent of any change in the difference between the foreign

exchange spot rate and forward rate; and upon sale or substantial liquidation of our net investments–to the extent of change in the

foreign exchange spot rates.

•We defer on the balance sheet foreign exchange gains and losses related to foreign exchange-denominated debt designated as a

hedge of our net investments in foreign subsidiaries and reclassify those amounts into earnings upon the sale or substantial liquidation

of our net investments.

Any ineffectiveness is recognized immediately into earnings. There was no significant ineffectiveness in 2010, 2009 or 2008.

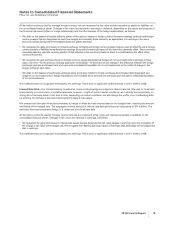

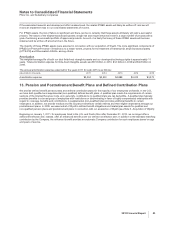

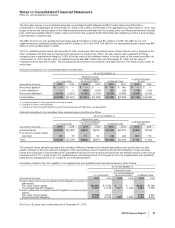

Interest Rate Risk—Our interest-bearing investments, loans and borrowings are subject to interest rate risk. We seek to invest and

loan primarily on a short-term or variable-rate basis; however, in light of current market conditions, we currently borrow primarily on

a long-term, fixed-rate basis. From time to time, depending on market conditions, we will change the profile of our outstanding debt

by entering into derivative financial instruments like interest rate swaps.

We entered into derivative financial instruments to hedge or offset the fixed interest rates on the hedged item, matching the amount

and timing of the hedged item. The aggregate notional amount of interest rate derivative financial instruments is $11.6 billion. The

derivative financial instruments hedge U.S. dollar and euro fixed-rate debt.

All derivative contracts used to manage interest rate risk are measured at fair value and reported as assets or liabilities on the

consolidated balance sheet. Changes in fair value are reported in earnings, as follows:

•We recognize the gains and losses on interest rate swaps that are designated as fair value hedges in earnings upon the recognition of

the change in fair value of the hedged risk. We recognize the offsetting earnings impact of fixed-rate debt attributable to the hedged risk

also in earnings.

Any ineffectiveness is recognized immediately into earnings. There was no significant ineffectiveness in 2010, 2009 or 2008.

2010 Financial Report 79