Pfizer 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

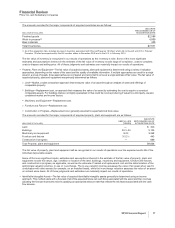

Holding all other assumptions constant, the effect of a 0.5 percentage-point decline in the return-on-assets assumption would

increase our 2011 U.S. qualified pension plans’ pre-tax expense by approximately $49 million.

The discount rate used in calculating our U.S. defined benefit plan obligations as of December 31, 2010, is 5.9%, which represents a

0.4 percentage-point decrease from our December 31, 2009, rate of 6.3%. The discount rate for our U.S. defined benefit plans is

based on a bond model constructed from a portfolio of high-quality corporate bonds rated AA or better for which the timing and

amount of cash flows approximate the estimated payouts of the plans. For our international plans, the discount rates are set by

benchmarking against investment grade corporate bonds rated AA or better, including where there is sufficient data, a yield curve

approach. Holding all other assumptions constant, the effect of a 0.1 percentage-point decrease in the discount rate assumption

would increase our 2011 U.S. qualified pension plans’ pre-tax expense by approximately $27 million and increase the U.S. qualified

pension plans’ projected benefit obligations as of December 31, 2010, by approximately $221 million.

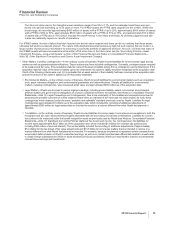

Asset Impairment Reviews—Long-Lived Assets

We review all of our long-lived assets, including goodwill and other intangible assets, for impairment indicators throughout the year

and we perform detailed impairment testing for goodwill and indefinite-lived assets annually and for all other long-lived assets

whenever impairment indicators are present. When necessary, we record charges for impairments of long-lived assets for the

amount by which the fair value is less than the carrying value of these assets.

Examples of events or circumstances that may be indicative of impairment include:

•A significant adverse change in legal factors or in the business climate that could affect the value of the asset. For example, a

successful challenge of our patent rights likely would result in generic competition earlier than expected.

•A significant adverse change in the extent or manner in which an asset is used. For example, restrictions imposed by the FDA or other

regulatory authorities could affect our ability to manufacture or sell a product.

•A projection or forecast that demonstrates losses or reduced profits associated with an asset. This could result, for example, from a

change in a government reimbursement program that results in an inability to sustain projected product revenues and profitability. This

also could result from the introduction of a competitor’s product that results in a significant loss of market share or the inability to

achieve the previously projected revenue growth, as well as the lack of acceptance of a product by patients, physicians and payers. For

IPR&D projects, this could result from, among other things, a change in outlook based on clinical trial data, a delay in the projected

launch date or additional expenditures to commercialize the product.

When determining fair value, any single estimate of fair value results from a complex series of judgments about future events and

uncertainties and relies heavily on estimates and assumptions (see the “Accounting Policies—Estimates and Assumptions” section

of this Financial Review). Although we believe that our judgments and assumptions are reasonable, the judgments made in

determining an estimate of fair value can materially impact our results of operations.

Our impairment review process is described in the Notes to Consolidated Financial Statements—Note 1L. Significant Accounting

Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets and, for deferred tax assets, in Note 1P.

Significant Accounting Policies: Deferred Tax Assets and Income Tax Contingencies.

Intangible Assets Other than Goodwill

As a result of our intangible asset impairment review work, described in detail below, we recognized a number of impairments of

intangible assets other than goodwill.

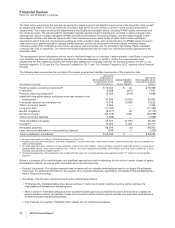

During 2010, we recorded the following intangible asset impairment charges in Other deductions—net:

•$1.8 billion related to intangible assets acquired from Wyeth primarily as a result of our updated estimate of the fair value of these

assets as compared with their assigned fair values as of the Wyeth acquisition date, October 15, 2009. Our updated forecasts reflected,

among other things, the following: for IPR&D assets, the impact of changes to the development programs, the projected development

and regulatory timeframes and the risk associated with these assets; for Brand assets, the current competitive environment and

planned investment support; and, for Developed Technology Rights, an increased competitive environment.

•Approximately $300 million related to our product Thelin as a result of our decisions to voluntarily withdraw Thelin in regions where it is

approved and to discontinue clinical studies worldwide.

Of these amounts, about $1.4 billion related to our Biopharmaceutical segment and about $700 million related to our Diversified

segment.

During 2009, we recorded $417 million in asset impairment charges primarily associated with certain materials used in our research

and development activities in our Biopharmaceutical segment that were no longer considered recoverable.

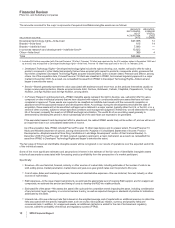

Accounting Policy and Specific Procedures

•For finite-lived intangible assets, such as Developed Technology Rights, whenever impairment indicators are present, we perform a

review for impairment. We calculate the undiscounted value of the projected cash flows associated with the asset, or asset group, and

compare this estimated amount to the carrying amount. If the carrying amount is found to be greater, we record an impairment loss for

the excess of book value over fair value. In addition, in all cases of an impairment review, we re-evaluate the remaining useful lives of

the assets and modify them, as appropriate.

2010 Financial Report 13