Pfizer 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

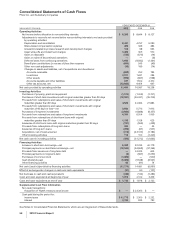

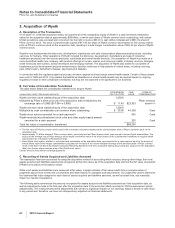

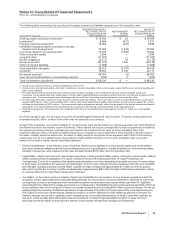

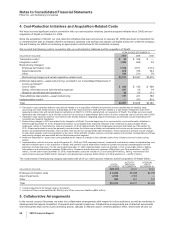

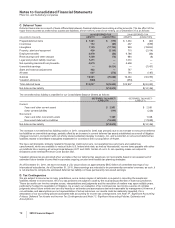

The following table summarizes the recording of the assets acquired and liabilities assumed as of the acquisition date:

(MILLIONS OF DOLLARS)

AMOUNTS PREVIOUSLY

RECOGNIZED AS OF

ACQUISITION DATE

(PROVISIONAL)(a)

MEASUREMENT

PERIOD

ADJUSTMENTS

AMOUNTS

RECOGNIZED AS OF

ACQUISITION DATE

(FINAL)

Working capital, excluding inventories(b) $ 16,342 $ 24 $ 16,366

Inventories(c) 8,388 (417) 7,971

Property, plant and equipment 10,054 (216) 9,838

Identifiable intangible assets, excluding in-process

research and development(c) 37,595 (1,533) 36,062

In-process research and development(c) 14,918 (1,096) 13,822

Other noncurrent assets 2,394 — 2,394

Long-term debt (11,187) — (11,187)

Benefit obligations (3,211) 36 (3,175)

Net tax accounts(d) (24,773) 1,035 (23,738)

Other noncurrent liabilities (1,908) — (1,908)

Total identifiable net assets 48,612 (2,167) 46,445

Goodwill(e) 19,954 2,163 22,117

Net assets acquired 68,566 (4) 68,562

Less: Amounts attributable to noncontrolling interests (330) 4 (326)

Total consideration transferred $ 68,236 $ — $ 68,236

(a) As previously reported in Pfizer’s 2009 Annual Report on Form 10-K.

(b) Includes cash and cash equivalents, short-term investments, accounts receivable, other current assets, assets held for sale, accounts payable and

other current liabilities.

(c) The measurement period adjustments were mainly recorded to reflect changes in the estimated fair value of certain intangible assets and

inventories. These adjustments were made largely to better reflect market participant assumptions about facts and circumstances existing as of the

acquisition date. The measurement period adjustments did not result from intervening events subsequent to the acquisition date.

(d) As of the acquisition date, included in Taxes and other current assets ($1.2 billion), Taxes and other noncurrent assets ($2.8 billion), Income taxes

payable ($500 million), Other current liabilities ($11.1 billion), Noncurrent deferred tax liabilities ($14.0 billion) and Other taxes payable ($2.1 billion,

including accrued interest of $300 million). The measurement period adjustments primarily reflect the tax impact of the pre-tax measurement period

adjustments. The measurement period adjustments did not result from intervening events subsequent to the acquisition date.

(e) Goodwill recognized as of the acquisition date totaled $19,340 million for our Biopharmaceutical segment and $2,777 million for our Diversified

segment.

As of the acquisition date, the fair value of accounts receivable approximated book value acquired. The gross contractual amount

receivable was $4.2 billion, of which $140 million was not expected to be collected.

As part of the acquisition, we acquired liabilities for environmental, legal and tax matters, as well as guarantees and indemnifications

that Wyeth incurred in the ordinary course of business. These matters can include contingencies. Except as specifically excluded by

the relevant accounting standard, contingencies are required to be measured at fair value as of the acquisition date, if the

acquisition-date fair value of the asset or liability arising from a contingency can be determined. If the acquisition-date fair value of

the asset or liability cannot be determined, the asset or liability would be recognized at the acquisition date if both of the following

criteria were met: (i) it is probable that an asset existed or that a liability had been incurred at the acquisition date, and (ii) the

amount of the asset or liability can be reasonably estimated.

•Environmental Matters—In the ordinary course of business, Wyeth incurred liabilities for environmental matters such as remediation

work, asset retirement obligations and environmental guarantees and indemnifications. Virtually all liabilities for environmental matters,

including contingencies, were measured at fair value and approximated $570 million as of the acquisition date.

•Legal Matters—Wyeth was involved in various legal proceedings, including product liability, patent, commercial, environmental, antitrust

matters and government investigations, of a nature considered normal to its business (see Note 19. Legal Proceedings and

Contingencies). Due to the uncertainty of the variables and assumptions involved in assessing the possible outcomes of events related

to these items, an estimate of fair value was not determinable. As such, these contingencies were measured under the same “probable

and estimable” standard previously used by Wyeth. Liabilities for legal contingencies approximated $1.3 billion as of the acquisition

date, which included the recording of additional adjustments of approximately $260 million for legal matters that we intended to resolve

in a manner different from what Wyeth had planned or intended.

•Tax Matters—In the ordinary course of business, Wyeth incurred liabilities for income taxes.Income taxes are exceptions to both the

recognition and fair value measurement principles associated with the accounting for business combinations. Reserves for income tax

contingencies continue to be measured under the benefit recognition model as previously used by Wyeth (see Note 1P. Significant

Accounting Policies: Deferred Tax Assets and Income Tax Contingencies). Net liabilities for income taxes approximated $23.7 billion as

of the acquisition date, which included $1.8 billion for uncertain tax positions (not including $300 million of accrued interest). The net tax

liability included the recording of additional adjustments of approximately $14.4 billion for the tax impact of fair value adjustments and

$10.5 billion for income tax matters that we intended to resolve in a manner different from what Wyeth had planned or intended. For

example, because we planned to repatriate certain overseas funds, we provided deferred taxes on Wyeth’s unremitted earnings, as

well as on certain book/tax basis differentials related to investments in certain foreign subsidiaries for which no taxes had been

previously provided by Wyeth as it was Wyeth’s intention to permanently reinvest those earnings and investments.

2010 Financial Report 63