Pfizer 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

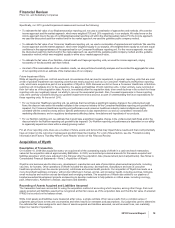

performance-based milestone payment from us in 2012 of up to approximately $200 million. We have an option to acquire the

remaining 60 percent of Teuto’s shares beginning in 2014, and Teuto’s shareholders have an option to sell their 60 percent stake to us

beginning in 2015.

We are accounting for our interest in Teuto as an equity method investment due to the significant influence we have over the

operations of Teuto through our board representation, minority veto rights and 40% voting interest. Our investment in Teuto is

reported as a private equity investment in Long-term investments and loans in our consolidated balance sheet as of

December 31, 2010. Our share of Teuto’s income and expenses is recorded in Other deductions—net. See also Notes to

Consolidated Financial Statements—Note 3E. Other Significant Transactions and Events: Equity-Method Investments.

•On October 18, 2010, we entered into a strategic global agreement with Biocon, a biotechnology company based in India, for the

worldwide commercialization of Biocon’s biosimilar versions of insulin and insulin analog products: Recombinant Human Insulin,

Glargine, Aspart and Lispro. We will have exclusive rights to commercialize these products globally, with certain exceptions, including

co-exclusive rights for all of the products with Biocon in Germany, India and Malaysia. We will also have co-exclusive rights with

existing Biocon licensees with respect to certain of these products, primarily in a number of developing markets. Biocon will remain

responsible for the clinical development, manufacture and supply of these biosimilar insulin products, as well as for regulatory activities

to secure approval for these products in various markets. Biocon’s Recombinant Human Insulin formulations are approved in 27

countries in developing markets, and commercialized in 23 of those countries, while Biocon’s Glargine has been launched in its first

market, India. Under the terms of the strategic global agreement, we made upfront payments totaling $200 million in the fourth quarter

of 2010, of which $100 million was paid to Biocon (recorded in Research and development expenses) and $100 million was paid into

an escrow account. The payment into the escrow account will be released to Biocon based on achievement of certain milestones.

Biocon also is eligible to receive additional development and regulatory milestone payments of up to $150 million and will receive

additional payments based on our sales of Biocon’s four insulin biosimilar products across global markets.

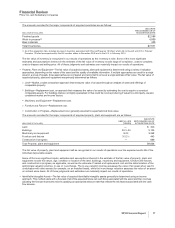

•On October 6, 2010, we completed our acquisition of FoldRx Pharmaceuticals, Inc. (FoldRx), a privately held drug discovery and

clinical development company, whose portfolio includes clinical and preclinical programs for investigational compounds to treat

diseases caused by protein misfolding. FoldRx’s lead product candidate, tafamidis meglumine, is in registration in both the U.S. and the

EU as a first-in-class oral therapy for the treatment of transthyretin amyloid polyneuropathy (ATTR-PN), a progressively fatal genetic

neurodegenerative disease, for which liver transplant is the only treatment option currently available. The total consideration for the

acquisition was approximately $400 million, which consisted of an upfront payment to FoldRx’s shareholders of about $200 million and

contingent consideration with an estimated acquisition-date fair value of about $200 million. The contingent consideration consists of up

to $455 million in additional payments that are contingent upon the attainment of future regulatory and commercial milestones. For

additional information see Notes to Consolidated Financial Statements—Note 3D. Other Significant Transactions and Events:

Acquisitions.

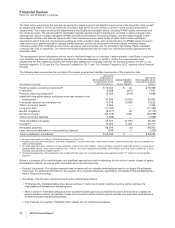

•On October 15, 2009 (the acquisition date), we acquired all of the outstanding equity of Wyeth in a cash-and-stock transaction, valued,

based on the closing market price of Pfizer common stock on the acquisition date, at $50.40 per share of Wyeth common stock, or a

total of approximately $68 billion. In connection with our acquisition of Wyeth, we are required to divest certain animal health assets.

Certain of these assets were sold in 2009. In addition, in 2010, we completed the divestiture of certain animal health products and

related assets in Australia, China, the EU, Switzerland and Mexico. It is possible that additional divestitures of animal health assets may

be required based on ongoing regulatory reviews in other jurisdictions worldwide, but they are not expected to be significant to our

business. For additional information related to our acquisition of Wyeth, see the “Acquisition of Wyeth” section of this Financial Review

and see Notes to Consolidated Financial Statements—Note 2. Acquisition of Wyeth.

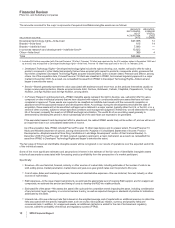

•In April 2009, we announced that we entered into an agreement with GlaxoSmithKline plc (GSK) to create a new company focused

solely on research, development and commercialization of human immunodeficiency virus (HIV) medicines. The transaction closed on

October 30, 2009, and the new company, ViiV Healthcare Limited (ViiV), began operations on November 2, 2009. We and GSK have

contributed certain HIV-related product and pipeline assets to the new company. ViiV has a broad product portfolio of 11 marketed

products, including innovative leading therapies such as Combivir and Kivexa products and Selzentry/Celsentri (maraviroc), and has a

pipeline of six innovative and targeted medicines, including four compounds in Phase 2 development. ViiV has contracted R&D and

manufacturing services directly from GSK and us and also has entered into a research alliance agreement with GSK and us. Under this

alliance, ViiV is investing in our and GSK’s programs for discovery research and development into HIV medicines. ViiV has exclusive

rights of first negotiation in relation to any new HIV-related medicines developed by either GSK or us. We recorded a pre-tax gain of

$482 million in connection with the formation of the new company and we currently hold a 15% equity interest and GSK holds an 85%

equity interest. The equity interests will be adjusted in the event that specified sales and regulatory milestones are achieved. Our equity

interest in ViiV could vary from 9% to 30.5%, and GSK’s equity interest could vary from 69.5% to 91%, depending upon the milestones

achieved with respect to the original pipeline assets contributed by us and by GSK to ViiV. Each company may also be entitled to

preferential dividend payments to the extent that specific sales thresholds are met in respect of the marketed products and pipeline

assets originally contributed. For additional information on our investment in ViiV, see Notes to Consolidated Financial Statements—

Note 3E. Other Significant Transactions and Events: Equity-Method Investments.

•In December 2008, we entered into an agreement with Auxilium Pharmaceuticals, Inc. (Auxilium) to develop, commercialize and supply

Xiapex, a novel, first-in-class biologic, for the treatment of Dupuytren’s contracture and Peyronie’s disease. Under the collaboration

agreement with Auxilium, we will receive exclusive rights to commercialize Xiapex in the EU and 19 other European and Eurasian

countries. We submitted an application for Xiapex for the treatment of Dupuytren’s contracture in the EU in December 2009. Under the

agreement with Auxilium, we made an upfront payment of $75 million in 2008 and a $15 million milestone payment in 2010, which is

included in Research and development expenses in 2008. We also may make additional payments to Auxilium of up to approximately

$400 million based upon regulatory and commercialization milestones, as well as additional milestone payments based upon the

successful commercialization of the product.

8 2010 Financial Report