Pfizer 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

Because tax law is complex and often subject to varied interpretations, it is uncertain whether some of our tax positions will be

sustained upon audit. As of December 31, 2010 and 2009, we had approximately $5.8 billion and $6.4 billion in net liabilities

associated with uncertain tax positions, excluding associated interest.

•Tax assets associated with uncertain tax positions primarily represent our estimate of the potential tax benefits in one tax jurisdiction

that could result from the payment of income taxes in another tax jurisdiction. These potential benefits generally result from cooperative

efforts among taxing authorities, as required by tax treaties to minimize double taxation, commonly referred to as the competent

authority process. The recoverability of these assets, which we believe to be more likely than not, is dependent upon the actual

payment of taxes in one tax jurisdiction and, in some cases, the successful petition for recovery in another tax jurisdiction. As of

December 31, 2010 and 2009, we had approximately $1.0 billion and $1.3 billion, respectively, in assets associated with uncertain tax

positions recorded in Taxes and other noncurrent assets.

•Tax liabilities associated with uncertain tax positions represent unrecognized tax benefits, which arise when the estimated benefit

recorded in our financial statements differs from the amounts taken or expected to be taken in a tax return because of the uncertainties

described above. These unrecognized tax benefits relate primarily to issues common among multinational corporations. Substantially

all of these unrecognized tax benefits, if recognized, would impact our effective income tax rate.

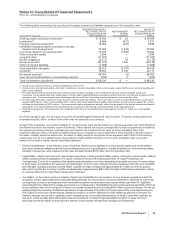

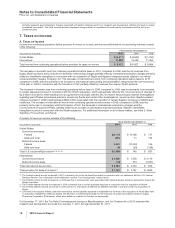

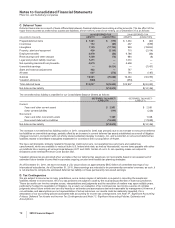

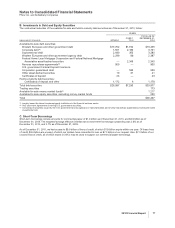

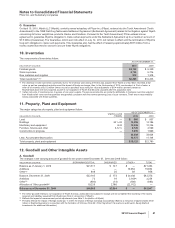

A reconciliation of the beginning and ending amounts of gross unrecognized tax benefits is as follows:

(MILLIONS OF DOLLARS) 2010 2009

Balance, January 1 $(7,657) $(5,372)

Acquisition of Wyeth (49) (1,785)

Increases based on tax positions taken during a prior period(a) (513) (79)

Decreases based on tax positions taken during a prior period(a), (b) 2,384 38

Decreases based on cash payments for a prior period 280 —

Increases based on tax positions taken during the current period(a) (1,396) (941)

Decreases based on tax positions taken during the current period — 712

Impact of foreign exchange 104 (284)

Other, net(c) 88 54

Balance, December 31(d) $(6,759) $(7,657)

(a) Primarily included in Provision for taxes on income.

(b) Decreases are primarily a result of effectively settling certain issues with the U.S. and foreign tax authorities for a net benefit of $1.7 billion,

reflecting the reversal of the related tax assets associated with the competent authority process and state and local taxes and are primarily included

in Provision for taxes on income.

(c) Primarily includes decreases as a result of a lapse of applicable statutes of limitations.

(d) In 2010, included in Income taxes payable ($421 million), Taxes and other current assets ($279 million), Taxes and other noncurrent assets ($169

million), Noncurrent deferred tax liabilities ($369 million) and Other taxes payable ($5.5 billion). In 2009, included in Income taxes payable ($144

million), Taxes and other current assets ($78 million), Noncurrent deferred tax liabilities ($208 million) and Other taxes payable ($7.2 billion).

•Interest related to our unrecognized tax benefits is recorded in accordance with the laws of each jurisdiction and is recorded in

Provision for taxes on income in our Consolidated Statements of Income. In 2010, we recorded net interest income of $545 million,

primarily as a result of settling certain issues with the U.S. and various foreign tax authorities, which are discussed below. In 2009 and

2008, we recorded net interest expense of $191 million and $106 million. Gross accrued interest totaled $952 million as of

December 31, 2010 and $1.9 billion as of December 31, 2009 (including $300 million recorded upon the acquisition of Wyeth). In 2010,

these amounts were included in Income taxes payable ($112 million), Taxes and other current assets ($122 million) and Other taxes

payable ($718 million). In 2009, these amounts were included in Income taxes payable ($90 million), Taxes and other current assets

($55 million) and Other taxes payable ($1.8 billion). Accrued penalties are not significant.

The United States is one of our major tax jurisdictions. During the fourth-quarter of 2010, we reached a settlement with the U.S.

Internal Revenue Service (IRS) related to issues we had appealed with respect to the audits of the Pfizer Inc. tax returns for the

years 2002 through 2005, as well as the Pharmacia audit for the year 2003 through the date of merger with Pfizer (April 16,

2003). The IRS concluded its examination of the aforementioned tax years and issued a final Revenue Agent’s Report (RAR). The

company has agreed with all of the adjustments and computations contained in the RAR. As a result of settling these audit years, in

the fourth quarter of 2010, we reduced our unrecognized tax benefits by approximately $1.4 billion and recorded a corresponding tax

benefit. The fourth-quarter and full-year 2010 effective tax rates were also favorably impacted by the reversal of $600 million of

accruals related to interest on these unrecognized tax benefits. The 2006, 2007 and 2008 tax years currently are under audit. The

2009 and 2010 tax years are not yet under audit. All other tax years in the U.S. for Pfizer Inc. are closed under the statute of

limitations. With respect to Wyeth, the years 2002 through 2005 currently are under IRS audit, and tax years 2006 through the

Wyeth acquisition date (October 15, 2009) are not yet under audit.

In addition to the open audit years in the U.S., we have open audit years in other major tax jurisdictions, such as Canada (1998-

2010), Japan (2006-2010), Europe (1997-2010, primarily reflecting Ireland, the United Kingdom, France, Italy, Spain and Germany)

and Puerto Rico (2003-2010). During 2010, we also recognized $320 million in tax benefits resulting from the resolution of certain

tax positions pertaining to prior years with various foreign tax authorities as well as from the expiration of the statute of limitations.

The 2010 effective tax rate was also favorably impacted by $140 million related to the reversal of accruals for interest on these

unrecognized tax benefits.

2010 Financial Report 73