Pfizer 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

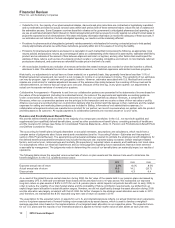

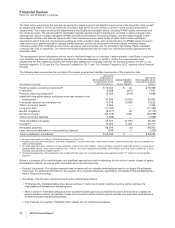

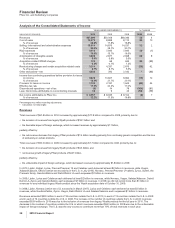

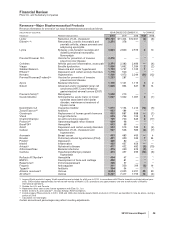

The amounts recorded for the major components of acquired identifiable intangible assets are as follows:

(MILLIONS OF DOLLARS)

AMOUNTS

RECOGNIZED

AS OF

ACQUISITION

DATE

WEIGHTED-

AVERAGE

USEFUL

LIVES

(YEARS)

Developed technology rights—finite-lived $27,065 12

Brands—finite-lived 615 14

Brands—indefinite-lived 7,993 —

In-process research and development—indefinite-lived(a) 13,822 —

Other—finite-lived 389 4

Total $49,884

(a) Includes $9.9 billion associated with Prevnar/Prevenar 13 Infant. Prevenar 13 Infant was approved by the EU member states in December 2009 and

as a result, was reclassified to Developed technology rights––finite-lived. Prevnar 13 Infant was approved in the U.S. in February 2010.

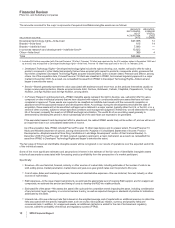

ODeveloped Technology Rights—Developed technology rights include the right to develop, use, market, sell and/or offer for sale a

product, compound or other intellectual property that we have acquired with respect to products, compounds and/or processes that

have been completed. Developed Technology Rights acquired include Enbrel, and to a lesser extent, Premarin and Effexor, among

others. As of the acquisition date, Prevnar/Prevenar 13 Infant was classified in IPR&D, but received regulatory approval in a major

market in December 2009. As a result, we reclassified the asset from IPR&D to Developed Technology Rights—finite-lived and

began to amortize the asset.

OBrands—Brands generally represent the value associated with tradenames and know-how, as the products themselves usually no

longer receive patent protection. Brands acquired include Advil, Centrum, Robitussin, Caltrate, ChapStick, Preparation H, 1st Age

Nutrition, 2nd Age Nutrition and 3rd Age Nutrition, among others.

OIn-Process Research and Development—IPR&D intangible assets represent the right to develop, use, sell and/or offer for sale a

compound or other intellectual property that we have acquired with respect to compounds and/or processes that have not been

completed or approved. These assets are required to be classified as indefinite-lived assets until the successful completion or

abandonment of the associated research and development efforts. Accordingly, during the development period after the date of

acquisition, these assets will not be amortized until approval is obtained in a major market, typically either the U.S. or the EU, or in a

series of other countries, subject to certain specified conditions and management judgment. At that time, we will determine the useful

life of the asset, reclassify the asset out of IPR&D and begin amortization. The useful life of an amortizing asset generally is

determined by identifying the period in which substantially all of the cash flows are expected to be generated.

If the associated research and development effort is abandoned, the related IPR&D assets likely will be written off, and we will record

an impairment loss in our consolidated statements of income.

As of the acquisition date, IPR&D included Prevnar/Prevenar 13 Infant (see below), and to a lesser extent, Prevnar/Prevenar 13

Adult, and Neratinib (treatment of cancer), among others (see the “Analysis of Consolidated Statements of Income: Product

Developments––Biopharmaceutical: New Drug Candidates in Late-Stage Development” section of this Financial Review). In

December 2009, Prevnar/Prevenar 13 Infant received regulatory approval in a major market and, as a result, we reclassified the

asset from IPR&D to Developed Technology Rights and began to amortize the asset.

The fair value of finite-lived identifiable intangible assets will be recognized in our results of operations over the expected useful life

of the individual assets.

Some of the more significant estimates and assumptions inherent in the estimate of the fair value of identifiable intangible assets

include all assumptions associated with forecasting product profitability from the perspective of a market participant.

Specifically:

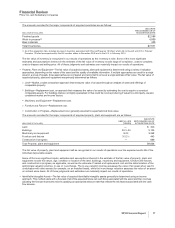

ORevenue—We use historical, forecast, industry or other sources of market data, including estimates of the number of units to be

sold, selling prices, market penetration, market share and year-over-year growth rates over the product’s life cycle.

OCost of sales, Sales and marketing expenses, General and administrative expenses—We use historical, forecast, industry or other

sources of market data.

OR&D expenses—In the case of approved products, we estimate the appropriate level of ongoing R&D support, and for unapproved

compounds, we estimate the amount and timing of costs to develop the R&D into viable products.

OEstimated life of the asset—We assess the asset’s life cycle and the competitive trends impacting the asset, including consideration

of any technical, legal, regulatory or economic barriers to entry, as well as expected changes in standards of practice for indications

addressed by the asset.

OInherent risk—We use a discount rate that is based on the weighted-average cost of capital with an additional premium to reflect the

risks associated with the specific intangible asset, such as country risks (political, inflation, currency and property risks) and

commercial risks. In addition, for unapproved assets, an additional risk factor is added for the risk of technical and regulatory

success, called the probability of technical and regulatory success (PTRS).

18 2010 Financial Report