Pfizer 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

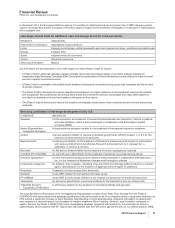

Acquisition-Related In-Process Research and Development Charges

As required through December 31, 2008, the estimated fair value of acquisition-related IPR&D charges was expensed at acquisition

date. As a result of adopting the provisions of a new accounting standard related to business combinations issued by the Financial

Accounting Standards Board (FASB), for acquisitions completed after December 31, 2008, we record acquired IPR&D on our

consolidated balance sheet as indefinite-lived intangible assets. In 2010 and 2009, we resolved certain contingencies and met

certain milestones associated with the CovX acquisition and recorded $125 million in 2010 and $68 million in 2009 of Acquisition-

related in-process research and development charges. In 2008, we expensed $633 million of IPR&D, primarily related to our

acquisitions of Serenex, Encysive, CovX, Coley and a number of animal health product lines from Schering-Plough, as well as two

smaller acquisitions also related to animal health.

Cost-Reduction and Productivity Initiatives and Related Costs

Programs Initiated Prior to 2011

Since the acquisition of Wyeth, our cost-reduction initiatives announced on January 26, 2009, but not completed as of December 31,

2009, have been incorporated into a comprehensive plan to integrate Wyeth’s operations, generate cost savings and capture

synergies across the combined company. In the aggregate, with the combination of these two initiatives into one comprehensive

program, we expect to generate cost reductions, net of investments in the business, of approximately $4 billion to $5 billion, by the

end of 2012, at 2008 average foreign exchange rates, in comparison with the 2008 proforma combined adjusted total costs of the

legacy Pfizer and legacy Wyeth operations. (For an understanding of adjusted total costs, see the “Adjusted Income” section of this

Financial Review). We achieved more than $2.0 billion of these cost savings in 2010 and are on track to meet the 2012 target.

We have incurred and will continue to incur costs in connection with these initiatives. We estimate that these total costs could be in

the range of approximately $11.5 billion to $13.5 billion through 2012, of which we have incurred approximately $9.5 billion in cost-

reduction and acquisition-related costs (excluding transaction costs) through December 31, 2010. The cost-reduction target

discussed in this section does not include the impact of the planned reduction in research and development spending that was

announced on February 1, 2011 and is discussed below under “New Research and Development Productivity Initiative”.

These targeted savings are being achieved through the following actions:

•The closing of duplicative facilities and other site rationalization actions Company-wide, including research and development facilities,

manufacturing plants, sales offices and other corporate facilities. In May and June 2010, we announced our plant network strategy for

our Global Supply division, excluding Capsugel. As of December 31, 2010, we operate plants in 76 locations around the world that

manufacture products for our businesses. Locations with major manufacturing facilities include Belgium, China, Germany, Ireland, Italy,

Japan, Philippines, Puerto Rico, Singapore and the United States. Our Global Supply division’s plant network strategy will result in the

exit of nine sites over the next several years.

•Workforce reductions across all areas of our business and other organizational changes.

OWe identified areas for a reduction in workforce across all of our businesses. As of December 31, 2010, the workforce totaled

approximately 110,600, a decrease of 5,900 from December 31, 2009. Since the closing of the Wyeth acquisition on October 15,

2009, the workforce has declined by 10,100, primarily in the U.S. Primary Care field force, manufacturing, R&D and corporate

operations. We expect to exceed our original 15% workforce reduction target.

•The increased use of shared services.

•Procurement savings.

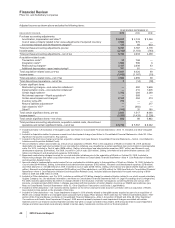

We have incurred significant costs in connection with our cost-reduction initiatives (including several programs initiated since 2005).

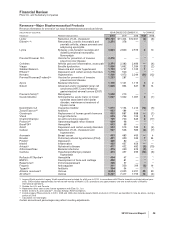

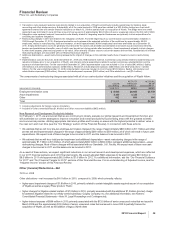

We incurred the following costs in connection with our cost-reduction initiatives and the acquisition of Wyeth:

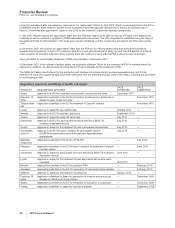

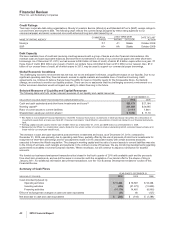

YEAR ENDED DECEMBER 31,

(MILLIONS OF DOLLARS) 2010 2009 2008

Transaction costs(a) $23 $ 768 $ —

Integration costs(b) 1,004 569 49

Restructuring charges(c)

Employee termination costs 1,125 2,571 2,004

Asset impairments 870 159 543

Other 192 270 79

Restructuring charges and certain acquisition-related costs $3,214 $4,337 $2,675

Additional depreciation—asset restructuring, recorded in our Consolidated Statements of Income as

follows(d):

Cost of Sales $ 526 $ 133 $ 596

Selling, informational and administrative expenses 227 53 19

Research and development expenses 34 55 171

Total additional depreciation—asset restructuring 787 241 786

Implementation costs(e) —250 819

Total $4,001 $4,828 $4,280

34 2010 Financial Report