Pfizer 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

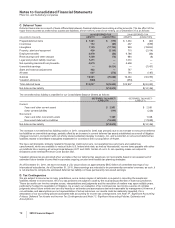

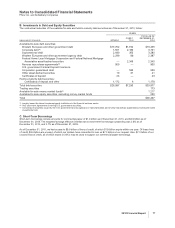

Any settlements or statute of limitations expirations would likely result in a significant decrease in our uncertain tax positions. We

estimate that within the next 12 months, our gross unrecognized tax benefits, exclusive of interest, could decrease by as much as $750

million, as a result of settlements with taxing authorities or the expiration of the statute of limitations. Our estimates of unrecognized tax

benefits and potential tax benefits may not be representative of actual outcomes, and variation from such estimates could materially

affect our financial statements in the period of settlement or when the statutes of limitations expire, as we treat these events as discrete

items in the period of resolution. Finalizing audits with the relevant taxing authorities can include formal administrative and legal

proceedings, and, as a result, it is difficult to estimate the timing and range of possible change related to our uncertain tax positions,

and such changes could be significant.

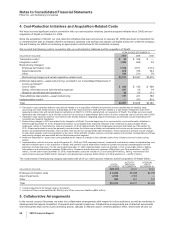

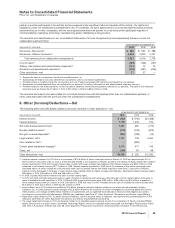

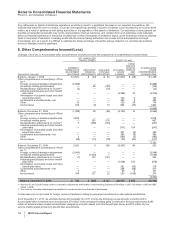

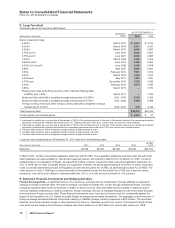

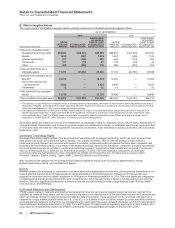

8. Other Comprehensive Income/(Loss)

Changes, net of tax, in Accumulated other comprehensive (loss)/income and the components of comprehensive income follow:

NET UNREALIZED

GAINS/(LOSSES) BENEFIT PLANS

ACCUMULATED

OTHER

COMPREHENSIVE

(LOSS)/INCOME(MILLIONS OF DOLLARS)

CURRENCY

TRANSLATION

ADJUSTMENT

AND OTHER

DERIVATIVE

FINANCIAL

INSTRUMENTS

AVAILABLE

FOR-SALE

SECURITIES

ACTUARIAL

GAINS/

(LOSSES)

PRIOR

SERVICE

(COSTS)/

CREDITS

AND

OTHER

Balance, January 1, 2008 $ 3,872 $ (32) $ 54 $(1,567) $ (28) $ 2,299

Other comprehensive income/(loss)—Pfizer

Inc(a):

Foreign currency translation adjustments (5,898) — — — — (5,898)

Unrealized holding gains/(losses) — 69 (193) — — (124)

Reclassification adjustments to income(b) (2) — (20) — — (22)

Actuarial gains/(losses) and other benefit

plan items — — — (3,098) 22 (3,076)

Amortization of actuarial losses and other

benefit plan items — — — 130 3 133

Curtailments and settlements—net — — — 280 3 283

Other 10 — — 129 35 174

Income taxes 629 (9) 73 994 (25) 1,662

(6,868)

Balance, December 31, 2008 (1,389) 28 (86) (3,132) 10 (4,569)

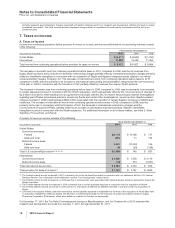

Other comprehensive income/(loss)—Pfizer

Inc.(a):

Foreign currency translation adjustments 4,978 — — — — 4,978

Unrealized holding gains — 291 576 — — 867

Reclassification adjustments to income(b) 5 (299) (143) — — (437)

Actuarial gains/(losses) and other benefit

plan items — — — (701) 154 (547)

Amortization of actuarial losses and other

benefit plan items — — — 291 (6) 285

Curtailments and settlements—net — — — 390 (5) 385

Other 2 — — (192) (3) (193)

Income taxes (46) (14) (78) (23) (56) (217)

5,121

Balance, December 31, 2009 3,550 6 269 (3,367) 94 552

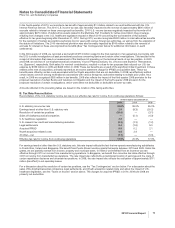

Other comprehensive income/(loss)—Pfizer

Inc.(a):

Foreign currency translation adjustments (3,544) — — — — (3,544)

Unrealized holding gains/(losses) — (1,043) 7 — — (1,036)

Reclassification adjustments to income(b) (7) 702 (141) — — 554

Actuarial gains/(losses) and other benefit

plan items — — — (1,428) 550 (878)

Amortization of actuarial losses and other

benefit plan items — — — 262 (43) 219

Curtailments and settlements—net — — — 266 (49) 217

Other 5 — — 90 6 101

Income taxes 165 127 22 230 (169) 375

(3,992)

Balance, December 31, 2010 $ 169 $ (208) $ 157 $(3,947) $ 389 $(3,440)

(a) Amounts do not include foreign currency translation adjustments attributable to noncontrolling interests of $4 million in 2010, $5 million in 2009 and $35

million in 2008.

(b) The currency translation adjustments reclassified to income resulted from the sale of businesses.

Income taxes are not provided for foreign currency translation relating to permanent investments in international subsidiaries.

As of December 31, 2010, we estimate that we will reclassify into 2011 income the following pre-tax amounts currently held in

Accumulated other comprehensive (loss)/income: $7 million of the unrealized holding gains on derivative financial instruments; $280

million of actuarial losses related to benefit plan obligations and plan assets and other benefit plan items; and $72 million of prior

service credits related primarily to benefit plan amendments.

74 2010 Financial Report