Pfizer 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

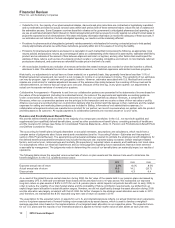

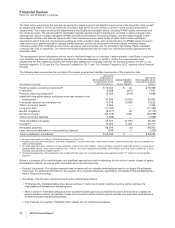

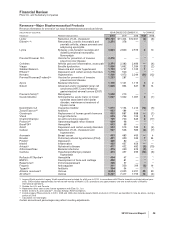

The table below summarizes the amounts recognized for assets acquired and liabilities assumed as of the acquisition date, as well

as adjustments made in the first year after the acquisition date to the amounts initially recorded in 2009 (measurement period

adjustments). The measurement period adjustments primarily affected intangible assets, including IPR&D assets, inventories and

the net tax accounts. The adjustments for identifiable intangible assets consist of adjustments recorded to reflect changes in the

estimated fair values of certain intangibles (IPR&D, Brands and Developed Technology Rights), and the related impacts on the

associated inventories and deferred tax accounts. These adjustments were made largely to better reflect market participant

assumptions about facts and circumstances existing as of the acquisition date, such as the following: for IPR&D assets, long-term

expectations as to patient population, general market potential, and the risk associated with these assets; for Brand assets,

consensus views of the competitive environment, as well as market potential; and, for Developed Technology Rights, expected

revenues after loss of exclusivity. The measurement period adjustments did not result from intervening events subsequent to the

acquisition date.

The measurement period adjustments did not have a significant impact on our earnings, balance sheets or cash flows in any period

and, therefore, we have not retrospectively adjusted our financial statements. In addition, neither the measurement period

adjustments nor the underlying scientific and market data leading to the changes impacted our financial guidance for 2011 or our

financial targets for 2012 (see the “Our Financial Guidance for 2011” and “Our Financial Targets for 2012” sections of this Financial

Review).

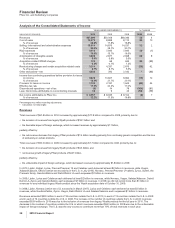

The following table summarizes the recording of the assets acquired and liabilities assumed as of the acquisition date:

(MILLIONS OF DOLLARS)

AMOUNTS

PREVIOUSLY

RECOGNIZED AS OF

ACQUISITION DATE

(PROVISIONAL)(a)

MEASUREMENT

PERIOD

ADJUSTMENTS

AMOUNTS

RECOGNIZED AS OF

ACQUISITION DATE

(FINAL)

Working capital, excluding inventories(b) $ 16,342 $ 24 $ 16,366

Inventories 8,388 (417) 7,971

Property, plant and equipment 10,054 (216) 9,838

Identifiable intangible assets, excluding in-process research and

development 37,595 (1,533) 36,062

In-process research and development 14,918 (1,096) 13,822

Other noncurrent assets 2,394 — 2,394

Long-term debt (11,187) — (11,187)

Benefit obligations (3,211) 36 (3,175)

Net tax accounts(c) (24,773) 1,035 (23,738)

Other noncurrent liabilities (1,908) — (1,908)

Total identifiable net assets 48,612 (2,167) 46,445

Goodwill(d) 19,954 2,163 22,117

Net assets acquired 68,566 (4) 68,562

Less: Amounts attributable to noncontrolling interests (330) 4 (326)

Total consideration transferred $ 68,236 $ — $ 68,236

(a) As previously reported in Pfizer’s 2009 Annual Report on Form 10-K.

(b) Includes cash and cash equivalents, short-term investments, accounts receivable, other current assets, assets held for sale, accounts payable and

other current liabilities.

(c) As of the acquisition date, included in Taxes and other current assets ($1.2 billion), Taxes and other noncurrent assets ($2.8 billion), Income taxes

payable ($500 million), Other current liabilities ($11.1 billion), Noncurrent deferred tax liabilities ($14.0 billion) and Other taxes payable ($2.1 billion,

including accrued interest of $300 million).

(d) Goodwill recognized as of the acquisition date totaled $19,340 million for our Biopharmaceutical segment and $2,777 million for our Diversified

segment.

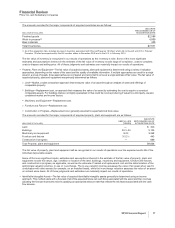

Below is a summary of the methodologies and significant assumptions used in estimating the fair value of certain classes of assets

and liabilities of Wyeth, as well as other information about recorded amounts.

•Financial instruments—Our valuation approach was consistent with our valuation methodologies used for our legacy Pfizer financial

instruments. For additional information on the valuation of our financial instruments, see Notes to Consolidated Financial Statements––

Note 9. Financial Instruments.

•Inventories—The fair value of acquired inventory was determined as follows:

OFinished goods—Estimated selling price, less an estimate of costs to be incurred to sell the inventory, and an estimate of a

reasonable profit allowance for that selling effort.

OWork in process—Estimated selling price of an equivalent finished good, less an estimate of costs to be incurred to complete the

work-in-process inventory, an estimate of costs to be incurred to sell the inventory and an estimate of a reasonable profit allowance

for those manufacturing and selling efforts.

ORaw materials and supplies—Estimated cost to replace the raw materials and supplies.

16 2010 Financial Report