Pfizer 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

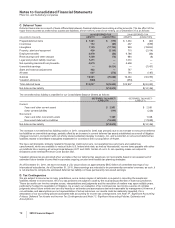

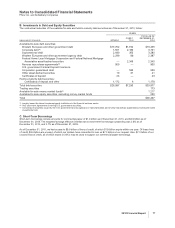

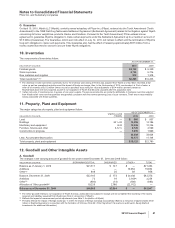

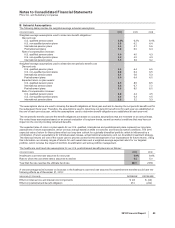

B. Investments in Debt and Equity Securities

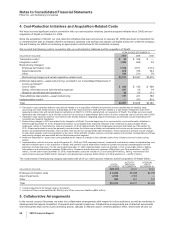

The contractual maturities of the available-for-sale and held-to-maturity debt securities as of December 31, 2010, follow:

(MILLIONS OF DOLLARS)

YEARS

WITHIN 1

OVER 1

TO 5

TOTAL AS OF

DECEMBER 31,

2010

Available-for-sale debt securities:

Western European and other government debt $17,702 $1,754 $19,456

Corporate debt(a) 1,551 2,180 3,731

Supranational debt 2,930 350 3,280

Western European and other government agency debt 2,299 88 2,387

Federal Home Loan Mortgage Corporation and Federal National Mortgage

Association asset-backed securities — 2,345 2,345

Reverse repurchase agreements(b) 900 — 900

U.S. government Federal Deposit Insurance

Corporation guaranteed debt — 536 536

Other asset-backed securities 10 31 41

Certificates of deposit 23 — 23

Held-to-maturity debt securities:

Certificates of deposit and other 1,172 6 1,178

Total debt securities $26,587 $7,290 $33,877

Trading securities 173

Available-for-sale money market funds(c) 1,217

Available-for-sale equity securities, excluding money market funds 230

Total $35,497

(a) Largely issued by above-investment-grade institutions in the financial services sector.

(b) Very short-term agreements involving U.S. government securities.

(c) Consisting of securities issued by the U.S. government and its agencies or instrumentalities and reverse repurchase agreements involving the same

investments held.

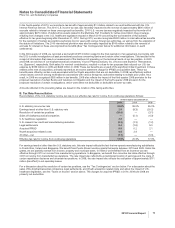

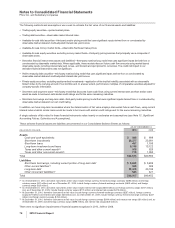

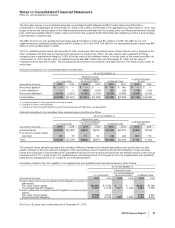

C. Short-Term Borrowings

Short-term borrowings include amounts for commercial paper of $1.2 billion as of December 31, 2010, and $3.9 billion as of

December 31, 2009. The weighted-average effective interest rate on short-term borrowings outstanding was 2.8% as of

December 31, 2010, and 0.7% as of December 31, 2009.

As of December 31, 2010, we had access to $9.0 billion of lines of credit, of which $1.9 billion expire within one year. Of these lines

of credit, $8.4 billion are unused, of which our lenders have committed to loan us $7.0 billion at our request. Also, $7.0 billion of our

unused lines of credit, all of which expire in 2013, may be used to support our commercial paper borrowings.

2010 Financial Report 77