Pfizer 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

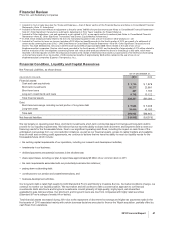

In 2011, we expect to spend approximately $1.7 billion on property, plant and equipment. Planned capital spending mostly

represents investment to maintain existing facilities and capacity. We rely largely on operating cash flow to fund our capital

investment needs. Due to our significant operating cash flows, we believe we have the ability to meet our capital investment needs

and anticipate no delays to planned capital expenditures.

Off-Balance Sheet Arrangements

In the ordinary course of business and in connection with the sale of assets and businesses, we often indemnify our counterparties

against certain liabilities that may arise in connection with a transaction or that are related to activities prior to a transaction. These

indemnifications typically pertain to environmental, tax, employee and/or product-related matters, and patent-infringement claims. If

the indemnified party were to make a successful claim pursuant to the terms of the indemnification, we would be required to

reimburse the loss. These indemnifications generally are subject to threshold amounts, specified claim periods and other restrictions

and limitations. Historically, we have not paid significant amounts under these provisions and, as of December 31, 2010, recorded

amounts for the estimated fair value of these indemnifications are not significant.

Certain of our co-promotion or license agreements give our licensors or partners the rights to negotiate for, or in some cases to

obtain under certain financial conditions, co-promotion or other rights in specified countries with respect to certain of our products.

Dividends on Common Stock

We declared dividends of $6.1 billion in 2010 and $5.5 billion in 2009 on our common stock. In December 2010, our Board of

Directors declared a first-quarter 2011 dividend of $0.20 per share, payable on March 1, 2011, to shareholders of record at the close

of business on February 4, 2011. The first-quarter 2011 cash dividend will be our 289th consecutive quarterly dividend.

Our current and projected dividends provide a return to shareholders while maintaining sufficient capital to invest in growing our

businesses and increasing shareholder value. Our dividends are not restricted by debt covenants. While the dividend level remains

a decision of Pfizer’s Board of Directors and will continue to be evaluated in the context of future business performance, we currently

believe that we can support future annual dividend increases, barring significant unforeseen events.

New Accounting Standards

Recently Adopted Accounting Standards

See Notes to Consolidated Financial Statements––Note 1B. Significant Accounting Policies: New Accounting Standards.

Recently Issued Accounting Standards, Not Adopted as of December 31, 2010

In December 2010, the FASB issued an accounting standard update that provides guidance on the recognition and presentation of

the annual fee to be paid by pharmaceutical companies beginning on January 1, 2011 to the U.S. Treasury as a result of U.S.

Healthcare Legislation. As a result of adopting this new standard, beginning on January 1, 2011, we will record the annual fee as an

operating expense in our consolidated statements of income. The provisions of this standard will not have a significant impact on our

consolidated financial statements.

In October 2009, the FASB issued an accounting standard update that addresses the accounting for multiple-deliverable

arrangements to enable companies to account for certain products or services separately rather than as a combined unit. This

update addresses how to separate deliverables and how to measure and allocate arrangement consideration to one or more units of

accounting through the use of a selling price hierarchy to determine the selling price of a deliverable. The provisions of the new

standard were adopted January 1, 2011, and we do not expect the provisions of this standard to have a significant impact on our

consolidated financial statements.

Forward-Looking Information and Factors That May Affect Future Results

The SEC encourages companies to disclose forward-looking information so that investors can better understand a company’s future

prospects and make informed investment decisions. This report and other written or oral statements that we make from time to time

contain such forward-looking statements that set forth anticipated results based on management’s plans and assumptions. Such

forward-looking statements involve substantial risks and uncertainties. We have tried, wherever possible, to identify such statements

by using words such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other

words and terms of similar meaning or by using future dates in connection with any discussion of future operating or financial

performance, business plans and prospects, in-line products and product candidates, and share-repurchase and dividend-rate

plans. In particular, these include statements relating to future actions, business plans and prospects, prospective products or

product approvals, future performance or results of current and anticipated products, sales efforts, expenses, interest rates, foreign

exchange rates, the outcome of contingencies, such as legal proceedings, share-repurchase and dividend-rate plans, and financial

results, including, in particular, the financial guidance and targets and anticipated cost savings set forth in the “Cost-Reduction and

Productivity Initiatives and Related Costs”, “Our Financial Guidance for 2011” and “Our Financial Targets for 2012” sections of this

Financial Review. Among the factors that could cause actual results to differ materially from past and projected future results are the

following:

•Success of research and development activities including, without limitation, the ability to meet anticipated clinical trial completion

dates, regulatory submission and approval dates, and launch dates for product candidates;

•Decisions by regulatory authorities regarding whether and when to approve our drug applications, as well as their decisions regarding

labeling, ingredients and other matters that could affect the availability or commercial potential of our products;

•Speed with which regulatory authorizations, pricing approvals and product launches may be achieved;

2010 Financial Report 45