Pfizer 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Appendix A

2010 Financial Report

Table of contents

-

Page 1

Appendix A 2010 Financial Report -

Page 2

-

Page 3

...in this Financial Review relating to our financial and operating performance, business plans and prospects, in-line products and product candidates, and share-repurchase and dividend-rate plans. Such forward-looking statements are based on management's current expectations about future events, which... -

Page 4

... interest rates coupled with lower average investment balances; an additional charge of $1.3 billion (pre-tax) for asbestos litigation related to our wholly owned subsidiary Quigley Company, Inc. (see Notes to Consolidated Financial Statements--Note 19. Legal Proceedings and Contingencies); 2010... -

Page 5

... December 2010, the Financial Accounting Standards Board (FASB) issued an accounting standard update which provides guidance that the annual fee based on branded prescription drug sales to specified government programs should be recorded as an operating expense rather than as a reduction of revenues... -

Page 6

Financial Review Pfizer Inc. and Subsidiary Companies that the annual fee based on branded prescription drug sales to specified government programs will adversely affect Selling, informational and administrative expenses by approximately $300 million in each of 2011 and 2012. These estimates are ... -

Page 7

...mania in children and in June 2010 with respect to the reporting of certain post-marketing adverse events relating to certain drugs. We are working with the FDA to address the issues raised in those letters. Pricing and Access Pressures--Governments, managed care organizations and other payer groups... -

Page 8

... us to share risk and to access external scientific and technological expertise. For information about our pending new drug applications (NDA) and supplemental filings, see the "Revenues-Product Developments-Biopharmaceutical" section of this Financial Review. • Our acquisition strategy included... -

Page 9

...-share quarterly dividend paid during 2010. On February 1, 2011, we announced that the Board of Directors authorized a new $5 billion share-repurchase plan, which increased our total current repurchase authorization to $9 billion. We expect to repurchase approximately $5 billion of our common stock... -

Page 10

... to Consolidated Financial Statements-Note 3D. Other Significant Transactions and Events: Acquisitions. On October 15, 2009 (the acquisition date), we acquired all of the outstanding equity of Wyeth in a cash-and-stock transaction, valued, based on the closing market price of Pfizer common stock on... -

Page 11

Financial Review Pfizer Inc. and Subsidiary Companies • • In the fourth quarter of 2008, we completed the acquisition of a number of animal health product lines from Schering-Plough Corporation (Schering-Plough) for approximately $170 million. In October 2008, an agreement with Medivation, Inc... -

Page 12

... in the "Forward-Looking Information and Factors That May Affect Future Results", "Our Operating Environment" and "Our Strategy" sections of this Financial Review and in Part I, Item 1A, "Risk Factors", of our 2010 Annual Report on Form 10-K. Accounting Policies We consider the following accounting... -

Page 13

... Financial Review, particularly in the sections "Our Operating Environment", "Our Strategy" and "Forward-Looking Information and Factors That May Affect Future Results", and in Part I, Item 1A, "Risk Factors" of our 2010 Annual Report on Form 10-K. Contingencies We and certain of our subsidiaries... -

Page 14

... on plan assets and the discount rate used to determine the benefit obligations for the U.S. qualified pension plans: 2010 2009 2008 Expected annual rate of return Actual annual rate of return Discount rate 8.5% 10.8 5.9 8.5% 14.2 6.3 8.5% (20.7) 6.4 As a result of the global financial market... -

Page 15

Financial Review Pfizer Inc. and Subsidiary Companies Holding all other assumptions constant, the effect of a 0.5 percentage-point decline in the return-on-assets assumption would increase our 2011 U.S. qualified pension plans' pre-tax expense by approximately $49 million. The discount rate used in... -

Page 16

... future impairment. Any negative change in the undiscounted cash flows, discount rate and/ or tax rate could result in an impairment charge. Xanax, which was launched in the mid 1980's and acquired in 2003, must continue to remain competitive against its generic challengers or the associated asset... -

Page 17

... and sale of prescription pharmaceutical products, including vaccines, for humans. Other operations of Wyeth included the discovery, development, manufacture and sale of consumer healthcare products (over-the-counter products), nutritionals and animal health products. Our acquisition of Wyeth has... -

Page 18

... reported in Pfizer's 2009 Annual Report on Form 10-K. Includes cash and cash equivalents, short-term investments, accounts receivable, other current assets, assets held for sale, accounts payable and other current liabilities. As of the acquisition date, included in Taxes and other current assets... -

Page 19

...Construction in Progress-Replacement cost, generally assumed to equal historical book value. O O O O The amounts recorded for the major components of acquired property, plant and equipment are as follows: USEFUL LIFE (YEARS) AMOUNTS RECOGNIZED AS OF ACQUISITION DATE (MILLIONS OF DOLLARS) Land... -

Page 20

... technology rights--finite-lived. Prevnar 13 Infant was approved in the U.S. in February 2010. O Developed Technology Rights-Developed technology rights include the right to develop, use, market, sell and/or offer for sale a product, compound or other intellectual property that we have acquired... -

Page 21

... under the benefit recognition model as previously used by Wyeth (see Notes to Consolidated Financial Statements--Note 1P. Significant Accounting Policies: Deferred Tax Assets and Income Tax Contingencies). Net liabilities for income taxes approximated $23.7 billion as of the acquisition date, which... -

Page 22

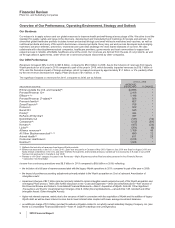

Financial Review Pfizer Inc. and Subsidiary Companies Analysis of the Consolidated Statements of Income YEAR ENDED DECEMBER 31, (MILLIONS OF DOLLARS) % CHANGE 2008 10/09 09/08 2010 2009 Revenues Cost of sales % of revenues Selling, informational and administrative expenses % of revenues R&D ... -

Page 23

... Capsugel, which represents our capsule products and services business. Diversified's segment profit includes costs related to research and development, manufacturing, and sales and marketing activities that are associated with the products in our Diversified segment. • 2010 Financial Report 21 -

Page 24

...2008(b) % CHANGE 10/09 09/08 Biopharmaceutical: Primary Care(c) Specialty Care(d) Established Products(e) Emerging Markets(f) Oncology(g) Returns adjustment Total Biopharmaceutical Diversified: Animal Health Consumer Healthcare Nutrition Capsugel Total Diversified Corporate/Other(h) Total Revenues... -

Page 25

Financial Review Pfizer Inc. and Subsidiary Companies 2010 vs. 2009 Worldwide Biopharmaceutical revenues in 2010 were $58.5 billion, an increase of 29% compared to 2009, due to: • • the inclusion of operational revenues from legacy Wyeth products of approximately $13.7 billion, which ... -

Page 26

... legacy Pfizer Animal Health products and the revenue increase from the addition of legacy Wyeth Animal Health products of 3%. The following factors impacted 2009 Animal Health results: • • • the global recession, which negatively affected global spending on veterinary care; historically low... -

Page 27

Financial Review Pfizer Inc. and Subsidiary Companies Revenues-Major Biopharmaceutical Products Revenue information for several of our major Biopharmaceutical products follows: (MILLIONS OF DOLLARS) PRODUCT PRIMARY INDICATIONS YEAR ENDED DECEMBER 31, 2010 2009 2008 % CHANGE 10/09 09/08 Lipitor ... -

Page 28

... the profits from Enbrel sales in those countries, recorded as alliance revenues. The co-promotion term is scheduled to end in October 2013, and, subject to the terms of the agreement, we are entitled to a royalty stream for 36 months thereafter, which is significantly less than our current share of... -

Page 29

... Sutent is dispensed. Pfizer maintains a global safety database, monitoring all sponsored clinical trials and spontaneous adverse event reports. Hepatic failure has been uncommonly observed in clinical trials (0.3%) and post-marketing experience, consistent with the very low rate of hepatic failure... -

Page 30

Financial Review Pfizer Inc. and Subsidiary Companies • • Zosyn/Tazocin, our broad-spectrum intravenous antibiotic, faces generic competition in the U.S. and certain other markets. It had worldwide revenues of $952 million in 2010. Genotropin, the world's leading human growth hormone, is used ... -

Page 31

Financial Review Pfizer Inc. and Subsidiary Companies Below are significant regulatory actions by, and filings pending with, the FDA and regulatory authorities in the EU and Japan as well as new drug candidates and additional indications in late-stage development: Recent FDA approvals: PRODUCT ... -

Page 32

Financial Review Pfizer Inc. and Subsidiary Companies prevention indications after we submit our response to the "approvable" letters. In April 2009, Wyeth received approval in the EU for CONBRIZA (the EU trade name for Viviant) for the treatment of post-menopausal osteoporosis in women at ... -

Page 33

Financial Review Pfizer Inc. and Subsidiary Companies In December 2010, the European Medicine Agency's Committee for Medicinal Products for Human Use (CHMP) issued a positive opinion recommending that the European Commission approve Xiapex for the treatment of Dupuytren's contracture in adult ... -

Page 34

... after the acquisition date; the inclusion of Wyeth's manufacturing operations for a full year in 2010, compared to part of the year in 2009; and the change in the mix of products and businesses as a result of the Wyeth acquisition, partially offset by: lower costs as a result of our cost-reduction... -

Page 35

...to asset restructuring, are included in Restructuring charges and certain acquisition-related costs. Research and Development (R&D) Expenses 2010 vs. 2009 R&D expenses increased 20% in 2010, compared to 2009, primarily as a result of: • • the inclusion of Wyeth operating costs for a full year... -

Page 36

... date. As a result of adopting the provisions of a new accounting standard related to business combinations issued by the Financial Accounting Standards Board (FASB), for acquisitions completed after December 31, 2008, we record acquired IPR&D on our consolidated balance sheet as indefinite-lived... -

Page 37

... related to system and process standardization and the expansion of shared services. For the year ended December 31, 2009, implementation costs are included in Cost of sales ($42 million), Selling, informational and administrative expenses ($166 million), Research and development expenses... -

Page 38

Financial Review Pfizer Inc. and Subsidiary Companies • • lower interest income of $344 million in 2010, primarily due to lower interest rates coupled with lower average investment balances; and the non-recurrence of a $482 million gain recorded in 2009 related to ViiV (see further discussion ... -

Page 39

...to portray the results of our major operations--the discovery, development, manufacture, marketing and sale of prescription medicines for humans and animals, consumer healthcare (over-the-counter) products, vaccines and nutritional products--prior to considering certain income statement elements. We... -

Page 40

... resulting from business combinations and net asset acquisitions. These impacts can include the incremental charge to cost of sales from the sale of acquired inventory that was written up to fair value, amortization related to the increase in fair value of the acquired finite-lived intangible assets... -

Page 41

...(MILLIONS OF DOLLARS) YEAR ENDED DECEMBER 31, 2010 2009 2008 % CHANGE 10/09 09/08 Reported net income attributable to Pfizer Inc. Purchase accounting adjustments-net of tax Acquisition-related costs-net of tax Discontinued operations-net of tax Certain significant items-net of tax Adjusted income... -

Page 42

... related to an intangible asset associated with a legacy Pfizer product, Thelin (see also the "Other (Income)/Deductions--Net" section of this Financial Review and Notes to Consolidated Financial Statements-Note 2. Acquisition of Wyeth and Note 3B. Other Significant Transactions and Events: Asset... -

Page 43

... due from companies with highly rated securities (Standard & Poor's ratings of mostly AA or better). Total financial assets decreased during 2010 due to the repayment of short-term borrowings and higher tax payments made in the first-quarter of 2010 associated mainly with certain business decisions... -

Page 44

... due to operating cash flows, partially offset by the use of proceeds of short-term investments for repayment of short-term borrowings and for tax payments made in 2010, associated mainly with certain business decisions executed to finance the Wyeth acquisition. The change in working capital and the... -

Page 45

... • net cash paid for acquisitions of $198 million in 2010 compared to $43.1 billion in 2009 for the acquisition of Wyeth, and net proceeds from redemption and sales of investments of $23 million in 2010, which were used for repayment of short-term borrowings and for tax payments in 2010, compared... -

Page 46

...that the Board of Directors authorized a new $5 billion share-purchase plan (the "2008 Stock Purchase Plan"), to be funded by operating cash flows that may be utilized from time to time. In total under the 2005 and 2008 Stock Purchase Plans, through December 31, 2010, we have purchased approximately... -

Page 47

... meaning or by using future dates in connection with any discussion of future operating or financial performance, business plans and prospects, in-line products and product candidates, and share-repurchase and dividend-rate plans. In particular, these include statements relating to future actions... -

Page 48

Financial Review Pfizer Inc. and Subsidiary Companies Success of external business-development activities; Competitive developments, including the impact on our competitive position of new product entrants, in-line branded products, generic products, private label products and product ... -

Page 49

... into fixed-rate investments and borrowings or through the use of derivative financial instruments such as interest rate swaps. In light of current market conditions, our current borrowings are primarily on a long-term, fixed-rate basis. We may change this practice as market conditions change... -

Page 50

... be no assurance as to the outcome of these matters, and a loss in any of these cases could result in a loss of patent protection for the drug at issue, which could lead to a significant loss of sales of that drug and could materially affect future results of operations. 48 2010 Financial Report -

Page 51

... reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company's assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or... -

Page 52

Audit Committee Report The Audit Committee reviews the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. In this context, the ... -

Page 53

... Financial Statements The Board of Directors and Shareholders of Pfizer Inc.: We have audited the accompanying consolidated balance sheets of Pfizer Inc. and Subsidiary Companies as of December 31, 2010 and 2009, and the related consolidated statements of income, shareholders' equity, and cash... -

Page 54

... accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Pfizer Inc. and Subsidiary Companies as of December 31, 2010 and 2009, and the related consolidated statements of income, shareholders' equity, and cash flows for each... -

Page 55

Consolidated Statements of Income Pfizer Inc. and Subsidiary Companies (MILLIONS, EXCEPT PER COMMON SHARE DATA) YEAR ENDED DECEMBER 31, 2010 2009 2008 Revenues Costs and expenses: Cost of sales(a) Selling, informational and administrative expenses(a) Research and development expenses(a) ... -

Page 56

Consolidated Balance Sheets Pfizer Inc. and Subsidiary Companies (MILLIONS, EXCEPT PREFERRED STOCK ISSUED AND PER COMMON SHARE DATA) AS OF DECEMBER 31, 2010 2009 Assets Cash and cash equivalents Short-term investments Accounts receivable, less allowance for doubtful accounts: 2010-$217; 2009-$176... -

Page 57

... option transactions Purchases of common stock Employee benefit trust transactions-net Preferred stock conversions and redemptions Other Balance, December 31, 2008 Comprehensive income: Net income Other comprehensive income, net of tax Total comprehensive income Acquisition of Wyeth Cash dividends... -

Page 58

... end of year Supplemental Cash Flow Information Non-cash transactions: Acquisition of Wyeth, treasury stock issued Cash paid during the period for: Income taxes Interest See Notes to Consolidated Financial Statements, which are an integral part of these statements. 56 2010 Financial Report $ 8,289... -

Page 59

.... Commencing from the acquisition date, our financial statements reflect the assets, liabilities, operating results and cash flows of Wyeth. As a result, and in accordance with our domestic and international fiscal year-ends, our consolidated financial statements for the year ended December 31... -

Page 60

...(see Note 1C. Significant Accounting Policies: Estimates and Assumptions). E. Acquisitions Our consolidated financial statements include the operations of an acquired business after the completion of the acquisition. We account for acquired businesses using the acquisition method of accounting. The... -

Page 61

...to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies H. Revenues Revenue Recognition-We record revenues from product sales when the goods are shipped and title passes to the customer. At the time of sale, we also record estimates for a variety of sales deductions, such as sales... -

Page 62

... certain costs associated with integrating an acquired business (if the restructuring action results in a change in the estimated useful life of an asset, that incremental impact is classified in Cost of sales, Selling, informational and administrative expenses and Research and development expenses... -

Page 63

... share-based payment programs are accounted for at fair value and these fair values generally are amortized on an even basis over the vesting terms into Cost of sales, Selling, informational and administrative expenses, and Research and development expenses, as appropriate. 2010 Financial Report... -

Page 64

...the closing market price of Pfizer's common stock on the acquisition date, resulting in a total merger consideration value of $50.40 per share of Wyeth common stock. Wyeth's core business was the discovery, development, manufacture and sale of prescription pharmaceutical products, including vaccines... -

Page 65

... the benefit recognition model as previously used by Wyeth (see Note 1P. Significant Accounting Policies: Deferred Tax Assets and Income Tax Contingencies). Net liabilities for income taxes approximated $23.7 billion as of the acquisition date, which included $1.8 billion for uncertain tax positions... -

Page 66

... pro forma consolidated results were prepared using the acquisition method of accounting and are based on the historical financial information of Pfizer and Wyeth, reflecting both in 2009 and 2008 Pfizer and Wyeth results of operations for a 12 month period. The historical financial information has... -

Page 67

... assets; for Brand assets, the current competitive environment and planned investment support; and, for Developed Technology Rights, an increased competitive environment. We recorded a charge of approximately $300 million in the fourth quarter of 2010 associated with our product Thelin, as a result... -

Page 68

... of 2008, we completed the acquisition of a number of animal health product lines from Schering-Plough Corporation (Schering-Plough) for approximately $170 million. In the second quarter of 2008, we acquired Encysive Pharmaceuticals Inc. (Encysive), a biopharmaceutical company whose main product was... -

Page 69

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies E. Equity-Method Investments Investment in Laboratório Teuto Brasileiro, an Equity-Method Investment In the fourth quarter of 2010, we consummated our partnership to develop and commercialize generic medicines with ... -

Page 70

... and certain acquisition-related costs Additional depreciation-asset restructuring, recorded in our Consolidated Statements of Income as follows(d): Cost of Sales Selling, informational and administrative expenses Research and development expenses Total additional depreciation--asset restructuring... -

Page 71

..., Brands and, to a lesser extent, Developed Technology Rights.; and (ii) an intangible asset associated with the legacy Pfizer product Thelin (see Note 2. Acquisition of Wyeth and Note 3B. Other Significant Transactions and Events: Asset Impairment Charges). The 2009 amounts 2010 Financial Report... -

Page 72

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies primarily represent asset impairment charges associated with certain materials used in our research and development activities that were no longer considered recoverable. The 2008 amounts primarily represent charges related... -

Page 73

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies In the fourth-quarter of 2010, we recorded a tax benefit of approximately $1.4 billion related to an audit settlement with the U.S. Internal Revenue Service. The 2010 U.S. income tax was also favorably impacted by the ... -

Page 74

..., primarily related to foreign tax credit carryovers, net operating loss carryovers and capital loss carryforwards, which are available to reduce future U.S. federal and state, as well as international, income taxes payable with either an indefinite life or expiring at various times between 2011 and... -

Page 75

... related to interest on these unrecognized tax benefits. The 2006, 2007 and 2008 tax years currently are under audit. The 2009 and 2010 tax years are not yet under audit. All other tax years in the U.S. for Pfizer Inc. are closed under the statute of limitations. With respect to Wyeth, the years... -

Page 76

... Financial Statements Pfizer Inc. and Subsidiary Companies Any settlements or statute of limitations expirations would likely result in a significant decrease in our uncertain tax positions. We estimate that within the next 12 months, our gross unrecognized tax benefits, exclusive of interest... -

Page 77

... companies with highly rated securities (Standard & Poor's (S&P) ratings of mostly AA or better). The decrease in selected financial assets is primarily due to the use of proceeds of short-term investments for repayment of short-term borrowings and for tax payments made in the first quarter of 2010... -

Page 78

...to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following methods and assumptions were used to estimate the fair value of our financial assets and liabilities: Trading equity securities-quoted market prices. Trading debt securities-observable market interest rates... -

Page 79

.... The weighted-average effective interest rate on short-term borrowings outstanding was 2.8% as of December 31, 2010, and 0.7% as of December 31, 2009. As of December 31, 2010, we had access to $9.0 billion of lines of credit, of which $1.9 billion expire within one year. Of these lines of credit... -

Page 80

...through operational means, including managing expected same-currency revenues in relation to same-currency costs and same-currency assets in relation to samecurrency liabilities. Depending on market conditions, foreign exchange risk also is managed through the use of derivative financial instruments... -

Page 81

... billion. The derivative financial instruments hedge U.S. dollar and euro fixed-rate debt. All derivative contracts used to manage interest rate risk are measured at fair value and reported as assets or liabilities on the consolidated balance sheet. Changes in fair value are reported in earnings, as... -

Page 82

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Information about gains/(losses) incurred to hedge or offset operational foreign exchange or interest rate risk is as follows: GAINS/(LOSSES) YEARS ENDED DECEMBER 31, 2010 2009 (MILLIONS OF DOLLARS) Derivative Financial... -

Page 83

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies G. Guarantee On April 15, 2010, Wyeth LLC (Wyeth), a wholly owned subsidiary of Pfizer Inc. (Pfizer), entered into the Tenth Amendment (Tenth Amendment) to the 1999 Diet Drug Nationwide Settlement Agreement (Settlement ... -

Page 84

... Developed Technology Rights Developed technology rights represent the amortized cost associated with developed technology, which has been acquired from third parties and which can include the right to develop, use, market, sell and/or offer for sale the product, compounds and intellectual property... -

Page 85

... The weighted-average life of both our total finite-lived intangible assets and our developed technology rights is approximately 11 years. Total amortization expense for finite-lived intangible assets was $5.5 billion in 2010, $3.0 billion in 2009 and $2.8 billion in 2008. The annual amortization... -

Page 86

... expected to be amortized into 2011 net periodic benefit costs: PENSION PLANS U.S. SUPPLEMENTAL (NON-QUALIFIED) POSTRETIREMENT PLANS (MILLIONS OF DOLLARS) U.S. QUALIFIED INTERNATIONAL Actuarial losses Prior service credits and other Total 84 2010 Financial Report $(141) 8 $(133) $(38) 3 $(35... -

Page 87

... market conditions. The 2010 expected rates of return for these plans reflect our long-term outlook for a globally diversified portfolio, which is influenced by a combination of return expectations for individual asset classes, actual historical experience and our diversified investment strategy... -

Page 88

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies C. Obligations and Funded Status The following table presents an analysis of the changes in 2010 and 2009 in the benefit obligations, plan assets and accounting funded status of our U.S. qualified, U.S. supplemental (... -

Page 89

...plan assets at end of year. Amounts recognized in our consolidated balance sheet follow: AS OF DECEMBER 31, PENSION PLANS U.S. SUPPLEMENTAL (NON-QUALIFIED) 2010 2009 POSTRETIREMENT PLANS 2010 2009 (MILLIONS OF DOLLARS) U.S. QUALIFIED 2010 2009 INTERNATIONAL 2010 2009 Noncurrent assets(a) Current... -

Page 90

... Financial Statements Pfizer Inc. and Subsidiary Companies D. Plan Assets Information about plan assets as of December 31, 2010 follows: FAIR VALUE(a) (MILLIONS OF DOLLARS) AS OF DECEMBER 31, 2010 LEVEL 1 LEVEL 2 LEVEL 3 U.S. qualified pension plans(a): Cash and cash equivalents Equity... -

Page 91

... Financial Statements Pfizer Inc. and Subsidiary Companies Information about plan assets as of December 31, 2009 follows: FAIR VALUE(a) (MILLIONS OF DOLLARS) AS OF DECEMBER 31, 2009 LEVEL 1 LEVEL 2 LEVEL 3 U.S. qualified pension plans(a): Cash and cash equivalents Equity securities: Global... -

Page 92

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The details of our plan assets classified as Level 3 assets, including an analysis of changes during 2010, are as follows: FAIR VALUE, BEGINNING OF YEAR ACTUAL RETURN ON PLAN ASSETS PURCHASES, FAIR ASSETS SOLD SALES AND... -

Page 93

... long-term return expectations are developed based on a diversified, global investment strategy that takes into account historical experience, as well as the impact of portfolio diversification, active portfolio management, and our view of current and future economic and financial market conditions... -

Page 94

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies E. Cash Flows It is our practice to fund amounts for our qualified pension plans that are at least sufficient to meet the minimum requirements set forth in applicable employee benefit laws and local tax laws. The ... -

Page 95

... fund the Company's matching contribution in the Pfizer Savings Plan. 15. Share-Based Payments Our compensation programs can include share-based payments. In 2010, 2009 and 2008, the primary share-based awards and their general terms and conditions are as follows: • • • Stock options, which... -

Page 96

... date uses, for virtually all grants, the Black-ScholesMerton option-pricing model, which incorporates a number of valuation assumptions noted in the following table, shown at their weighted-average values: YEAR ENDED DECEMBER 31, 2010 2009 2008 Expected dividend yield(a) Risk-free interest rate... -

Page 97

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies The following table summarizes all stock option activity during 2010: SHARES (THOUSANDS) WEIGHTED-AVERAGE EXERCISE PRICE PER SHARE WEIGHTED-AVERAGE REMAINING CONTRACTUAL TERM (YEARS) AGGREGATE INTRINSIC VALUE(a) (... -

Page 98

... the resulting shares were adjusted to the fair value of our common stock at each accounting period until the date of payment. The weighted-average assumptions used in the valuation of PSAs are as follows: YEAR ENDED DECEMBER 31, 2010 2009 2008 Risk-free interest rate Expected Pfizer stock price... -

Page 99

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies price of Pfizer common stock during the 20 trading days ending on the fifth anniversary of the grant; the grant price is the closing price of Pfizer common stock on the date of the grant. The TSRUs are automatically ... -

Page 100

...net of tax Net income attributable to Pfizer Inc. common shareholders and assumed conversions EPS Denominator: Weighted-average number of common shares outstanding-Basic Common-share equivalents: stock options, stock issuable under employee compensation plans and convertible preferred stock Weighted... -

Page 101

...the following: A. Patent Matters Like other pharmaceutical companies, we are involved in numerous suits relating to our patents, including but not limited to those discussed below. Most of the suits involve claims by generic drug manufacturers that patents covering our products, processes or dosage... -

Page 102

... non-infringement of the Viagra use patent, which expires in 2019, but have not challenged the basic patent, which expires in 2012. In October 2010, we filed a patent-infringement action with respect to Viagra in the U.S. District Court for the Southern District of New York against Apotex Inc. and... -

Page 103

... of New Jersey held that the generic gabapentin (Neurontin) products of a number of generic manufacturers did not infringe our gabapentin low-lactam patent, which expires in 2017, and it granted summary judgment in their favor. Several generic manufacturers launched their gabapentin products in... -

Page 104

... Financial Statements Pfizer Inc. and Subsidiary Companies January 2008, respectively. Wyeth launched its own generic version of Protonix tablets in January 2008, and Wyeth and Nycomed filed amended complaints in the pending patent-infringement action seeking compensation for damages resulting... -

Page 105

... Financial Statements Pfizer Inc. and Subsidiary Companies In February 2008, the Bankruptcy Court authorized Quigley to solicit an amended reorganization plan for acceptance by claimants. According to the official report filed with the court by the balloting agent in July 2008, the requisite number... -

Page 106

... in off-label marketing of certain drugs. Plaintiffs seek damages in an unspecified amount. • Actions by Health Care Service Corporation In June 2010, Health Care Service Corporation (HCSC), for itself and its affiliates, Blue Cross and Blue Shield plans in Illinois, New Mexico, Oklahoma and... -

Page 107

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies This litigation originally included both individual actions as well as various purported nationwide and statewide class actions. However, as a result of the denial of class certification by the courts in certain actions, the... -

Page 108

...purported class. In July 2010, a related action was filed in the U.S. District Court for the Southern District of New York against Elan Corporation (Elan), certain directors and officers of Elan, and Pfizer, as successor to Wyeth. This action asserts claims on behalf of purchasers of call options of... -

Page 109

...A number of states as well as most counties in New York have sued Pharmacia, Pfizer and other pharmaceutical manufacturers alleging that they provided average wholesale price (AWP) information for certain of their products that was higher than the actual prices at which those products were sold. The... -

Page 110

...Pfizer did not report to the states their best price for certain products under the Medicaid program. In addition, Pharmacia, Pfizer and other pharmaceutical manufacturers are defendants in a number of purported class action suits in various federal and state courts brought by employee benefit plans... -

Page 111

... could result from government investigations, including but not limited to those discussed below. The Company has voluntarily provided the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) with information concerning potentially improper payments made by Pfizer... -

Page 112

... products that consist mainly of infant and toddler nutritional products; and Capsugel, which represents our capsule products and services business. Diversified's segment profit includes costs related to research and development, manufacturing, and sales and marketing activities that are associated... -

Page 113

... includes contract manufacturing and bulk pharmaceutical chemical sales. Assets included within Corporate/Other are primarily cash and cash equivalents, short-term investments, long-term investments and loans and tax assets. Certain production facilities are shared. Property, plant and equipment... -

Page 114

Notes to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Geographic Revenues and long-lived assets by geographic region are as follows: (MILLIONS OF DOLLARS) YEAR ENDED/AS OF DECEMBER 31, 2010(a) 2009(a) 2008 Revenues United States Developed Europe(b) Developed Rest of World... -

Page 115

... to Consolidated Financial Statements Pfizer Inc. and Subsidiary Companies Revenues by Product Significant product revenues are as follows: YEAR ENDED DECEMBER 31, (MILLIONS OF DOLLARS) 2010 2009 2008 Biopharmaceutical products: Lipitor Enbrel(a), (b) Lyrica Prevnar/Prevenar 13(a) Celebrex Viagra... -

Page 116

... drug delivery, which develops and manufactures the EpiPen®; and an animal health business that offers a variety of feed-additive products for a wide range of species. The assets acquired and liabilities assumed from King, the consideration paid to acquire King, and the results of King's operations... -

Page 117

Quarterly Consolidated Financial Data (Unaudited) Pfizer Inc. and Subsidiary Companies QUARTER (MILLIONS OF DOLLARS, EXCEPT PER COMMON SHARE DATA) FIRST SECOND THIRD FOURTH 2010 Revenues Costs and expenses(a) Acquisition-related in-process research and development charges Restructuring charges... -

Page 118

Quarterly Consolidated Financial Data (Unaudited) Pfizer Inc. and Subsidiary Companies (MILLIONS OF DOLLARS, EXCEPT PER COMMON SHARE DATA) FIRST QUARTER SECOND THIRD FOURTH(a) 2009 Revenues Costs and expenses Acquisition-related in-process research and development charges Restructuring charges ... -

Page 119

... operations-net of tax Net income attributable to Pfizer Inc. common shareholders Market value per share (December 31) Return on Pfizer Inc. shareholders' equity Cash dividends paid per common share Shareholders' equity per common share(g) Current ratio Weighted-average shares used to calculate... -

Page 120

Financial Summary Pfizer Inc. and Subsidiary Companies Peer Group Performance Graph 200.0 150.0 100.0 50.0 0.0 2005 2006 2007 2008 2009 2010 PFIZER PEER GROUP S&P 500 Five Year Performance 2005 2006 2007 2008 2009 2010 PFIZER PEER GROUP S&P 500 100.0 100.0 100.0 115.2 110.7 115.2 105.8 ...