Pfizer 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

sales, Selling, informational and administrative expenses and Research and development expenses, as appropriate. The PCSA

grants awarded prior to 2006 are accounted for using the intrinsic value method in the consolidated income statement. Senior and

other key members of management may receive PSA and PCSA grants. In most instances, PSA grants vest after three years and

PCSA grants vest after five years of continuous service from the grant date. In certain instances, PCSA grants vest over two to four

years of continuous service from the grant date. The vesting terms are equal to the contractual terms.

The 2004 Plan limitations on the maximum amount of share-based awards apply to all awards, including PCSA and PSA grants. In

2001, our shareholders approved the 2001 Performance-Contingent Share Award Plan (the 2001 Plan), allowing a maximum of

12.5 million shares to be awarded to all participants. This maximum was applied to awards for performance periods beginning after

January 1, 2002 through 2004. The 2004 Plan is the only plan under which share-based awards may be granted in the future.

PSA grants made in 2008, 2007 and 2006 will vest and be paid based on a non-discretionary formula that measures our

performance using relative total shareholder return over a performance period relative to an industry peer group. If our minimum

performance in the measure is below the threshold level relative to the peer group, then no shares will be paid. PCSA grants made

prior to 2006 will vest and be paid based on a non-discretionary formula, which measures our performance using relative total

shareholder return and relative change in diluted EPS over a performance period relative to an industry peer group. If our minimum

performance in the measures is below the threshold level relative to the peer group, then no shares will be paid.

We measure PSA grants at fair value, using a Monte Carlo simulation model, times the target number of shares. The target number

of shares is determined by reference to the fair value of share-based awards to similar employees in the industry peer group. We

measure PCSA grants at intrinsic value whereby the probable award was allocated over the term of the award, then the resultant

shares are adjusted to the fair value of our common stock at each accounting period until the date of payment.

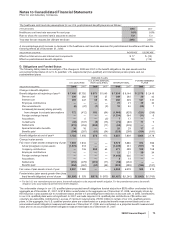

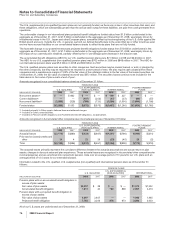

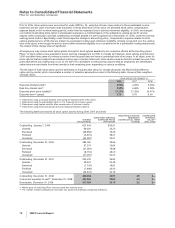

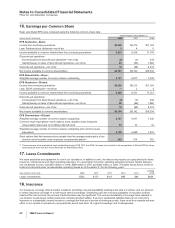

The weighted average assumptions used in the valuation of PSAs are as follows:

YEAR ENDED DECEMBER 31,

2008 2007 2006

Risk-free interest rate 2.05% 4.68% 4.70%

Expected Pfizer stock price volatility 27.21% 21.28% 24.47%

Average peer stock price volatility 32.13% 18.85% 23.34%

Contractual term in years 333

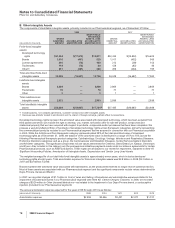

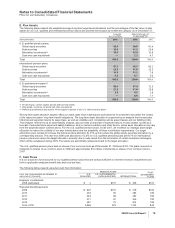

The following table summarizes all PSA and PCSA activity during 2008, 2007 and 2006, with the shares granted representing the

maximum award that could be achieved:

SHARES

(THOUSANDS)

WEIGHTED-

AVERAGE

GRANT DATE

FAIR VALUE

PER SHARE

Nonvested, January 1, 2006 15,979 $23.32

Granted 1,728 34.84

Vested (1,583) 26.20

Forfeited(a) (2,388) 26.11

Nonvested, December 31, 2006 13,736 26.78

Granted 1,183 28.80

Vested (1,788) 25.87

Forfeited(a) (5,166) 26.44

Modifications(b) 2,192 25.66

Nonvested, December 31, 2007 10,157 24.76

Granted 1,529 30.93

Vested (657) 22.55

Forfeited(a) (3,591) 23.06

Modifications(b) 454 17.55

Nonvested, December 31, 2008 7,892 23.52

(a) Forfeited includes nil in 2008 and 2007, and 345 thousand shares in 2006 that were forfeited by retirees. At the discretion of the Compensation

Committee of our Board of Directors, $9 million in 2006 was paid in cash to such retirees, which was equivalent to the fair value of the forfeited

shares pro rated for the portion of the performance period that was completed prior to retirement.

(b) Modifications includes pro-ration of the awards for service to the date of termination for 15 former employees in 2008 and 34 employees and former

employees in 2007. The modifications were made at the discretion of the Senior Vice President of Worldwide Human Resources, or her designee,

for 2008, and the Board of Directors, the Executive Leadership Team or the Chairman and Chief Executive Officer for 2007. There was no

incremental cost related to the modifications.

80 2008 Financial Report