Pfizer 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

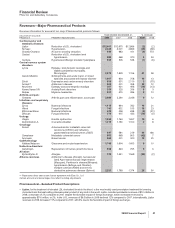

Financial Review

Pfizer Inc and Subsidiary Companies

being evaluated in a Phase 3 trial in patients with mild-to-moderate Alzheimer's disease. Under the collaboration agreement with

Medivation, we made an up-front payment of $225 million, which is included in Research and development expenses. We may also

make additional payments of up to $500 million based upon development and regulatory milestones, as well as additional milestone

payments based upon the successful commercialization of the product.

•In the second quarter of 2008, we acquired Encysive, a biopharmaceutical company, whose main product (Thelin), for the treatment of

pulmonary arterial hypertension, is commercially available in much of the E.U., is approved in certain other markets, and is under

review by the FDA. The cost of acquiring Encysive, through a tender offer and subsequent merger, was approximately $200 million,

including transaction costs. In addition, in the second quarter of 2008, we acquired Serenex, a privately held biotechnology company

that owns SNX-5422, an oral Heat Shock Protein 90 (Hsp90) inhibitor currently in Phase 1 trials for the potential treatment of solid

tumors and hematological malignancies. Serenex also owns an extensive Hsp90 inhibitor compound library, which has potential uses

in treating cancer and inflammatory and neurodegenerative diseases. In connection with these acquisitions, we recorded approximately

$170 million in Acquisition-related in-process research and development charges and approximately $450 million in intangible assets.

•In the second quarter of 2008, we entered into an agreement with a subsidiary of Celldex for an exclusive worldwide license to

CDX-110, an experimental therapeutic vaccine in Phase 2 development for the treatment of glioblastoma multiforme, and exclusive

rights to the use of EGFRvIII vaccines in other potential indications. Under the license and development agreement, an up-front

payment was made. Additional payments exceeding $390 million could potentially be made to Celldex based on the successful

development and commercialization of CDX-110 and additional EGFRvIII vaccine products.

•In the first quarter of 2008, we acquired CovX, a privately held biotherapeutics company specializing in preclinical oncology and

metabolic research and the developer of a biotherapeutics technology platform that we expect will enhance our biologic portfolio. Also

in the first quarter of 2008, we acquired all the outstanding shares of Coley, a biopharmaceutical company specializing in vaccines and

drug candidates designed to fight cancers, allergy and asthma disorders, and autoimmune diseases, for approximately $230 million. In

connection with these and two smaller acquisitions related to Animal Health, we recorded approximately $440 million in Acquisition-

related in-process research and development charges.

•In December 2007, we entered into a license agreement with Scil Technology Gmbh (Scil) for worldwide collaboration on Scil cartilage

specific growth factor CD-RAP. Under this agreement, Pfizer obtained a worldwide exclusive license to develop and commercialize

CD-RAP. We may make payments of up to $242 million based upon development and regulatory milestones.

•In December 2007, we entered into a license and collaboration agreement with Adolor Corporation (Adolor) to develop and

commercialize ADL5859 and ADL577, proprietary delta opioid receptor agonist compounds for the treatment of pain. We may make

payments of up to $233 million to Adolor, based on development and regulatory milestones.

•In December 2007, we entered into a research collaboration and license agreement with Taisho Pharmaceutical Co., Ltd. (Taisho) to

acquire worldwide rights outside of Japan for TS-032, a metabolic glutamate receptor agonist that may offer a new treatment option for

central nervous system disorders, and is currently in pre-clinical development for the treatment of schizophrenia. We may make

payments of up to $255 million to Taisho based upon development and regulatory milestones.

•In the second quarter of 2007, we entered into a collaboration agreement with BMS to further develop and commercialize apixaban, an

oral anticoagulant compound discovered by BMS. We made an initial payment to BMS of $250 million and additional payments to BMS

related to product development efforts, which are included in Research and development expenses in 2007. We may also make

additional payments of up to $780 million to BMS, based on development and regulatory milestones. In a separate agreement, we are

also collaborating with BMS on the research, development and commercialization of a Pfizer discovery program, which includes

preclinical compounds with potential applications for the treatment of metabolic disorders, including diabetes. We exited research

efforts in the area of obesity during the third quarter of 2008.

•In April 2007, we agreed with OSI Pharmaceuticals, Inc. (OSI) to terminate a 2002 collaboration agreement to co-promote Macugen, for

the treatment of age-related macular degeneration (AMD), in the U.S. We also agreed to amend and restate a 2002 license agreement

for Macugen, and to return to OSI all rights to develop and commercialize Macugen in the U.S. In return, OSI granted us an exclusive

right to develop and commercialize Macugen in the rest of the world.

•In the first quarter of 2007, we acquired BioRexis, a privately held biopharmaceutical company with a novel technology platform for

developing new protein drug candidates, and Embrex, an animal health company that possesses a unique vaccine delivery system

known as Inovoject that improves consistency and reliability by inoculating chicks while they are still inside the egg. In connection with

these and other smaller acquisitions, we recorded $283 million in Acquisition-related in-process research and development charges.

•In December 2006, we entered into a collaboration agreement with Kosan Biosciences Inc. (Kosan) to develop a gastrointestinal

disease treatment. In 2006, we expensed a payment of $12 million, which was included in Research and development expenses.

Additional milestone payments of up to approximately $238 million may be made to Kosan, based upon the successful development

and commercialization of a product.

•In September 2006, we entered into a license agreement with Quark Biotech Inc. for exclusive worldwide rights to a compound for the

treatment of neovascular (wet) AMD.

•In September 2006, we entered into a license and collaboration agreement with TransTech Pharma Inc. (TransTech) to develop and

commercialize small- and large-molecule compounds for treatment of Alzheimer’s disease and diabetic neuropathy. Under the terms of

the agreement, Pfizer received exclusive worldwide rights to TransTech’s portfolio of compounds. In 2006, we expensed a payment of

$101 million, which was included in Research and development expenses. Additional significant milestone payments may be made to

TransTech, based upon the successful development and commercialization of a product.

2008 Financial Report 11