Pfizer 2008 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc and Subsidiary Companies

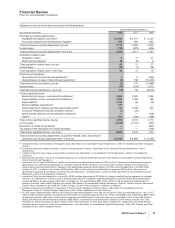

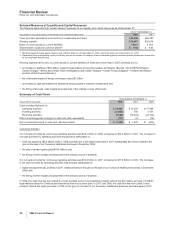

partially offset by:

•the impact of higher implementation costs associated with our cost-reduction initiatives of $433 million in 2008, compared to $416

million in 2007;

•the up-front payment to Medivation of $225 million in connection with our collaboration to develop and commercialize Dimebon,

recorded in 2008; and

•higher R&D spending in 2008 related to clinical trials for our expanded Phase 3 portfolio.

R&D expenses increased 6% in 2007, compared to 2006, which reflects:

•the impact of higher implementation costs associated with our cost-reduction initiatives of $416 million in 2007, compared to $176

million in 2006;

•the up-front payment to BMS of $250 million and additional payments to BMS related to product development efforts, in connection with

our collaboration to develop and commercialize apixaban, recorded in 2007;

•the unfavorable impact of foreign exchange on expenses;

•a one-time R&D milestone due to us from sanofi-aventis (approximately $118 million) recorded in 2006; and

•exit costs, such as contract termination costs, associated with Exubera of $100 million recorded in 2007 (see the “Our 2008

Performance: Certain Charges—Exubera” section of this Financial Review),

partially offset by:

•savings related to our cost-reduction initiatives.

R&D expenses also include payments for intellectual property rights of $377 million in 2008, $603 million in 2007 and $292 million in

2006. (For further discussion, see the “Our Strategic Initiatives—Strategy and Recent Transactions: Acquisitions, Licensing and

Collaborations” section of this Financial Review.)

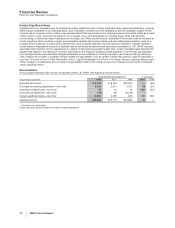

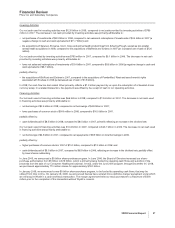

Acquisition-Related In-Process Research and Development Charges

The estimated value of acquisition-related IPR&D is expensed at the acquisition date. In 2008, we expensed $633 million of IPR&D,

primarily related to our acquisitions of Serenex, Encysive, CovX, Coley and a number of animal health product lines from Schering-

Plough Corporation, as well as two smaller acquisitions also related to Animal Health. In 2007, we expensed $283 million of IPR&D,

primarily related to our acquisitions of BioRexis and Embrex. In 2006, we expensed $835 million of IPR&D, primarily related to our

acquisitions of Rinat and PowderMed.

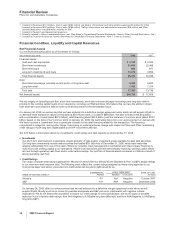

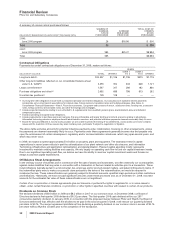

Cost-Reduction Initiatives

In connection with our cost-reduction and transformation initiatives launched in early 2005, broadened in October 2006 and

expanded in January 2007, to change the way we run our business to meet the challenges of a changing business environment and

take advantage of the diverse opportunities in the marketplace, our management performed a comprehensive review of our

processes, organizations, systems and decision-making procedures in a company-wide effort to improve performance and

efficiency. We are generating net cost reductions through site rationalization in R&D and manufacturing, streamlined organizational

structures, sales force and staff function reductions, and increased outsourcing and procurement savings.

In 2008 and 2007, we achieved a total net reduction of the pre-tax total expense component of Adjusted income of $2.8 billion,

compared to 2006 on a constant currency basis (the actual foreign exchange rates in effect in 2006). (For an understanding of

Adjusted income, see the “Adjusted Income” section of this Financial Review.)

The actions associated with the expanded cost-reduction initiatives resulted in restructuring charges, such as asset impairments,

exit costs and severance costs (including any related impacts to our benefit plans, including settlements and curtailments) and

associated implementation costs, such as accelerated depreciation charges, primarily associated with supply network transformation

efforts, and expenses associated with system and process standardization and the expansion of shared services worldwide. (See

Notes to Consolidated Financial Statements—Note 5. Cost-Reduction Initiatives.) The strengthening of the euro and other

currencies relative to the dollar, while favorable on Revenues, has had an adverse impact on our total expenses (Cost of sales,

Selling, administrative and informational expenses, and Research and development expenses), including the reported impact of

these cost-reduction efforts.

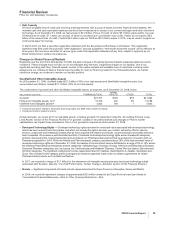

On January 26, 2009, we announced the implementation of a new cost-reduction initiative that we anticipate will achieve a reduction

in adjusted total costs of approximately $3 billion, at 2008 actual foreign exchange rates, by the end of 2011, compared with our

2008 adjusted total costs. We expect that this program will be completed by the end of 2010, with full savings to be realized by the

end of 2011. We plan to reinvest approximately $1 billion of these savings in the business, resulting in an expected $2 billion net

decrease compared to our 2008 adjusted total costs. (For an understanding of Adjusted income, see the “Adjusted income” section

of this Financial Review).

28 2008 Financial Report