Pfizer 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

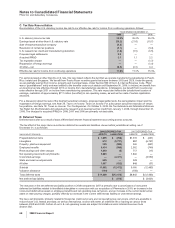

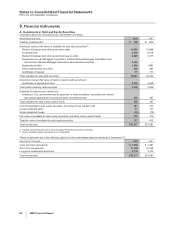

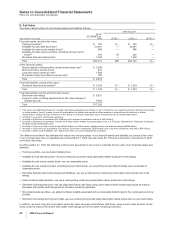

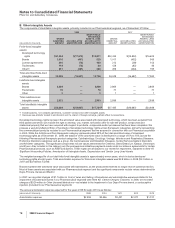

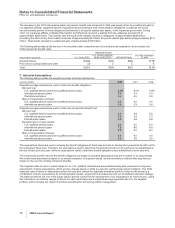

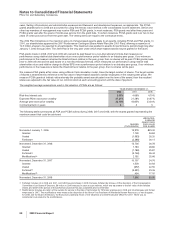

B. Other Intangible Assets

The components of identifiable intangible assets, primarily included in our Pharmaceutical segment, as of December 31 follow:

2008 2007

(MILLIONS OF DOLLARS)

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORTIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

GROSS

CARRYING

AMOUNT

ACCUMULATED

AMORTIZATION

IDENTIFIABLE

INTANGIBLE

ASSETS, LESS

ACCUMULATED

AMORTIZATION

Finite-lived intangible

assets:

Developed technology

rights $31,484 $(17,673) $13,811 $32,433 $(15,830) $16,603

Brands 1,016 (487) 529 1,017 (452) 565

License agreements 246 (78) 168 212 (59) 153

Trademarks 118 (78) 40 128 (82) 46

Other(a) 531 (291) 240 459 (264) 195

Total amortized finite-lived

intangible assets 33,395 (18,607) 14,788 34,249 (16,687) 17,562

Indefinite-lived intangible

assets:

Brands 2,860 — 2,860 2,864 — 2,864

Trademarks 70 — 70 71 — 71

Other 3—31—1

Total indefinite-lived

intangible assets 2,933 — 2,933 2,936 — 2,936

Total identifiable intangible

assets $36,328 $(18,607) $17,721(b) $37,185 $(16,687) $20,498

(a) Includes patents, non-compete agreements, customer contracts and other intangible assets.

(b) Decrease was primarily related to amortization and the impact of foreign exchange, partially offset by acquisitions.

Developed technology rights represent the amortized value associated with developed technology, which has been acquired from

third parties and which can include the right to develop, use, market, sell and/or offer for sale the product, compounds and

intellectual property that we have acquired with respect to products, compounds and/or processes that have been completed. We

possess a well-diversified portfolio of hundreds of developed technology rights across therapeutic categories, primarily representing

the commercialized products included in our Pharmaceutical segment that we acquired in connection with our Pharmacia acquisition

in 2003. While the Arthritis and Pain therapeutic category represents about 29% of the total amortized value of developed

technology rights as of December 31, 2008, the balance of the amortized value is distributed in a range of 5% to 15% across the

following Pharmaceutical therapeutic product categories: Ophthalmology; Oncology; Urology; Infectious and Respiratory Diseases;

Endocrine Disorders categories; and as a group, the Cardiovascular and Metabolic Diseases, Central Nervous System Disorders

and All Other categories. The significant components include values determined for Celebrex, Detrol/Detrol LA, Xalatan, Genotropin

and Zyvox. Also included in this category are the post-approval milestone payments made under our alliance agreements for certain

Pharmaceutical products, such as Rebif and Spiriva. These rights are all subject to our review for impairment, explained in Note 1K.

Significant Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

The weighted-average life of our total finite-lived intangible assets is approximately seven years, which includes developed

technology rights at eight years. Total amortization expense for finite-lived intangible assets was $2.8 billion in 2008, $3.2 billion in

2007 and $3.4 billion in 2006.

Brands represent the amortized value associated with tradenames, as the products themselves no longer receive patent protection.

Most of these assets are associated with our Pharmaceutical segment and the significant components include values determined for

Depo-Provera, Xanax and Medrol.

In 2007, we recorded charges of $1.1 billion in Cost of sales and Selling, informational and administrative expenses related to the

impairment of Exubera (included in our Pharmaceutical segment) (see Note 4D. Certain Charges: Exubera). In 2006, we recorded

charges of $320 million in Other (income)/deductions—net related to the impairment of our Depo-Provera brand, a contraceptive

injection (included in our Pharmaceutical segment).

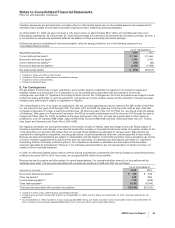

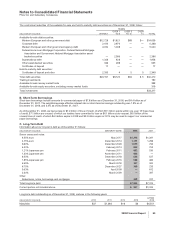

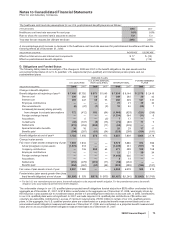

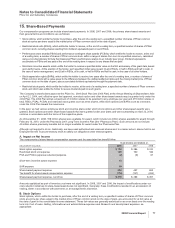

The annual amortization expense expected for the years 2009 through 2013 is as follows:

(MILLIONS OF DOLLARS) 2009 2010 2011 2012 2013

Amortization expense $2,459 $2,446 $2,421 $2,077 $1,727

70 2008 Financial Report