Pfizer 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

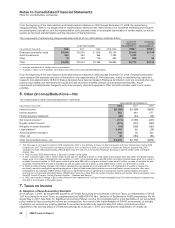

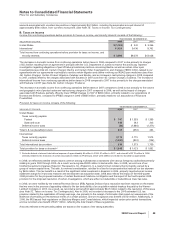

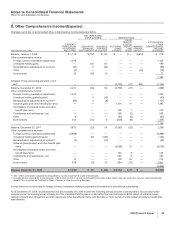

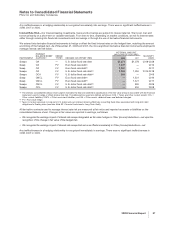

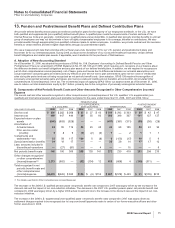

8. Other Comprehensive Income/(Expense)

Changes, net of tax, in accumulated other comprehensive income/(expense) follow:

(MILLIONS OF DOLLARS)

CURRENCY

TRANSLATION

ADJUSTMENT

AND OTHER

NET UNREALIZED

GAINS/(LOSSES) BENEFIT PLANS

ACCUMULATED

OTHER

COMPREHENSIVE

INCOME/

(EXPENSE)

DERIVATIVE

FINANCIAL

INSTRUMENTS

AVAILABLE-

FOR-SALE

SECURITIES

ACTUARIAL

GAINS/

(LOSSES)

PRIOR

SERVICE

(COSTS)/

CREDITS

AND

OTHER

MINIMUM

PENSION

LIABILITY

Balance, January 1, 2006 $ 1,113 $(107) $ 83 $ — $ — $(610) $ 479

Other comprehensive income:

Foreign currency translation adjustments 1,104 — — — — — 1,104

Unrealized holding gains — 126 63 — — — 189

Reclassification adjustments to income(a) (40) 5 (64) — — — (99)

Other (3) — — — — (16) (19)

Income taxes 53 (50) 14 — — — 17

1,192

Adoption of new accounting standard, net of

tax(b) — — — (2,739) (27) 626 (2,140)

Balance, December 31, 2006 2,227 (26) 96 (2,739) (27) — (469)

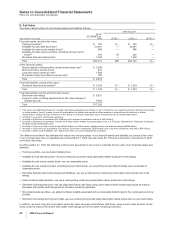

Other comprehensive income:

Foreign currency translation adjustments 1,422 — — — — — 1,422

Unrealized holding gains/(losses) — 3 (43) — — — (40)

Reclassification adjustments to income(a) (96) 3 (8) — — — (101)

Actuarial gains and other benefit plan items — — — 1,374 11 — 1,385

Amortization of actuarial losses and other

benefit plan items — — — 248 7 — 255

Curtailments and settlements—net — — — 268 (5) — 263

Other 6 — — (62) (6) — (62)

Income taxes 313 (12) 9 (656) (8) — (354)

2,768

Balance, December 31, 2007 3,872 (32) 54 (1,567) (28) — 2,299

Other comprehensive expense:

Foreign currency translation adjustments (5,898) — — — — — (5,898)

Unrealized holding gains/(losses) — 69 (193) — — — (124)

Reclassification adjustments to income(a) (2) — (20) — — — (22)

Actuarial gains/(losses) and other benefit plan

items — — — (3,098) 22 — (3,076)

Amortization of actuarial losses and other

benefit plan items — — — 130 3 — 133

Curtailments and settlements—net — — — 280 3 — 283

Other 10 — — 129 35 — 174

Income taxes 629 (9) 73 994 (25) — 1,662

(6,868)

Balance, December 31, 2008 $(1,389) $ 28 $ (86) $(3,132) $ 10 $ — $(4,569)

(a) The currency translation adjustments reclassified to income result from the sale of businesses.

(b) Includes pre-tax amounts for Actuarial losses of $4.3 billion and Prior service costs/(credits) and other of $27 million. See also Note 13A. Pension and Postretirement

Benefit Plans and Defined Contribution Plans: Adoption of New Accounting Standard.

Income taxes are not provided for foreign currency translation relating to permanent investments in international subsidiaries.

As of December 31, 2008, we estimate that we will reclassify into 2009 income the following pre-tax amounts currently held in Accumulated other

comprehensive income/(expense): virtually all of the unrealized holding gains on derivative financial instruments; $302 million of actuarial losses

related to benefit plan obligations and plan assets and other benefit plan items; and $6 million of prior service credits related primarily to benefit plan

amendments.

2008 Financial Report 63