Pfizer 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc and Subsidiary Companies

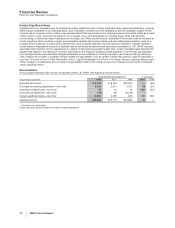

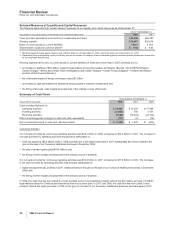

Investing Activities

Our net cash used in investing activities was $12.8 billion in 2008, compared to net cash provided by investing activities of $795

million in 2007. The decrease in net cash provided by investing activities was primarily attributable to:

•net purchases of investments of $8.3 billion in 2008, compared to net sales and redemptions of investments of $3.4 billion in 2007 (a

negative change in cash and cash equivalents of $11.7 billion); and

•the acquisitions of Serenex, Encysive, CovX, Coley and animal health product lines from Schering-Plough, as well as two smaller

animal health acquisitions in 2008, compared to the acquisitions of BioRexis and Embrex in 2007 (an increased use of cash of $720

million).

Our net cash provided by investing activities was $795 million in 2007, compared to $5.1 billion in 2006. The decrease in net cash

provided by investing activities was primarily attributable to:

•lower net sales and redemptions of investments of $3.4 billion in 2007, compared to $9.5 billion in 2006 (a negative change in cash and

cash equivalents of $6.1 billion),

partially offset by:

•the acquisitions of BioRexis and Embrex in 2007, compared to the acquisitions of PowderMed, Rinat and sanofi-aventis’ rights

associated with Exubera in 2006 (a decreased use of cash of $1.9 billion).

In 2008, the cash flow line item called Other primarily reflects a $1.2 billion payment by us upon the redemption of a Swedish krona

currency swap. In a related transaction, this payment was offset by the receipt of cash in our operating activities.

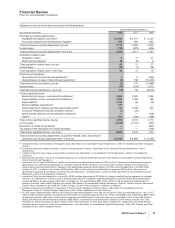

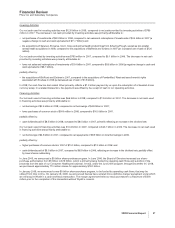

Financing Activities

Our net cash used in financing activities was $6.6 billion in 2008, compared to $12.6 billion in 2007. The decrease in net cash used

in financing activities was primarily attributable to:

•net borrowings of $2.4 billion in 2008, compared to net borrowings of $4.9 billion in 2007;

•lower purchases of common stock of $500 million in 2008, compared to $10.0 billion in 2007,

partially offset by:

•cash dividends paid of $8.5 billion in 2008, compared to $8.0 billion in 2007, primarily reflecting an increase in the dividend rate.

Our net cash used in financing activities was $12.6 billion in 2007, compared to $23.1 billion in 2006. The decrease in net cash used

in financing activities was primarily attributable to:

•net borrowings of $4.9 billion in 2007, compared to net repayments of $9.9 billion on total borrowings in 2006,

partially offset by:

•higher purchases of common stock in 2007 of $10.0 billion, compared to $7.0 billion in 2006; and

•cash dividends paid of $8.0 billion in 2007, compared to $6.9 billion in 2006, reflecting an increase in the dividend rate, partially offset

by lower shares outstanding.

In June 2005, we announced a $5 billion share-purchase program. In June 2006, the Board of Directors increased our share-

purchase authorization from $5 billion to $18 billion, which is primarily being funded by operating cash flows and a portion of the

proceeds from the sale of our Consumer Healthcare business. In total, under the June 2005 program, through December 31, 2008,

we purchased approximately 710 million shares for approximately $18.0 billion.

In January 2008, we announced a new $5 billion share-purchase program, to be funded by operating cash flows, that may be

utilized from time to time. On January 26, 2009, we announced that we have entered into a definitive merger agreement under which

we will acquire Wyeth in a cash-and-stock transaction. The merger agreement limits our stock purchases to a maximum of $500

million prior to the completion of the transaction without Wyeth’s consent.

2008 Financial Report 37