Pfizer 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

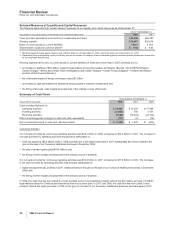

Financial Review

Pfizer Inc and Subsidiary Companies

Legal Proceedings and Contingencies

We and certain of our subsidiaries are involved in various patent, product liability, consumer, commercial, securities, environmental

and tax litigations and claims; government investigations; and other legal proceedings that arise from time to time in the ordinary

course of our business. We do not believe any of them will have a material adverse effect on our financial position.

Beginning in 2007 upon the adoption of a new accounting standard, we record accruals for income tax contingencies to the extent

that we conclude that a tax position is not sustainable under a ‘more likely than not’ standard and we record our estimate of the

potential tax benefits in one tax jurisdiction that could result from the payment of income taxes in another tax jurisdiction when we

conclude that the potential recovery is more likely than not. (See Notes to Consolidated Financial Statements—Note 1B. Significant

Accounting Policies: New Accounting Standards and Note 7E. Taxes on Income: Tax Contingencies.) We record accruals for all

other contingencies to the extent that we conclude their occurrence is probable and the related damages are estimable, and we

record anticipated recoveries under existing insurance contracts when assured of recovery. If a range of liability is probable and

estimable and some amount within the range appears to be a better estimate than any other amount within the range, we accrue

that amount. If a range of liability is probable and estimable and no amount within the range appears to be a better estimate than

any other amount within the range, we accrue the minimum of such probable range. Many claims involve highly complex issues

relating to causation, label warnings, scientific evidence, actual damages and other matters. Often these issues are subject to

substantial uncertainties and, therefore, the probability of loss and an estimation of damages are difficult to ascertain. Consequently,

we cannot reasonably estimate the maximum potential exposure or the range of possible loss in excess of amounts accrued for

these contingencies. These assessments can involve a series of complex judgments about future events and can rely heavily on

estimates and assumptions (see Notes to Consolidated Financial Statements—Note 1C. Significant Accounting Policies: Estimates

and Assumptions). Our assessments are based on estimates and assumptions that have been deemed reasonable by

management. Litigation is inherently unpredictable, and excessive verdicts do occur. Although we believe we have substantial

defenses in these matters, we could in the future incur judgments or enter into settlements of claims that could have a material

adverse effect on our results of operations in any particular period.

Patent claims include challenges to the coverage and/or validity of our patents on various products or processes. Although we

believe we have substantial defenses to these challenges with respect to all our material patents, there can be no assurance as to

the outcome of these matters, and a loss in any of these cases could result in a loss of patent protection for the drug at issue, which

could lead to a significant loss of sales of that drug and could materially affect future results of operations.

42 2008 Financial Report